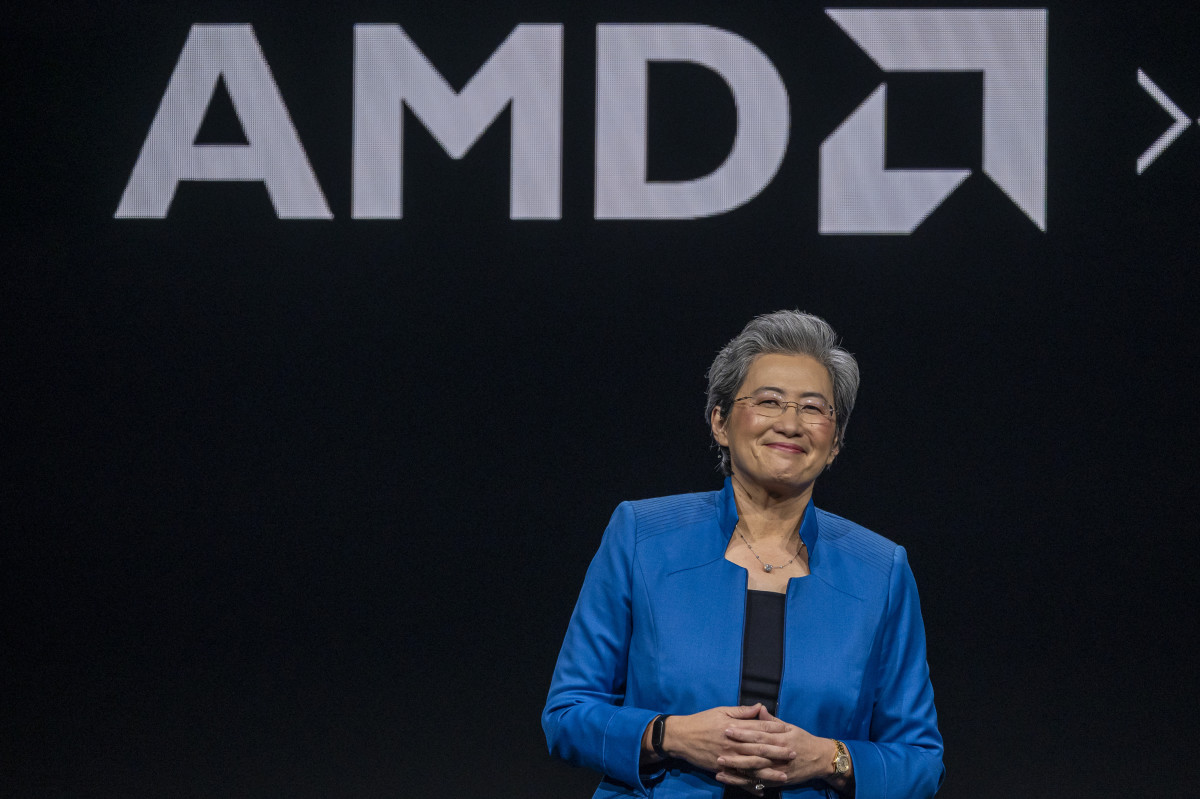

Things move so fast with artificial intelligence that even Lisa Su is amazed.

Su is the CEO of chipmaker Advanced Micro Devices (AMD,) and she confessed to being astonished by the rapid pace of this technology.

Related: Analysts reset AMD stock outlooks after AI acquisition

"What has actually really surprised me is just how fast the technology is moving," Su told Yahoo Finance at the Goldman Sachs Communacopia & Technology Conference.

"What we are seeing is whether you're a large hyperscaler, or you're an enterprise customer, or you're the newest AI startup, it's all about speed," she said. "We're learning at an incredibly fast pace."

Su said that the people at AMD have learned and done more than the previous several years in the last 9 to 12 months "because the market is moving so fast."

"This is a place where innovation begets more innovation," she said, "and so we're learning a ton on the software side, we're learning a ton about what is the most efficient way to get these these products to market."

Su said she believes the AI market that will grow to $400 billion by 2027, "which is huge."

"And the key is there's no one-size-fits-all in this technology race. It's all about end-to-end AI," she added.

AMD CEO: 'We're making bets five years out'

Su also stressed the importance of looking down the road in the tech sector.

"Sometimes people get caught on what's happening today, what's happening tomorrow, or the next quarter," Su noted. "What I'd like to say is that you have to take a step back. As a tech company, it's our job to make bets that are three to five years out."

Related: Analysts reboot AMD stock price target after earnings

AMD has made a number of acquisitions, most recently signing a definitive agreement last month to acquire AI infrastructure provider ZT Systems. The acquisition, valued at $4.9 billion, is expected to enhance AMD's non-GAAP earnings by the end of 2025.

At that time, Citi analysts said they believed the acquisition should allow AMD to better compete with Nvidia NVDA "in the data center GPU market via additional system experience and faster hyper scaler deployment times."

Citi, which reiterated its buy rating on AMD and $210 price target, said in an Aug. 21 research note that ZT Systems customers include some of the largest cloud hyperscalers, including Microsoft's (MSFT) Azure and Amazon's (AMZN) AWS. It develops systems using components from Nvidia, Intel (INTC) , and AMD among others.

The firm said AMD intends to sell about 95% of ZT Systems’ manufacturing business while keeping 1,000 engineers.

Earlier this month, AMD announced that Keith Strier had joined the company as senior vice president of global AI markets.

Strier, most recently vice president of worldwide AI initiatives at AMD's arch-rival Nvidia, will be responsible for expanding AMD's "AI vision, driving new ecosystem capabilities and accelerating strategic AI engagements globally across public and private sectors."

The Santa Clara-based company, which is slated to report quarterly earnings next month, is down nearly 30% from its all-time of $227.30 in March but still up roughly 40% from a year ago.

In July, AMD beat Wall Street's second-quarter earnings expectations.

AMD plans AI conference to highlight new chips

Revenue for the quarter was above the midpoint of guidance, and profitability increased by a double-digit percentage due to higher-than-expected sales of the company's Instinct, Ryzen, and EPYC processors.

Data-center-segment revenue more than doubled year-over-year to a record $2.8 billion, driven by the steep ramp of Instinct MI300 GPU shipments and a double-digit percentage increase in EPYC central-processing-unit sales.

More AI Stocks:

- Palantir stock leaps on big S&P 500 boost for data analytics group

- Veteran fund manager unveils startling Nvidia stock forecast

- Analysts reset Alphabet stock price target before key September court event

AMD has scheduled "Advancing AI 2024," an in-person and live-streamed event for October 10.

The company said the event will showcase its next-generation Instinct accelerators and 5th Gen AMD EPYC server processors, as well as Networking and AI PC updates.

The event will also highlight the company’s growing AI solutions ecosystem. AMD executives and AI ecosystem partners, customers, and developers will join Su to discuss how "AMD products and software are reshaping the AI and high-performance computing landscape."

Analyst updates AMD stock outlook, cites "headwind"

Ahead of the conference, Citi Research noted that August notebook shipments increased 15% month-over-month.

However, the increase was more a reflection of the weak demand recorded in July than a material strengthening of the market.

Analyst Carrie Liu forecasts that notebook demand will increase 4% quarter over quarter in the third quarter, less than the average of 5%.

"We believe the PC recovery appears weaker than expected following our conversations with Intel, Dell (DELL) , and Western Digital (WDC) last week," said Citi analyst Christopher Danely. "We believe the inventory replenishment in PCs is over and could be a mild headwind near-term."

Related: Veteran fund manager sees world of pain coming for stocks