The artificial intelligence revolution is upon us and could be the biggest thing since the Internet.

The successful launch of OpenAI's ChatGPT in December 2022 has caused a flurry of AI activity, with companies rushing to train AI apps to reshape how businesses and people interact with information.

The surge in AI activity, including training and operating large language models, is exciting. However, it's taxing existing network infrastructure built around central processing units or CPUs that are less suited to handling AI's heavy workloads.

As a result, many enterprises and cloud solution providers are upgrading their networks with next-gen accelerated computing servers packed with graphic processing units, or GPUs, made by Nvidia and Advanced Micro Devices.

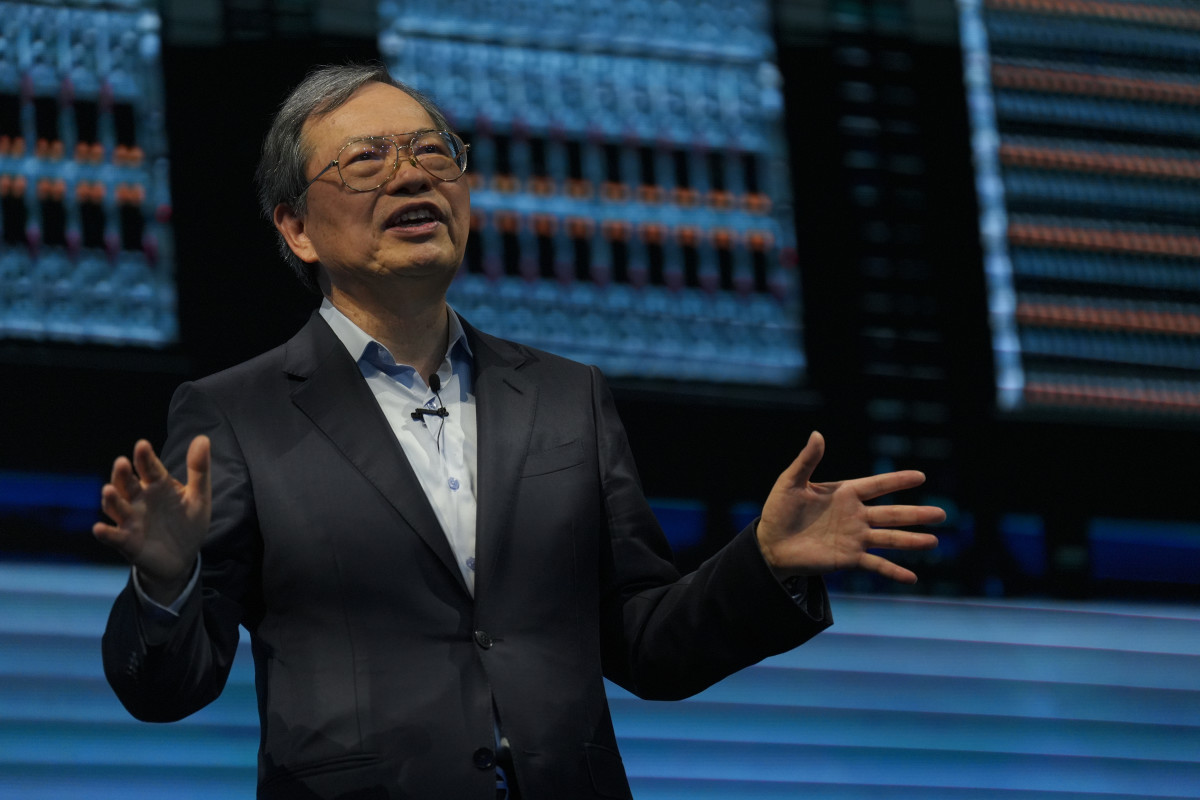

Super Micro Computer, a 30-year-old company specializing in high-end servers, is one of the biggest beneficiaries of this spending. The company's sales and profit have skyrocketed, catching the eyes of analysts who are revamping their stock price targets.

Super Micro Computer rushes to keep up with AI-driven demand

ChatGPT's ability to quickly search, parse, and create content has led to optimism that new AI apps could unlock insight from previously siloed data.

Manufacturers are exploring AI's use to improve quality and reduce equipment downtime, retailers are considering if it can stop theft, drug developers are seeing if it can improve medicines, and financial institutions are using it to hedge their risks better.

Related: Analyst overhauls Nvidia stock price target after conference

The applications for AI are seemingly endless, which is why so many companies (and countries) are plowing big money into creating generative AI solutions.

Much of the AI research and development is occurring within cloud networks like Amazon's AWS, Google Cloud, and Microsoft's Azure. Those hyperscalers are quickly discovering that AI R&D will likely create an explosion in new data that will need to be stored, retrieved, and further manipulated, driving demand for their services higher.

However, a lot of the spending until last year by these and enterprise network operators has been on CPU-based machines lacking the technological horsepower necessary. As a result, they're increasingly embracing the concept of accelerated computing.

Accelerated computers marry CPUs and other processors, like Nvidia and AMD GPUs, together in heterogeneous computing. The goal: process tasks faster using less energy.

These systems aren't cheap. GPUs used in AI can cost tens of thousands of dollars alone. That's proving to be a boon to Supermicro, given its long history of building top-shelf rack servers, storage systems, and other similar solutions for data centers.

In Q4, Super Micro's revenue more than doubled year-over-year to $3.65 billion, resulting in earnings soaring 71% to $5.59 per share.

Wall Street expects the good times to continue. Analysts consensus estimate is for earnings to improve 89% this year to $22.35 per share. In 2025, they're expected to increase by another 19%.

Analysts jump on the Super Micro stock bandwagon

The potential for additional sales and profit growth at Super Micro has led many stock research firms to boost their outlook. Wall Street firms that have yet to cover the stock have also warmed up to the story, leading them to initiate coverage.

More AI Stocks:

- Analysts revamp C3.ai stock price targets after earnings

- Analyst overhauls Nvidia stock price target after conference

- AMD stock analysts overhaul price targets after China news

J.P. Morgan is the latest big firm on the Super Micro bandwagon. It recently started coverage on the stock, giving it an overweight rating.

The rating, which came from J.P. Morgan's Telecom & Networking Equipment/IT Hardware team, is based on analysis suggesting that it's still in the early innings of the AI upgrade cycle.

"The Compute revolution is still in its infancy, with demand in AI Training led by large hyperscalers and larger Tier 2 Cloud Service Providers, which should be followed by similar investments in AI training by a broader swath of customers, and eventually investments in Inferencing," wrote the analysts in a recent note to institutional investors.

The analysts don't necessarily think that Super Micro shares will benefit from further expansion in valuation because the stock has already made a big move. Instead, they see gains supported by ongoing leadership in the server market driving revenue and profit higher.

"Our optimism for upside from SMCI shares is more driven by a rapid increase in expectations of the size of the AI Server market, which is already estimated to expand from $41 bn in 2023 to $283 bn in 2028 (source: 650 Group)," said the analysts. "We are forecasting +43% revenue [compounded annual growth rate] CAGR between FY23 and FY27, and the 2027 revenue forecast implies that Super Micro will have 10% -15% share of the AI Server market, which we view as conservative."

J.P. Morgan's analysis suggests that Super Micro Computer's revenue opportunity in fiscal 2028 could reach $40 billion, up from $7.1 billion in fiscal 2023.

Given their revenue optimism, it's unsurprising that they expect profit growth and higher share prices. Their current Super Micro Computer stock price target is $1,150.

Related: Veteran fund manager picks favorite stocks for 2024