OneMain Holdings (NYSE:OMF) has been analyzed by 13 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 9 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 4 | 2 | 0 | 0 |

| 3M Ago | 0 | 3 | 1 | 0 | 0 |

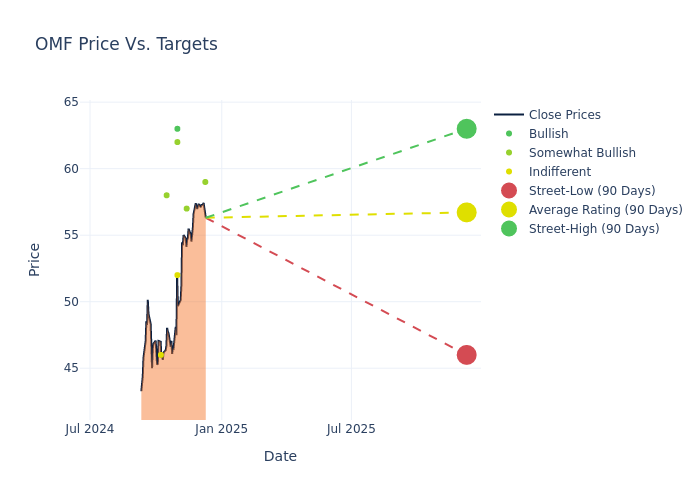

Analysts have recently evaluated OneMain Holdings and provided 12-month price targets. The average target is $56.54, accompanied by a high estimate of $63.00 and a low estimate of $46.00. Highlighting a 0.81% decrease, the current average has fallen from the previous average price target of $57.00.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of OneMain Holdings by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Shane | JP Morgan | Raises | Overweight | $59.00 | $56.00 |

| Kyle Joseph | Stephens & Co. | Announces | Overweight | $57.00 | - |

| Michael Kaye | Wells Fargo | Raises | Equal-Weight | $52.00 | $49.00 |

| David Scharf | JMP Securities | Raises | Market Outperform | $62.00 | $60.00 |

| Giuliano Bologna | Compass Point | Raises | Buy | $63.00 | $60.00 |

| Kenneth Lee | RBC Capital | Maintains | Outperform | $58.00 | $58.00 |

| David Scharf | JMP Securities | Maintains | Market Outperform | $60.00 | $60.00 |

| Michael Kaye | Wells Fargo | Lowers | Equal-Weight | $49.00 | $53.00 |

| Kenneth Lee | RBC Capital | Lowers | Outperform | $58.00 | $60.00 |

| Terry Ma | Barclays | Lowers | Equal-Weight | $46.00 | $52.00 |

| Richard Shane | JP Morgan | Lowers | Overweight | $51.00 | $56.00 |

| David Scharf | JMP Securities | Maintains | Market Outperform | $60.00 | $60.00 |

| Kenneth Lee | RBC Capital | Maintains | Outperform | $60.00 | $60.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to OneMain Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of OneMain Holdings compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into OneMain Holdings's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on OneMain Holdings analyst ratings.

About OneMain Holdings

OneMain Holdings Inc is engaged in nonprime consumer finance companies in the United States and is one of only a few companies in the consumer installment lending industry. It formed after a transaction brought together two branch-based consumer finance companies with complementary strategies and locations. Its services include providing personal loan products, offering credit and noncredit insurance, servicing loans, pursuing strategic acquisitions and dispositions of assets and businesses, and on occasion, establishing joint ventures or forming strategic alliances. The company's one reportable segment is consumer and insurance. In addition to hundreds of branches, the company also has an online business. The main source of revenue is net interest income.

Understanding the Numbers: OneMain Holdings's Finances

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, OneMain Holdings showcased positive performance, achieving a revenue growth rate of 7.28% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: OneMain Holdings's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 13.49%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): OneMain Holdings's ROE stands out, surpassing industry averages. With an impressive ROE of 4.94%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): OneMain Holdings's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.62%, the company may face hurdles in achieving optimal financial performance.

Debt Management: OneMain Holdings's debt-to-equity ratio is notably higher than the industry average. With a ratio of 6.59, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.