Nvidia shares tuned lower in early Monday trading despite a bullish note on the AI-chip maker's near-term prospects heading into its crucial fourth quarter earnings report after the close of trading on Wednesday.

Nvidia (NVDA) , which remains in negative territory for the year following its staggering $2.3 trillion market-value surge in 2024, will update markets on the final quarter of its fiscal year, which ended in January, and guide investors on its current-quarter sales forecast while also detailing the impact of capacity constraints at some of its key suppliers.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💵

Wall Street analysts are looking for overall revenue growth of around 72%, with a tally of $38.05 billion. Data center sales, which comprise its AI-powering chips and processors, including its new Blackwell line and its legacy Hopper offerings, are estimated 82% higher from last year to $33.6 billion.

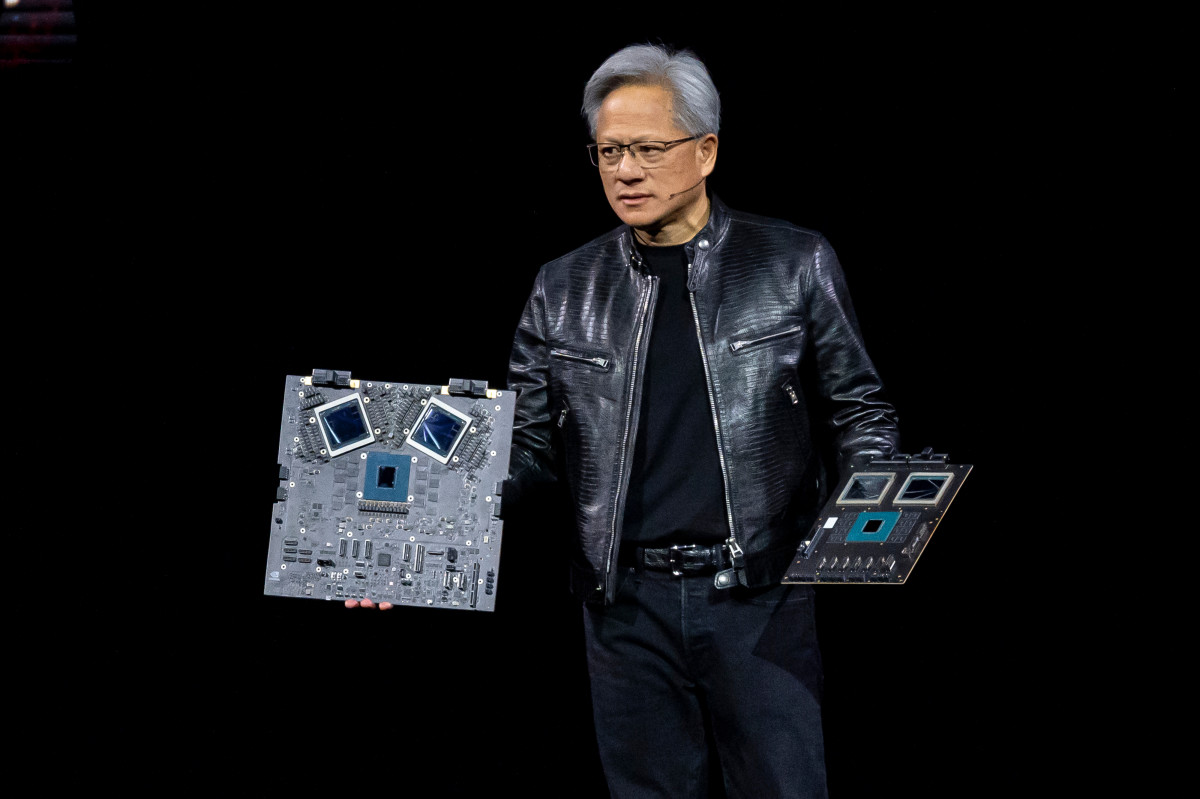

Key to the update will be CEO Jensen Huang's commentary on broader AI demand, particularly in light of China-based DeepSeek's emergence as a cut-priced chatbot competitor, as well as capacity constraints that may have slowed the sale of its higher-end Blackwell server racks.

Nvidia stock lost $593 billion in market value, the most on record, after the DeepSeek chatbot launched in late January.

Markets braced for Nvidia swings

Markets are also braced for more volatility from the update amid the broader underperformance of megacap tech stocks and worries that massive capital spending plans from top providers of cloud infrastructure and services have yet to yield significant profits.

Options traders expect a 7.7% swing, in either direction, for Nvidia's share price in the wake of its Wednesday report, which based on the stock's $3.4 trillion market value could result in gains or losses of around $280 billion.

"All eyes will be on Blackwell commentary, where we see management reaffirming Blackwell shipments beginning in [Q4] and demand continuing to exceed supply through [fiscal 2026]," said Rosenblatt analyst Hans Mosesmann.

"We see shipments of Blackwell accelerating as we progress through the year, with a stronger [second half]," he said.

Related: Analyst revisits Nvidia stock price target with Q4 earnings in focus

Mosesmann, who reiterated his 'buy' rating and $220 price target on Nvidia stock in a note published Monday, expects a "modest beat and raise for Nvidia's January quarter and March quarter outlook versus consensus estimates."

LSEG data suggest analysts expect April-quarter revenue in the region of $41.75 billion, a tally that suggests a slower, but still impressive, 60% growth rate, with data center sales expected to rise 65% to $37.21 billion.

Nvidia set-up well for 2025 - Rosenblatt

"We continue to view the setup in (calendar year 2025) positively for Nvidia, with a strong Blackwell ramp that is resilient to unit share losses to GPU and ASIC accelerator players," Mosesmann said.

"Nvidia's roadmap ([for] which we expect an update at GTC in March) is one of increasing value that is highly complex with multiple configurations," he added.

More AI Stocks:

- AI startup smashes funding round, signals big changes for health care

- Analyst revisits Palantir stock forecast following annual report filing

- Analyst who predicted Palantir rally picks best AI software stocks

KeyBanc Capital markets analyst John Vinh, who boosted his Nvidia price target by $10 to $190 a share in a note published late last week, noted the impact of capacity constraints on Blackwell deliveries but still expected strong results and guidance after the close of trading Wednesday.

Vinh also said the launch of the DeepSeek chatbot likely created "a surge in demand for (Hopper) GPUs from China cloud-service providers," which could offset some of the Blackwell revenue concern.

Nvidia shares at last check were marked 0.08% lower in early Monday trading and changing hands at $134.20 each, a move that would extend the stock's 2025 decline to around 3%.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast