Microsoft shares edged higher in early Tuesday trading following yesterday's AI-led selloff as a top Wall Street analyst suggested the tech giant could benefit from a reset in thinking on capital spending.

Microsoft (MSFT) shares were caught in the downdraft of Monday's brutal tech selloff, which lopped more than $1 trillion in value from the world's biggest companies and a record $593 billion from AI-chip maker Nvidia (NVDA) .

The broader market slump was tied to the emergence of China-based AI agent DeepSeek, which claims to have built and trained a large-language model system for around $6 million. That development challenged the tech market's narrative that billions in data center and GPU investments are needed to develop, train and deploy new AI technologies.

OpenAI CEO Sam Altman called DeepSeek's model "impressive," adding in a post on X that it is "legit invigorating to have a new competitor."

Microsoft may have a different view, however, given that it's poised to spend more than $80 billion alone over its current fiscal year, which ends in June, while the tech industry at large is forecast to burn through more than $2 trillion over the next three years.

Returns on that spending have so far proven thin, however, and even Microsoft's AI-powered CoPilot has yet to find the kind of user scale required to generate network effects and bottom-line profit for what is now that world's second-largest tech company.

Microsoft's 'clever' AI bet: Analyst

Microsoft also hold a 49% stake in OpenAI and backed the ChatGPT creator early in its development phase, enabling it to leapfrog its rivals when the AI race began in late 2022.

But UBS analyst Karl Kierstead thinks the AI industry's "Sputnik moment," as it's been described, could actually prove beneficial for Microsoft's longer-term AI strategy.

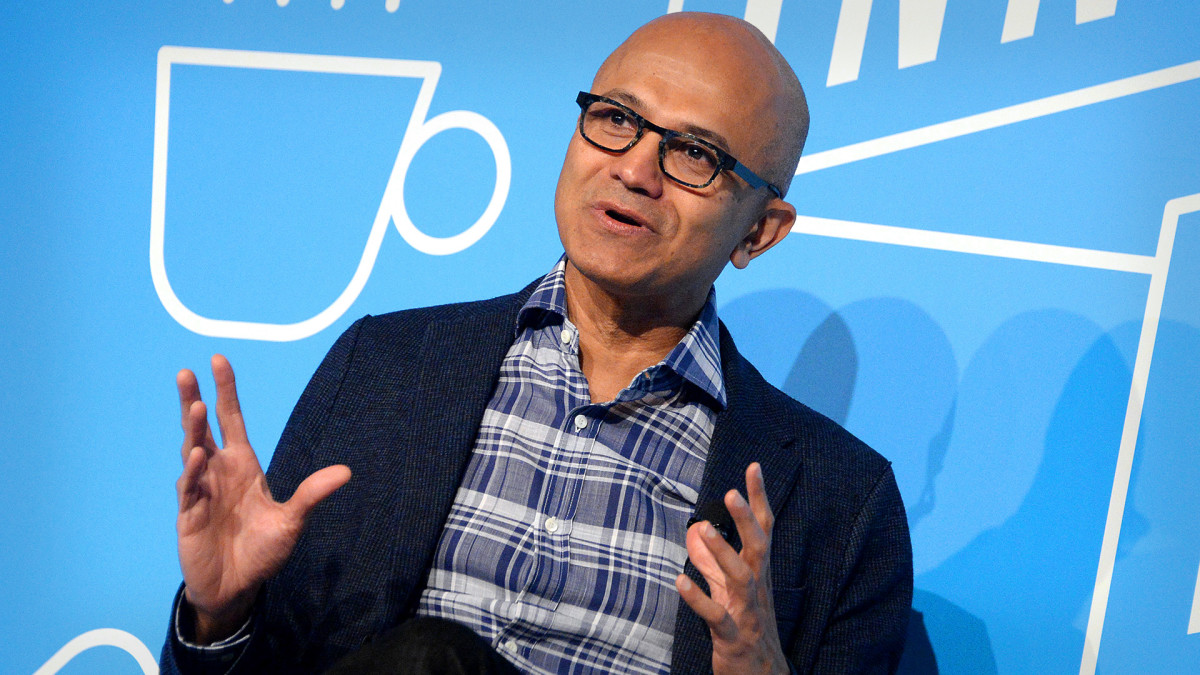

In a Tuesday note that reiterated a buy rating and $525 price target on Microsoft, Kierstead argued that CEO Satya Nadella's early comments on DeepSeek's impact, and its arms-length stake in OpenAI, look like a "clever bet" on the AI evolution.

Related: DeepSeek rattles tech stocks ahead of Microsoft, Meta earnings

"By electing not to fund OpenAI’s ambitious GPU compute targets, and by being the most vocal CEO about 'LLMs commoditizing,' Microsoft’s CEO has been signaling a desire to pivot away from material training GPU commitments to a single [large language model] and instead to scale an inference infrastructure for large enterprise customers," Kierstead and his team wrote.

That could leave Microsoft nimble enough to benefit from a host of AI advances, which it would then infuse into its own product base and its client-facing cloud offering, without having to commit massive sums of spending on development.

Microsoft earnings on deck

"While Microsoft has made a very large singular bet on OpenAI, which now faces heightened competition, the pace of Microsoft’s [capital-spending] growth could slow beyond fiscal 2025 if, in fact, AI becomes LESS compute-heavy," Kierstead said.

Microsoft is scheduled to post its fiscal-second-quarter earnings after the close of trading on Wednesday. Investors are now laser-focused on commentary tied to its capital-spending plans, DeepSeek's challenge to OpenAI, and the Stargate AI joint venture unveiled last week and backed by President Donald Trump.

Jevons paradox strikes again! As AI gets more efficient and accessible, we will see its use skyrocket, turning it into a commodity we just can't get enough of. https://t.co/omEcOPhdIz

— Satya Nadella (@satyanadella) January 27, 2025

"Investor sentiment might even improve post-Wednesday’s print if Microsoft explains that their StarGate/OpenAI decision was about capex discipline, restoring investor confidence in their capex growth and [return on investment] outlook," said Kierstead.

Wall Street is looking for a bottom line of $3.11 a share on revenue of $67.8 billion. Intelligent cloud revenue, which includes its flagship cloud offering Azure, is expected to edge modestly higher to $26 billion.

More AI Stocks:

- Veteran trader discloses his top stock pick for 2025

- Analyst who bet correctly in 2024 unveils top AI stock picks for 2025

- One AI stock has become analysts’ top pick for 2025

"We still expect Azure growth to accelerate from H1 [the second half of MSFT's financial year] as our capital investments create an increase in available AI capacity to serve more of the growing demand," Microsoft's finance chief, Amy Hood, told investors in late October.

Microsoft shares were last marked 0.57% higher in premarket trading to indicate an opening bell price of $437.06 each.

Related: Veteran fund manager issues dire S&P 500 warning for 2025