Nvidia (NVDA) is looking to the East.

The semiconductor titan is said to be partnering with the Indonesian telecommunications firm Indosat Ooredoo Hutchison on a project expected to bolster local telecommunications infrastructure and digital talent, CNBC reported on April 4, citing Indonesia’s communication minister.

The new facility will reportedly be based in Surakarta, Central Java province, and will bolster local telecommunications infrastructure, human resources, and digital talent.

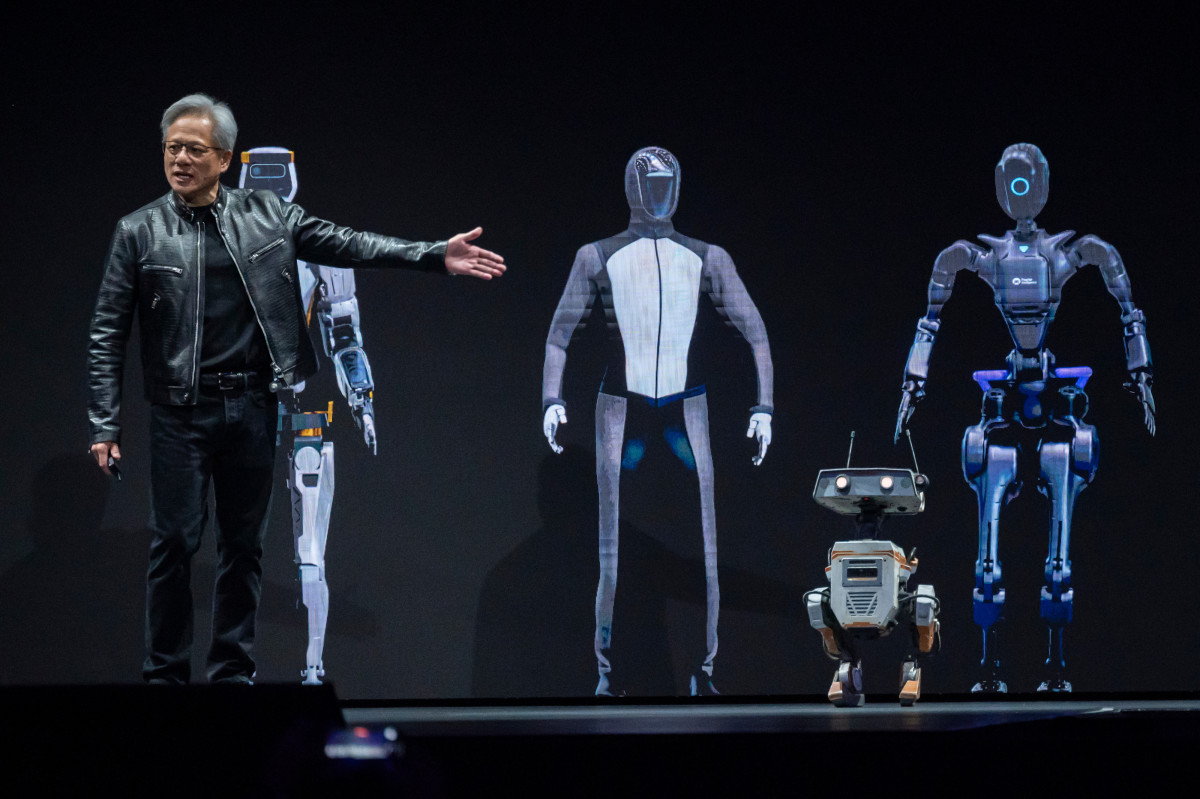

Nvidia makes chips for artificial intelligence and has an estimated 80% share of the market for AI-powering processors.

The company is in a strong position since AI could potentially change, well, just about everything.

Last month, Indosat said it was ready to integrate Nvidia’s next-generation chip architecture, Blackwell, into its infrastructure, with “the goal of propelling Indonesia into a new era of sovereign AI and technological advancement.”

Nvidia’s increased presence in Indonesia highlights a broader push into Southeast Asia this year as data demand in the region is booming.

Analysts see 'signs of life in China'

It's an important move for Nvidia, considering that the Asia-Pacific region is the world's largest market for semiconductors, accounting for more than half of the global market share. The area is also home to some of the world's largest chipmakers.

China is the world’s largest semiconductor market, representing 31.4% of worldwide final sales or $180 billion out of $574 billion in 2022, Citigroup said in October.

Related: JP Morgan CEO Jamie Dimon delivers stark warning on inflation, economy

Last year, global semiconductor revenue declined 11% year-over-year, with imports of semiconductors and integrated circuits in China witnessing their largest-ever drop.

However, things may be picking up, according to KeyBanc analysts John Vinh and Jim Long, who said they saw "signs of life in China" as they raised their price targets for Nvidia and other chipmakers.

"We were surprised to hear commentary from distribution in China that demand appears to be picking up," the analysts wrote in a research note. "It’s unclear whether this is true end-demand or simply restocking; however, resales in the China market appear to be tracking better than (the rest of the world)."

Vinh and Long raised their price targets for Nvidia to $1,200 from $1,100 while keeping an overweight rating.

The analysts said positive implications include supply chain feedback for Nvidia’s GB200 computer systems for networking. GB200 systems with average selling prices of $1.5 million to $2 million are expected to become a mainstream configuration in 2025, generating as much as $90 billion to $140 billion in revenues alone.

The analysts said, among other things, that supply chain feedback indicates GB200 systems with average selling prices of $1.5 million to $2 million are expected to become a mainstream configuration in 2025, generating as much as $90 billion to $140 billion in revenues alone.

Other tech stocks boosted

“Feedback from Asia indicates that end-demand trends across all major end-markets (auto, industrial, consumer) with the exception of AI continue to be weak,” the analysts said.

“However, 1Q is tracking to be the bottom with most channel partners expecting sequential growth in 2Q/3Q but at a more measured pace, and clearly not V-shaped," they added.

More Tech Stocks:

- Google fined $270 million by French regulatory authority

- Analysts revamp Nvidia price targets as Blackwell tightens AI market grip

- Analysts overhaul Micron stock price target ahead of earnings

In February, Nvidia walloped Wall Street's elevated fourth-quarter-earnings estimates, as revenue increased by a mind-blowing 265% to $22.1 billion, its third consecutive quarter of triple-digit growth.

Earnings jumped 486% to $5.16 per share, boosted by the company’s highly profitable graphics-processing units or GPUs.

Goldman Sachs analysts declared Nvidia's shares "the most important stock on planet Earth."

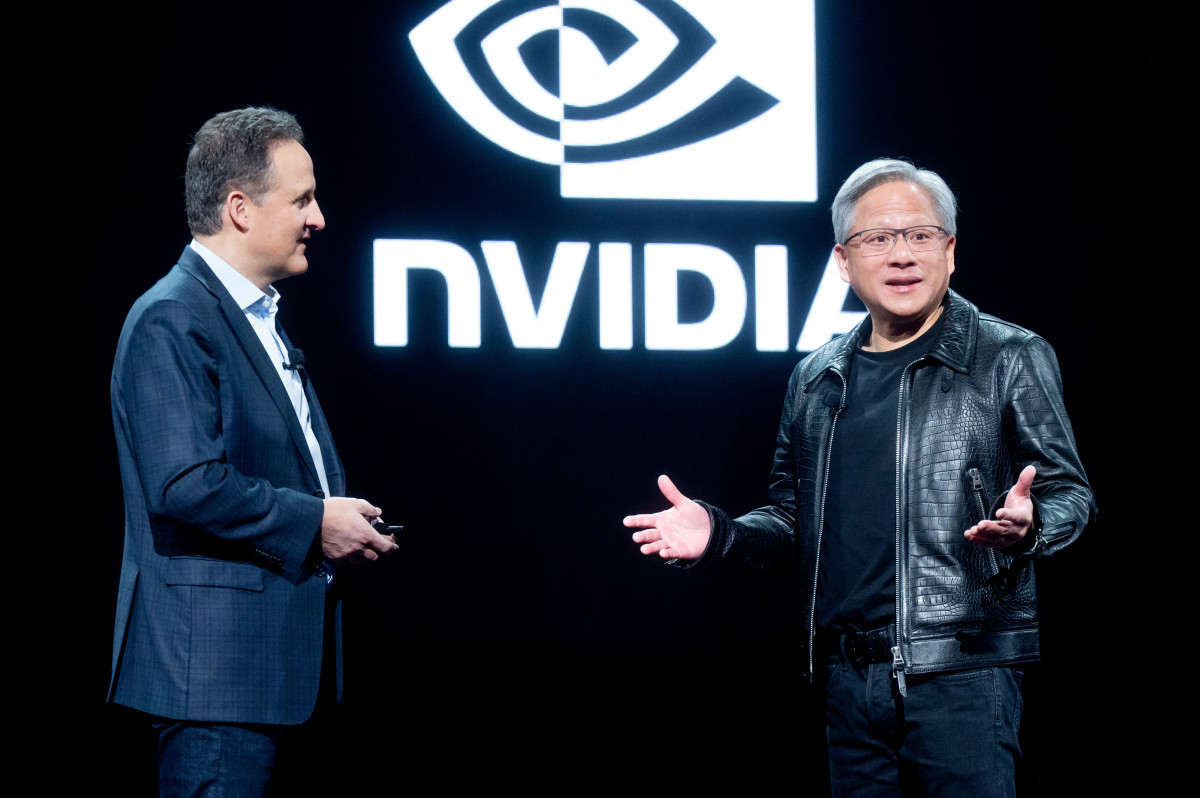

Nvidia's CEO, Jensen Huang, has said that he thinks AI demand growth is a “huge opportunity” for the company and that he expects the embrace of accelerated computing and generative AI to provide tailwinds for years.

In addition to Nvidia, KeyBanc raised its price target for Qualcomm (QCOM) to $205 per share from $180 and boosted Monolithic Power Systems' (MPWR) to $850 from $830.

KeyBanc also increased its Arm Holdings (ARM) price target to $135 from $120, and its Micron Technology (MU) target to $150 from $130. It slashed its Marvell Technology (MRVL) price target to $90 from $95.

The analysts said they saw "moderately negative implications for Marvell" as its design win for next-generation Trainium machine learning accelerator at Amazon's (AMZN) Amazon Web Services has been delayed and is likely to ramp in 2025 compared with the second half of 2024.

Meanwhile, Cantor Fitzgerald analysts maintained their overweight rating and a $1,200 price target on Nvidia, noting the continued strong momentum in AI as a driving force for the company, and anticipating another significant beat and raise in performance.

Nvidia remains a top pick for Cantor Fitzgerald because upcoming earnings are anticipated to serve as a catalyst for further stock appreciation.

Related: Veteran fund manager picks favorite stocks for 2024