You may think you know everything about artificial intelligence, but, brother, you ain't heard nothing yet.

The AI revolution gets so much attention in the media that many people might be tempted to dismiss it as just a bunch of hype.

Related: Nvidia's stock flashes key warning sign

Well, not so fast, chuckles, because people in the know who say otherwise.

"In the midst of all the technological advancements happening today, one term has taken over almost every discourse about technology: artificial intelligence," the tech platform Wevolver said in a recent report. "Once a thrilling notion for sci-fi movies, AI is now an indisputable reality, and it has taken multiple industries by storm."

From large language models enabling chatbots like OpenAI's ChatGPT to internet-of-things connected devices bringing about Industry 4.0, the study said, "AI has found applications and use cases across almost every modern industry."

Nvidia's market cap means flip-flop with Apple

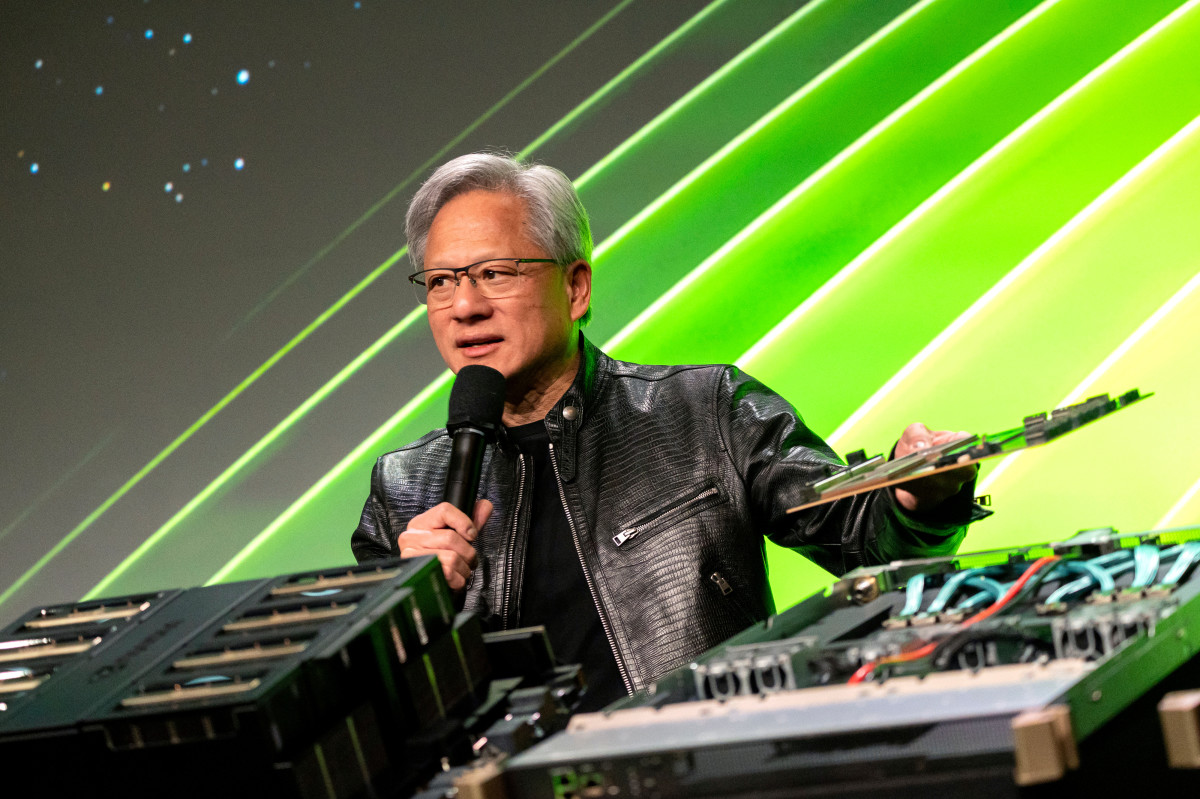

Nvidia (NVDA) is at the center of the AI storm, and it's probably the first name that pops into most people's heads when we're talking about artificial intelligence.

The AI-chip maker's shares have seemingly soared to infinity and beyond, with the company crossing the $3 trillion market-capitalization threshold on June 5 and blasting by Microsoft (MSFT) on Tuesday to become the world's most valuable company.

Related: Analysts reset Nvidia stock price targets amid split, Dow entry talk

In fact, State Street Global Advisors is on track to revamp the composition of its $71 billion Technology Select Sector SPDR Fund (XLK) after Nvidia’s market value closed above Apple (AAPL) on Friday, according to Bloomberg.

For months, the fund has held way fewer Nvidia shares even as the AI giant surged 166% year-to-date.

When the chipmaker ranked in third place, it made up roughly 6% of the ETF’s assets, compared with 22% in the S&P 500 Information Technology Index.

The ownership cap, imposed under diversification rules, has caused XLK to underperform massively this year.

While the S&P, in theory, reserves the right to make an exception, industry participants say the ETF is on track to be retooled when it enacts the quarterly rebalance near the end of June.

On that basis, Apple and Nvidia are set to reverse their positions in the ETF, with the former’s weight dropping to 4.5% and the latter rising above 20%, Bloomberg reported. The news service cited calculations sent by the index provider to three market participants familiar with the matter.

State Street stands to purchase $11 billion of Nvidia shares and shed $12 billion of Apple, according to one estimate.

“By our calculation, the flip-flop between Nvidia and Apple will occur,” Chris Harvey, head of equity strategy at Wells Fargo Securities, told Bloomberg. “This aligns the XLK ETF more closely with the momentum trade and semis. At the margin, it’s more dollars chasing a stock that does not need any additional help.”

Analysts: The 'AI revolution starts with Nvidia'

Analysts at Wedbush say the AI revolution started with Nvidia, and the AI party is just getting started.

Related: What is Jensen Huang’s net worth & salary as Nvidia CEO?

Wedbush on Monday estimated that over the next year, the race to a $4 trillion market cap in tech will be front and center among Nvidia, Apple, and Microsoft.

More AI Stocks:

- Apple's AI launch at WWDC could hinge on something it hates to do

- Analyst revamps Microsoft stock price target despite controversy

- Analysts race to reset HPE stock price targets as AI powers earnings

Nvidia's GPU chips are, in essence, the new gold or oil in the tech sector, as more enterprises and consumers quickly follow this path with the fourth Industrial Revolution well underway, the firm added.

Wedbush said it's all about the pace of AI-driven data-center spending. The only game in town for graphics-processing units to run generative-AI applications goes through Nvidia, the investment firm said.

Nvidia’s 10-for-one stock split went into effect earlier this month, and, on Tuesday, Rosenblatt analysts raised Nvidia's stock price target to $200 from $140 and affirmed a buy rating on the shares.

The investment firm sees Nvidia's Hopper, Blackwell, and Rubin chip series driving "value" market share in what it calls "one of Silicon Valley's most successful silicon/platform product cycles."

The firm, which estimated that Nvidia was "already in the $5-earnings-per-share-plus level for calendar 2026," is also updating its model to account for its recent share split, completed on June 10.

Related: Veteran fund manager picks favorite stocks for 2024