Nvidia shares moved firmly higher in early Monday trading, putting the stock withing touching distance of a new record peak, after CEO Jensen Huang outlined details of a new line of chips and processors that could further cement its grip on the global AI market.

Nvidia (NVDA) , which added just over $500 million of market value over the past month alone, has powered more than 127% higher so far this year to claim its place as both tech's most important stock and the world's third largest company.

Related: Roaring Kitty sparks another GameStop stock surge, short squeeze

The group's 80% share of the market for the graphics chips and central processors that power the massive artificial-intelligence datasets of hyperscalers like Meta Platforms (META) , Microsoft (MSFT) and Alphabet (GOOG) , has brought the Santa Clara, Calif., group billions in new revenue alongside impressive profit margins.

Data-center sales, which include the group's key AI offerings, surged more than fivefold from a year earlier to a record $22.6 billion over the three months ended in April and gross profit margins expanded to 78.9%

Nvidia also said current-quarter revenue would rise to around $28 billion, with a 2% margin for error, even as it noted that its new Blackwell system of processors and software wouldn't start shipping until the back half of the year.

The new Blackwell GPU architecture, named after the African American mathematician David Harold Blackwell, performs AI tasks at more than twice the speed of Nvidia's current Hopper chips, while using less energy and providing more bespoke flexibility, the tech group said. It's expected to hit the market sometime next year.

From Blackwell to Rubin

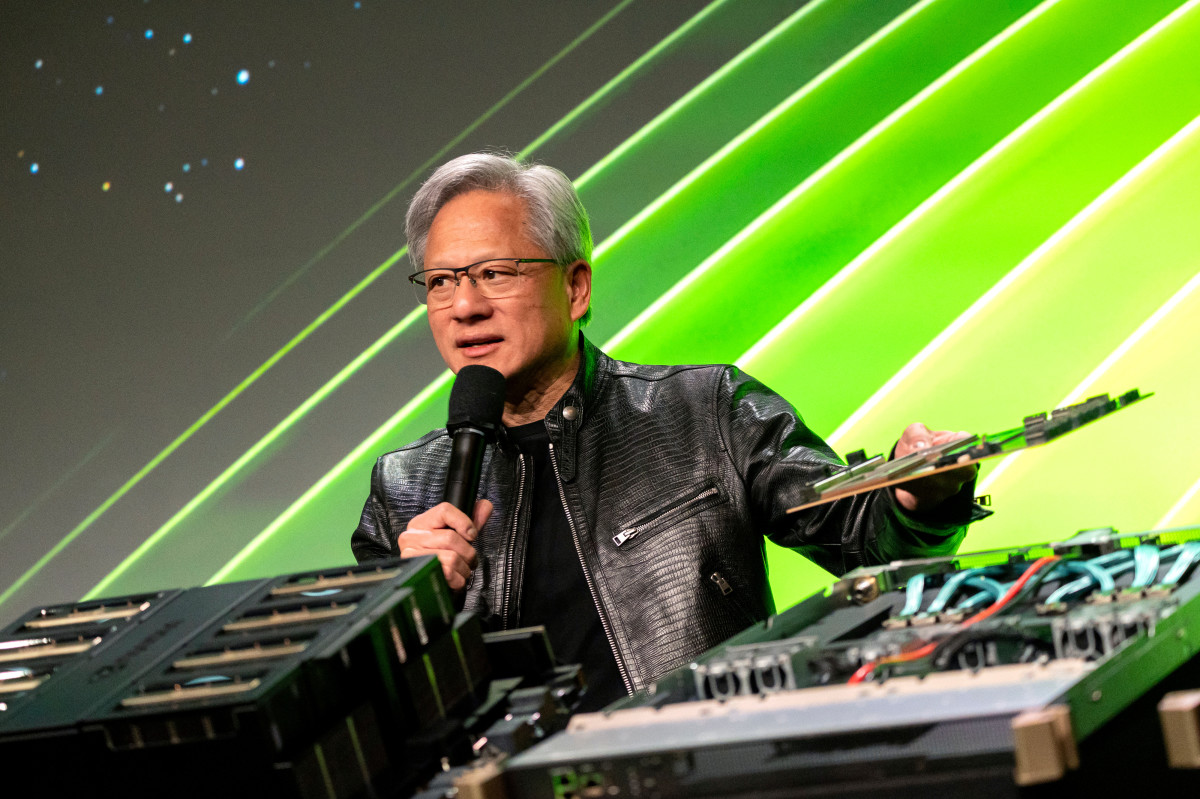

Huang added yet another layer of demand potential to Nvidia's growing lineup during a speech at the National Taiwan University in Taipei over the weekend, where he disclosed details of a new family of chips and processors called Rubin.

Named after the American astronomer Vera Rubin, credited for the discovery of so-called dark matter, the new Rubin systems will be rolled out in 2026, Huang said.

Related: Analysts overhaul Nvidia stock price targets as earnings address key problem

“Our company has a one-year rhythm," Huang said. "Our basic philosophy is very simple: build the entire data-center scale, disaggregate and sell to you parts on a one-year rhythm, and push everything to technology limits.”

BofA Securities analyst Vivek Arya said the new announcements, which effectively accelerate the group's product cycle to one year from two years, will "continue to bolster Nvidia's AI leadership position.'

Arya and his team lifted their Nvidia price target by $180 to $1,500 a share, calling the stock a top pick while maintaining a buy rating.

Nvidia earnings power

"We continue to believe Nvidia's turnkey system design could sustain 80%+ market share in AI accelerators and generate sustained growth in networking (Ethernet switch to already ramp to multibillion dollars within a year)," the B of A team said.

"With potentially faster Blackwell adoption (increased mainstream AI), we see potential EPS power of $50+ within two years," the bank added.

Related: Nvidia earnings seal Big Tech stock dominance

Analysts at Evercore ISI, meanwhile, noted that Nvidia's pending 10-for-1 split could add an extra dimension of volatility to the market's most-important stock. The stock is scheduled to start trading post-split on Monday, June 10.

More AI Stocks:

- Analysts retool C3.ai stock price target after earnings

- Analysts revamp Salesforce stock price targets after earnings

- Veteran fund manager issues blunt warning on Nvidia stock

Nvidia shares, in fact, have risen nearly 15.5% since the group reported better-than-expected fiscal-first-quarter earnings on May 22, while the S&P 500 has fallen 0.55% and the Nasdaq has slipped 0.4%.

That divergence could suggest Nvidia's recent market leadership is starting to fade, as it's been unable to drag broader indexes along with it, Evercore said. There is "no precedent for a stock of Nvidia’s size having its post-earnings share surge 'ignored' by the broader S&P 500,” the investment firm said.

Nvidia shares were marked 3.65% higher in early Monday trading to change hands at $1,134.31 each.

Related: Veteran fund manager picks favorite stocks for 2024