Throughout the last three months, 4 analysts have evaluated Mirion Technologies (NYSE:MIR), offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

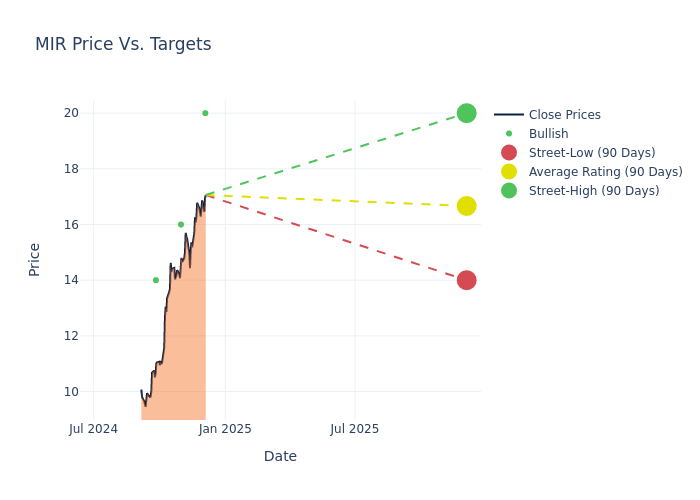

Analysts have recently evaluated Mirion Technologies and provided 12-month price targets. The average target is $17.0, accompanied by a high estimate of $20.00 and a low estimate of $14.00. This current average reflects an increase of 6.25% from the previous average price target of $16.00.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Mirion Technologies among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Kaplowitz | Citigroup | Raises | Buy | $20.00 | $18.00 |

| Andrew Kaplowitz | Citigroup | Raises | Buy | $18.00 | $17.00 |

| Joe Ritchie | Goldman Sachs | Raises | Buy | $16.00 | $13.00 |

| Yuan Zhi | B. Riley Securities | Announces | Buy | $14.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Mirion Technologies. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Mirion Technologies compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Mirion Technologies's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Mirion Technologies's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Mirion Technologies analyst ratings.

Get to Know Mirion Technologies Better

Mirion Technologies Inc provides products, services, and software that allows customers to safely leverage the power of ionizing radiation for the greater good of humanity through critical applications in the medical, nuclear, defense markets, as well as laboratories, scientific research, analysis and exploration. The Company manages its operations through two segments: Medical and Technologies. The Medical segment provides radiation oncology quality assurance, delivering patient safety solutions for diagnostic imaging and radiation therapy centers. The Technologies segment is based around the nuclear energy, defense, laboratories, and scientific research markets as well as other industrial markets. It derives maximum revenue from Technologies Segment.

Financial Milestones: Mirion Technologies's Journey

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Mirion Technologies's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 8.16%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Mirion Technologies's net margin is impressive, surpassing industry averages. With a net margin of -6.58%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Mirion Technologies's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -0.9%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Mirion Technologies's ROA stands out, surpassing industry averages. With an impressive ROA of -0.52%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Mirion Technologies's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.47, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.