20 analysts have shared their evaluations of Expedia Group (NASDAQ:EXPE) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 15 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 6 | 0 | 0 |

| 2M Ago | 0 | 0 | 5 | 0 | 0 |

| 3M Ago | 1 | 0 | 4 | 0 | 0 |

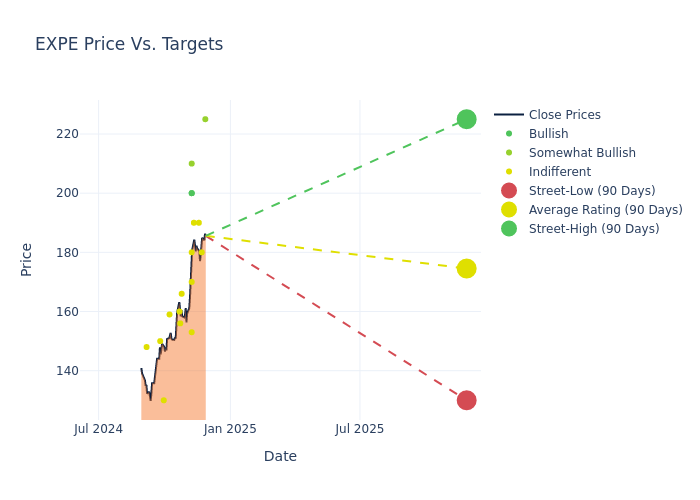

Analysts have recently evaluated Expedia Group and provided 12-month price targets. The average target is $170.1, accompanied by a high estimate of $225.00 and a low estimate of $130.00. This current average has increased by 18.08% from the previous average price target of $144.06.

Decoding Analyst Ratings: A Detailed Look

In examining recent analyst actions, we gain insights into how financial experts perceive Expedia Group. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Bellisario | Baird | Announces | Outperform | $225.00 | - |

| Brian Nowak | Morgan Stanley | Raises | Equal-Weight | $180.00 | $150.00 |

| Tom White | DA Davidson | Raises | Neutral | $190.00 | $135.00 |

| Shyam Patil | Susquehanna | Raises | Neutral | $190.00 | $145.00 |

| Trevor Young | Barclays | Raises | Equal-Weight | $153.00 | $134.00 |

| Jake Fuller | BTIG | Raises | Buy | $200.00 | $175.00 |

| Doug Anmuth | JP Morgan | Raises | Neutral | $170.00 | $135.00 |

| Jed Kelly | Oppenheimer | Raises | Outperform | $210.00 | $155.00 |

| Scott Devitt | Wedbush | Raises | Neutral | $180.00 | $130.00 |

| Daniel Kurnos | Benchmark | Raises | Buy | $200.00 | $180.00 |

| Justin Post | B of A Securities | Raises | Neutral | $166.00 | $144.00 |

| Stephen Ju | UBS | Raises | Neutral | $156.00 | $137.00 |

| John Colantuoni | Jefferies | Raises | Hold | $160.00 | $145.00 |

| Ken Gawrelski | Wells Fargo | Raises | Equal-Weight | $159.00 | $130.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Maintains | Neutral | $130.00 | $130.00 |

| Jake Fuller | BTIG | Raises | Buy | $175.00 | $150.00 |

| Kevin Kopelman | TD Cowen | Announces | Hold | $150.00 | - |

| Deepak Mathivanan | Cantor Fitzgerald | Maintains | Neutral | $130.00 | $130.00 |

| Greg Miller | Truist Securities | Announces | Hold | $148.00 | - |

| Deepak Mathivanan | Cantor Fitzgerald | Announces | Neutral | $130.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Expedia Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Expedia Group compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Expedia Group's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Expedia Group's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Expedia Group analyst ratings.

Delving into Expedia Group's Background

Expedia is the world's second-largest online travel agency by bookings, offering services for lodging (80% of total 2023 sales), air tickets (3%), rental cars, cruises, in-destination, and other (11%), and advertising revenue (6%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Expedia Group's Economic Impact: An Analysis

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Expedia Group's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 3.33%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Expedia Group's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 16.85%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Expedia Group's ROE excels beyond industry benchmarks, reaching 61.87%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Expedia Group's ROA stands out, surpassing industry averages. With an impressive ROA of 2.77%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 4.96, Expedia Group faces challenges in effectively managing its debt levels, indicating potential financial strain.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

.png?w=600)