Jensen Huang unveiled the future last week — with a little help from his friends.

The co-founder and chief executive of Nvidia (NVDA) took the stage to deliver the keynote address at the artificial-intelligence-chip maker's GTC conference in San Jose, Calif., to let the world know what his company has been up to.

“General-purpose computing has run out of steam,” Huang told the audience. “We need another way of doing computing.”

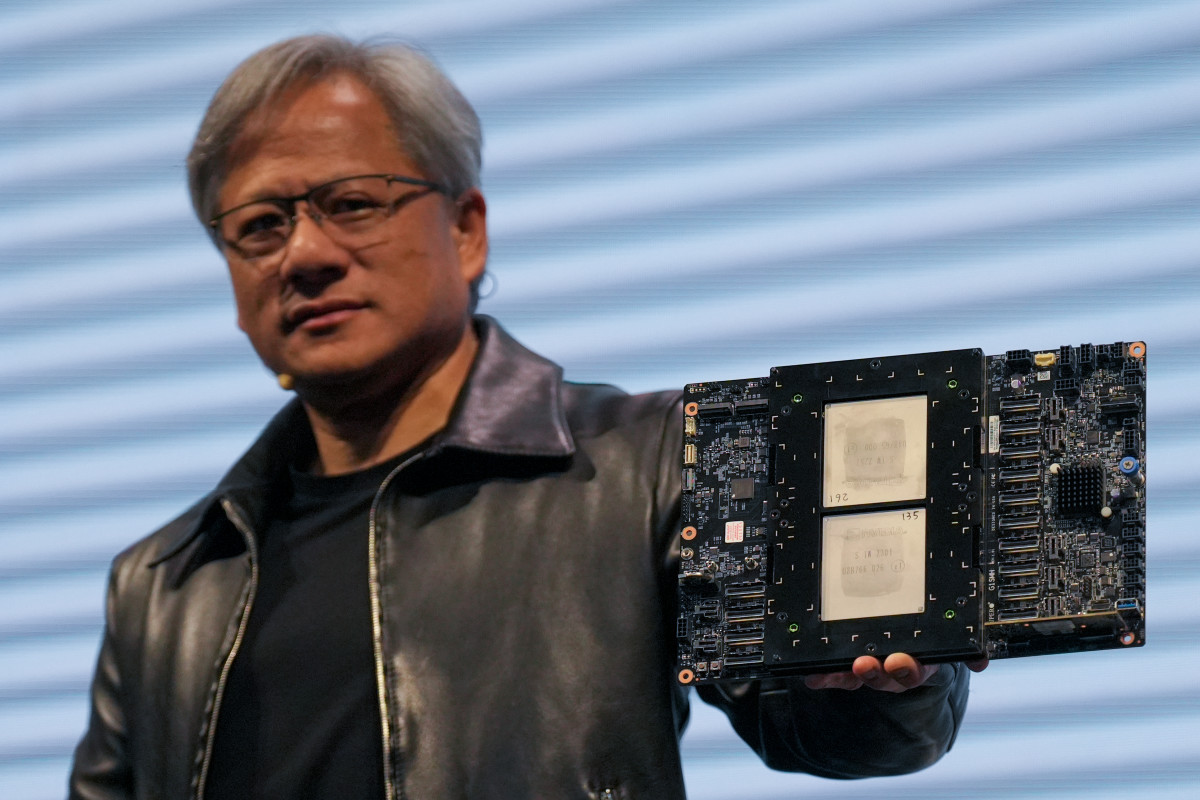

The top executive unveiled Blackwell, Nvidia’s next-generation GPU architecture, which the company has said will "power a new era of computing."

Named after David Blackwell, the first black scholar inducted into the National Academy of Science, Blackwell has been described by Rosenblatt Securities analyst Hans Mosesmann as "likely the most ambitious project Silicon Valley has ever witnessed."

The Blackwell platform will use a new series of chips, the B200 family, combined with new components and software to get the most out of the chips.

Nvidia CEO discusses 'next generation of robotics'

Nvidia said the Blackwell chip architecture uses 25% less energy than the company's Hopper chips.

Huang emphasized the ease of transitioning to this new architecture, commenting that the switch from Hopper to Blackwell is instantaneous.

Related: Boeing shares leap as it unveils CEO exit, major leadership changes

The first Blackwell chip is called the GB200 and will ship later this year. Amazon (AMZN) , Google (GOOG) , Microsoft and Oracle (ORCL) will sell access to the GB200 through cloud services.

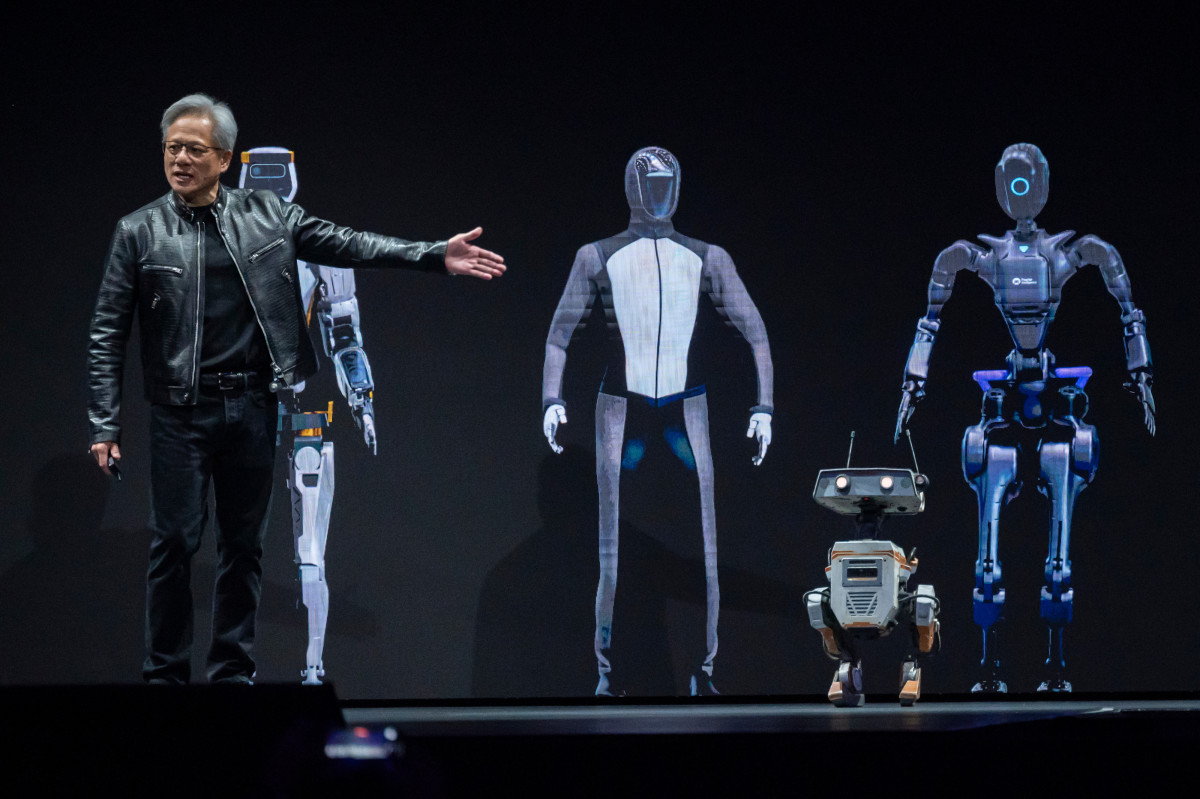

Huang also announced Project Groot, or "Generalist Robot 00 Technology," a general-purpose foundation model for humanoid robots,

"The next generation of robotics will likely be humanoid robots," Huang said. "We now have the necessary technology to imagine generalized human robotics."

He was joined on the stage by a crew of robots, including two "special guests" in the form of Disney's (DIS) Orange and Green BD-X robots, which were trained with Nvidia’s simulation tools.

Huang also noted that company is not limited to AI alone but is also a leader in accelerated computing, a market valued at $250 billion annually..

He estimated the company's AI data center market at around $1 trillion.

Naturally, all this activity has gotten Wall Street's attention. Shares of Nvidia have skyrocketed this year, nearly doubling to $937.38 at last check from $481.68 on Jan. 2.

The company has a market capitalization of $2.4 trillion, making it the third most valuable company in the world behind Microsoft (MSFT) and Apple (AAPL) .

Analyst sees 'new wave of demand'

Nvidia clobbered Wall Street's elevated fourth-quarter-earnings estimates last month, as revenue increased by a staggering 265% to $22.1 billion, its third consecutive quarter of triple-digit growth.

The company forecast 2024 sales in the region of $24 billion and an implied bottom line of $5.41 a share.

More AI Stocks:

- Analysts revamp C3.ai stock price targets after earnings

- Analyst updates stock price target for Super Micro Computer

- Analysts unveil new Nvidia price targets ahead of 'AI Woodstock' conference

UBS analyst Timothy Arcuri raised his price target for Nvidia shares on Friday to $1,100 from $800.

Arcuri told investors in a research note that Nvidia “sits on the cusp of an entirely new wave of demand from global enterprises and sovereigns.”

Specifically, he noted that Huang had mentioned countries like the United Arab Emirates, Saudi Arabia, Sweden, Japan, South Korea and Malaysia as key government customers, which the analyst said could result in Nvidia generating $150 billion in revenue in 2025, up 30% year over year.

Arcuri also said that new prepackaged and pretrained modular AI models announced with together with Blackwell "should also accelerate the distribution flywheel for [Nvidia’s] AI solutions to ride alongside enterprise software."

"The entire framework creates a central distribution structure similar to an app store, and given the vast array of companies to potentially license NVDA’s AI Enterprise software ($4,500/GPU/yr), monetization can add up quickly," Arcuri wrote, according to Investorplace.com.

Arcuri said he would view any near-term weakness as a buying opportunity.

Related: Veteran fund manager picks favorite stocks for 2024