A prominent Wall Street investment bank on Thursday called on chip giant Intel (INTC) to exit its foundry business.

At the same time, an analyst with another firm said investors should sell the stock.

Foundries are the factories that build semiconductors based on internal corporate designs or, in the case of Taiwan Semiconductor (TSM) , that build chips based on others' designs.

Taiwan Semi customers include Nvidia (NVDA) and Advanced Micro Devices (AMD) . and companies building chips for cellphones based on designs from Arm Holdings (ARM) .

Related: 5 stocks that could be tossed from the Dow

Intel has been betting that its future depends on its ability to make state-of-the-art chips for itself and others in foundries located in the U.S. The plan would be financed with $8.5 billion in grants and $11 billion in federal loans.

The problem is that not a dime of the money has been made available to the storied semiconductor company, whose results this year have been subpar. Moreover, the Commerce Department and Intel are at loggerheads about disclosure requirements.

A separate chip factory, not in the scope of the grant-and-loan aid package, is already under way, a $28 billion project in Licking County, Ohio, near Columbus.

Intel foundry unit has minimal chance of success

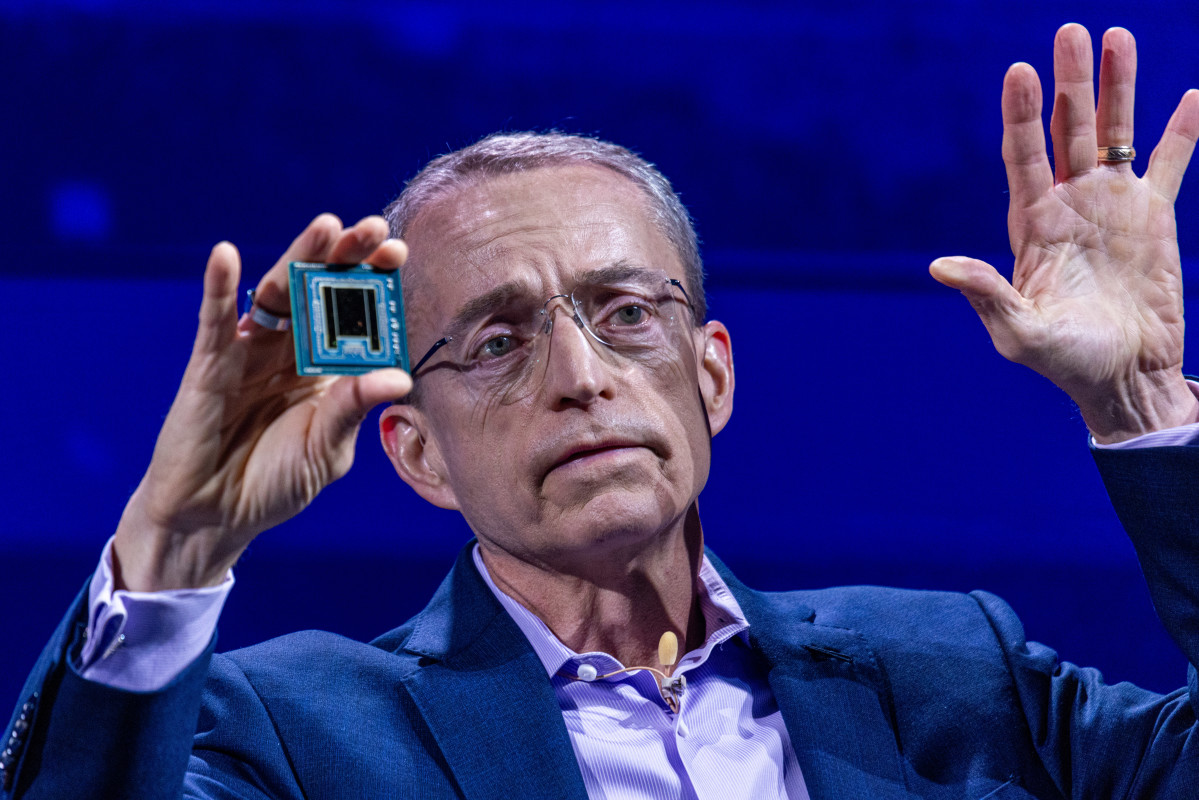

Intel executives presented at the Citi TMT conference on Wednesday. By Thursday morning, Citi analyst Christopher Danely, already bearish on Intel, repeated his call for Intel to get out of the foundry business. He gave the stock a $25 target.

It's too expensive, Danely wrote, and its plan "has minimal chance of succeeding." (TMT stands for telecom, media and technology.)

Intel shares finished down 3 cents to $19.40 in Nasdaq trading on Thursday. The shares were up after hours to $19.45.

That's the good news.

Intel shares are down 61.4% for the year and nearly 12% just in the first three days of September. They fell 28.3% in August. And they're trading just above their 52-week low of $18.84, reached on Aug. 8.

More Tech Stocks:

- Nvidia stock extends $280 billion slump after DoJ probe

- Analysts reset Alphabet stock price target before key September court event

- Trader who predicted Palantir, SoFi, Rocket Lab rallies updates outlook

The stock's collapse came after Intel reported a second-quarter loss of $1.61 billion, and the company said it would cut 15,000 jobs. The report sent its shares to their worst rout in decades.

Citi wasn't the only firm to give Intel bad news this week.

On Thursday Analyst Hans Engel at Vienna-based Erste Group Research downgraded Intel shares to sell from hold. He didn't offer a price target. He attributed the move to "the very unclear outlook, the weak sales (declining market share for its server CPUs) and the high level of debt."

He did concede that Intel was in a transformation phase.

There's speculation it could be replaced as a component in the Dow. Intel's greatest success came in the 1990s when its chips powered computers running on Microsoft (MSFT) Windows. It has not been a player in chips powering artificial intelligence applications.

Intel has a big Broadcom problem

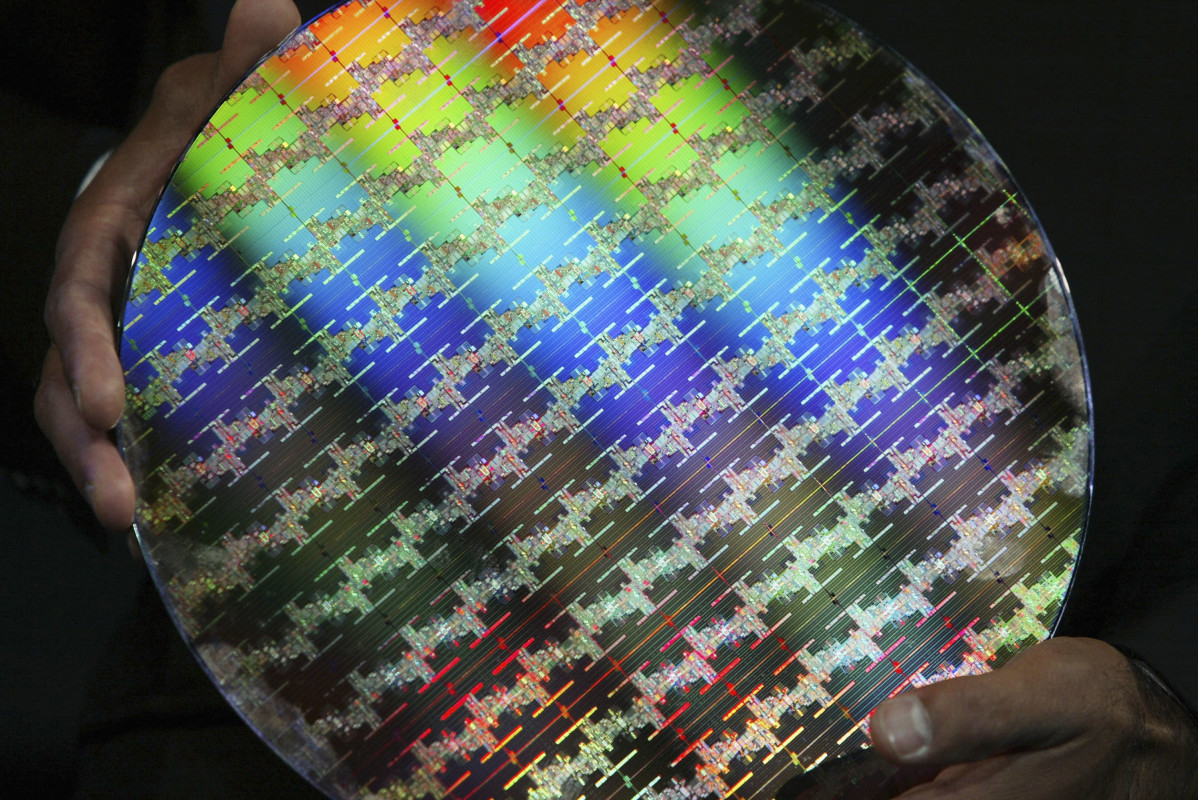

One other report from Reuters suggested another issue: Tests of new Intel silicon wafers by semiconductor company Broadcom (AVGO) failed.

Wafers are foot-wide discs on which semiconductor circuitry is etched. Broadcom is considering having Intel manufacture chips. It's not clear what the next step will be.

Intel's board is to meet later in December and may decide to do major surgery, including a split of its product-design and manufacturing businesses, scrapping some of its new factory projects and maybe mergers or acquisitions.

Related: Veteran fund manager sees world of pain coming for stocks