It seemed like science fiction until November 2022, when OpenAI's ChatGPT sparked a wave of interest in artificial intelligence's real-world potential.

Since then, almost every industry has experienced a whirlwind of AI activity.

Banks are using AI to hedge risks, drugmakers are investigating its use to develop better medicines more quickly, manufacturers are using it to improve productivity, and retailers are using it to improve supply chains. The military is even considering how AI may help on the battlefield.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💵

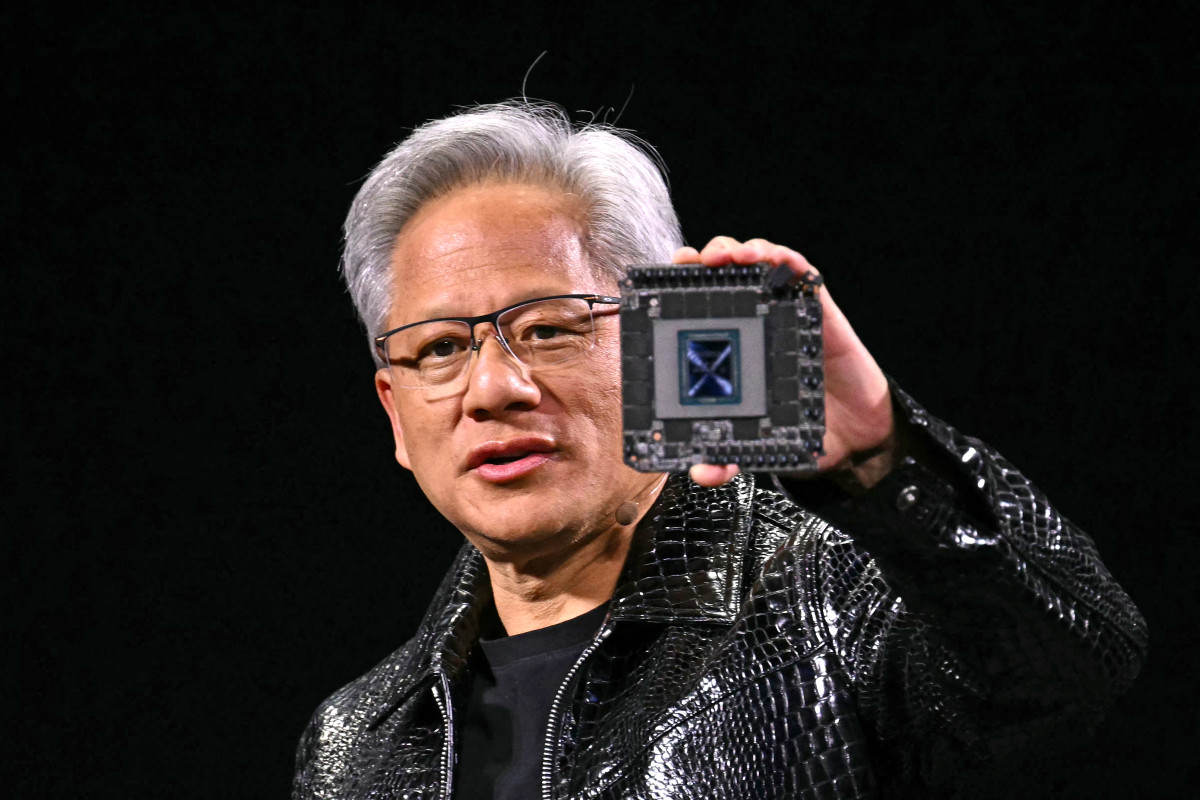

At the center of all this interest sits Nvidia, the world's largest maker of graphics-processing units, or GPUs, ideally suited to training and running AI chatbots like ChatGPT, Google's Gemini and Microsoft's CoPilot.

Demand for Nvidia's chips has been so strong that its revenue and profit have soared, taking the stock to arguably stratospheric levels.

Nvidia's (NVDA) stock price rallied 171% in 2024 alone, raising big questions about whether the company's valuation, which now exceeds $2.8 trillion, is stretched.

The biggest player in a fast-growing market

Some of the largest technology companies have ramped their spending to capitalize on the AI opportunity.

Related: Fund manager who predicted Nvidia rally revamps stock forecast

In 2024 the capital expenditures at Meta Platforms, Microsoft, Google and Amazon totaled $230 billion, up from $144 billion in 2023. In 2025, that spending is expected to surge again, to $325 billion. Much of the increase has gone to upgrading older servers and the silicon chips necessary to power them in cloud networks.

Nvidia is at the forefront of this trend thanks to its high-powered GPUs, which were best known for powering videogaming consoles and mining cryptocurrency before the AI boom.

The surge in demand catapulted Nvidia's revenue nearly five times, to $130 billion in 2024 from about $27 billion in 2023.

With so much money at stake, Nvidia is plowing dollars back into research and development to stave off rivals, including Advanced Micro Devices, which launched its own AI chips last year, and companies like Broadcom, which is working with OpenAI to develop its own chips.

The potential is undeniably large.

Last October, AMD's CEO, Lisa Su, said the GPU market could grow to $500 billion in 2028, or more than 60% per year.

Nvidia's valuation comes under the microscope

Technology stocks like Nvidia aren't known for being cheap. Often, they command higher than market price-to-earnings multiples.

Related: Veteran analyst offers AI spending prediction as worries mount

It's not uncommon to find fast-growing technology stocks trading with p/e multiples in the high double digits. Some high-flyers have seen triple-digit multiples, which dwarf the S&P 500's average forward p/e of about 22.

Given Nvidia's massive runup, debate about whether Nvidia's stock price has gotten ahead of itself has sharpened.

Stacy Rasgon, an analyst with Bernstein Société Générale Group, is the latest analyst to weigh in on the debate. Rasgon's take on Nvidia's valuation might surprise you.

Nvidia's stock price dropped about 15% this year as investors became antsy about the likelihood of AI spending continuing to grow rapidly.

Rasgon finds that drop "a little stunning," noting that Nvidia is only now accelerating sales of Blackwell, its newest generation of AI chips.

"After yesterday's rout, the stock trades at [about 25 times next 12 months] earnings, their weakest level in a year and close to 10-year lows," wrote Rasgon's team in a research note to clients.

"In fact, the stock now trades BELOW parity relative to the SOX (something we have seen only once or twice in the past decade) and at only a slight S&P premium, the lowest they have been since 2016."

Nvidia's 5-year trailing price-to-earnings multiple is 26.

The SOX is the Philadelphia Semiconductor Index, made up of 30 of the largest semiconductor stocks.

Last quarter, Nvidia sold $11 billion of Blackwell chips. On its fourth-quarter conference call, Nvidia CEO Jensen Huang said it was the fastest ramp in Nvidia's history.

"Our post-earnings conversations with the company indicated the $11 billion in [fiscal-fourth-quarter] Blackwell revenues all shipped in January (suggesting the floodgates are now open) and the company indicated to us that demand will continue to exceed supply for the next several quarters as they ramp," added Rasgon.

More Nvidia:

- Nvidia-backed startup could be hottest tech IPO of the year

- Fund manager who predicted Nvidia rally revamps stock forecast

- Surprising news hits Nvidia stock price

If that proves out, Blackwell's sales could continue supporting Nvidia's revenue growth, and once production is at scale, profitability should bounce back.

Gross margin is expected to narrow to 71% this quarter. It was 73% last quarter, down from 76% in the year-earlier period. Nvidia says it should rebound to a mid-70% margin later this year.

Blackwell's sales potential and the chance for a rebound in margin could mean that Nvidia is in the bargain rack, given its relatively low p/e multiple compared with its historic levels.

"Valuation is getting increasingly attractive," said Rasgon.

Bernstein's Nvidia stock price target is $185.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast