Moelis (NYSE:MC) underwent analysis by 5 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 1 | 2 | 1 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 0 | 0 | 1 | 1 | 1 |

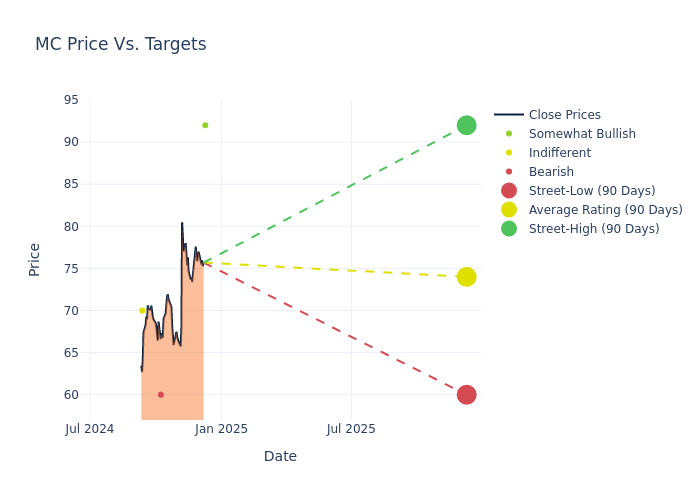

Analysts have recently evaluated Moelis and provided 12-month price targets. The average target is $71.0, accompanied by a high estimate of $92.00 and a low estimate of $60.00. Witnessing a positive shift, the current average has risen by 14.52% from the previous average price target of $62.00.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Moelis. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ryan Kenny | Morgan Stanley | Raises | Overweight | $92.00 | $66.00 |

| Ryan Kenny | Morgan Stanley | Lowers | Underweight | $66.00 | $67.00 |

| Brennan Hawken | UBS | Raises | Sell | $60.00 | $54.00 |

| Ryan Kenny | Morgan Stanley | Raises | Underweight | $67.00 | $61.00 |

| Michael Brown | Wells Fargo | Announces | Equal-Weight | $70.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Moelis. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Moelis compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Moelis's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Moelis's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Moelis analyst ratings.

All You Need to Know About Moelis

Moelis & Co is an independent investment bank that provides strategic and financial advice to a diverse client base, including corporations, financial sponsors, governments, and sovereign wealth funds. The company assists its clients in achieving their strategic goals by offering comprehensive, globally integrated financial advisory services across all industry sectors. It also advises clients on their critical decisions, including mergers and acquisitions, recapitalizations and restructurings, capital markets transactions, and other corporate finance matters. it generates revenue from advisory transactions. The firm derives a majority of its revenue from the United States followed by Europe and the rest of the World.

Financial Insights: Moelis

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining Moelis's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.58% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Moelis's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 6.17%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Moelis's ROE stands out, surpassing industry averages. With an impressive ROE of 4.66%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Moelis's ROA stands out, surpassing industry averages. With an impressive ROA of 1.53%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Moelis's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.58.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.