Across the recent three months, 14 analysts have shared their insights on Bank of America (NYSE:BAC), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 12 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 7 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

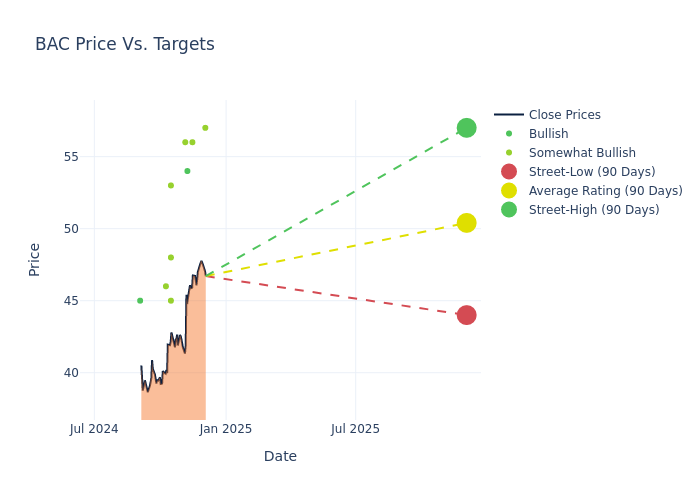

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $50.36, a high estimate of $57.00, and a low estimate of $44.00. This upward trend is evident, with the current average reflecting a 5.25% increase from the previous average price target of $47.85.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Bank of America among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Siefers | Piper Sandler | Raises | Neutral | $50.00 | $44.00 |

| David Konrad | Keefe, Bruyette & Woods | Raises | Outperform | $57.00 | $50.00 |

| Whit Mayo | Wells Fargo | Raises | Overweight | $56.00 | $52.00 |

| Keith Horowitz | Citigroup | Raises | Buy | $54.00 | $46.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $56.00 | $50.00 |

| Glenn Thum | Phillip Securities | Announces | Accumulate | $44.00 | - |

| Jason Goldberg | Barclays | Raises | Overweight | $53.00 | $49.00 |

| Glenn Schorr | Evercore ISI Group | Raises | Outperform | $45.00 | $44.00 |

| David Konrad | Keefe, Bruyette & Woods | Raises | Outperform | $50.00 | $48.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $50.00 | $49.00 |

| Betsy Graseck | Morgan Stanley | Raises | Overweight | $48.00 | $47.00 |

| Gerard Cassidy | RBC Capital | Maintains | Outperform | $46.00 | $46.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $49.00 | $48.00 |

| Betsy Graseck | Morgan Stanley | Lowers | Overweight | $47.00 | $49.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Bank of America. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Bank of America compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Bank of America's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Bank of America's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Bank of America analyst ratings.

Get to Know Bank of America Better

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America's consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company's Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

Bank of America: Delving into Financials

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining Bank of America's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.71% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Bank of America's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 25.17%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Bank of America's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.37%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Bank of America's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.19%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Bank of America's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.23.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.