Just remember: You can't spell Nvidia (NVDA) without AI.

The Santa Clara, Calif., chip giant has pretty much become synonymous with the artificial intelligence revolution.

Nvidia makes graphics-processing units, or GPUs, which play a crucial role in AI. The company's shares have tripled over the past year, giving it a market capitalization of $2.27 trillion.

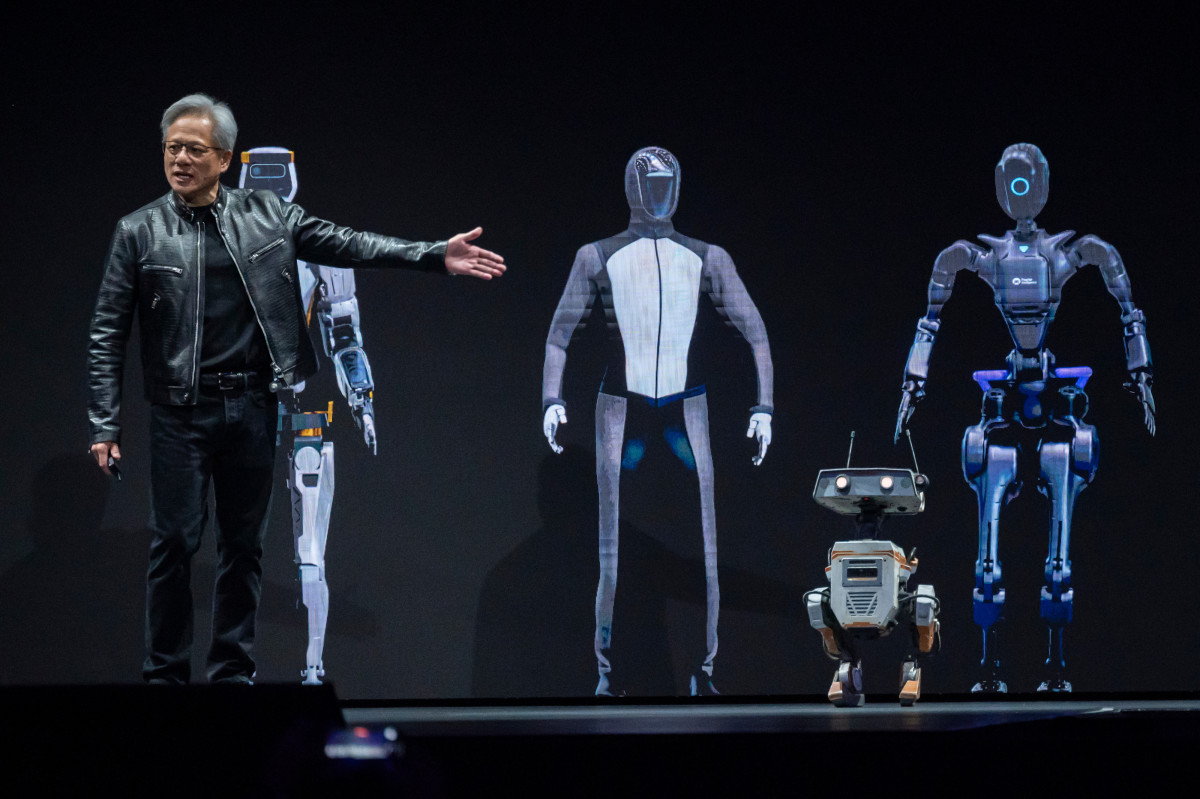

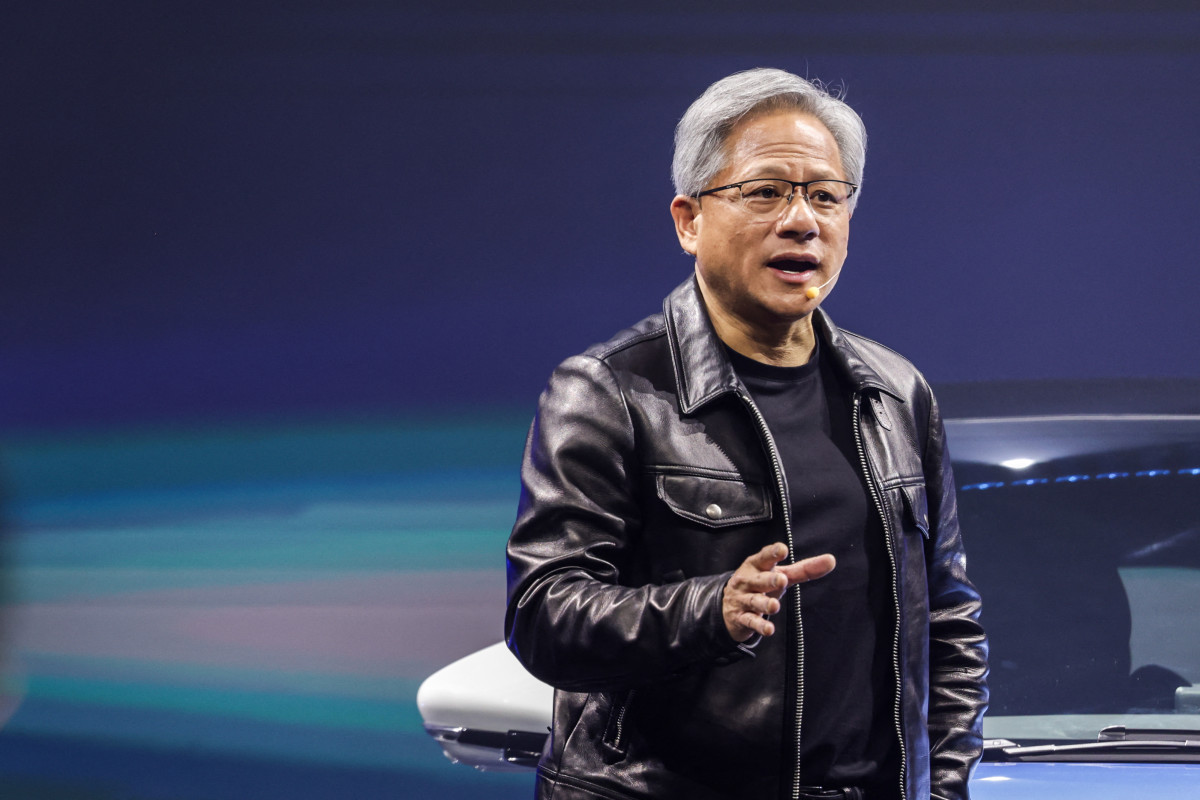

Chief Executive Jensen Huang, who co-founded the company at a Denny's restaurant in San Jose in 1993, was named to Time magazine's list of the 100 most influential people of 2024.

Nvidia's next-generation AI chip, the R-series/R100, will reportedly enter into mass production in fourth-quarter 2025, according to analyst Ming-Chi Kuo, and will focus on improving power consumption and enhancing AI computing power.

Related: Single Best Trade: Wall Street veteran picks Palantir stock

Meanwhile, Mitre, a key supplier to the Pentagon and U.S. intelligence agencies, is building a $20 million supercomputer with Nvidia to speed deployment of artificial-intelligence capabilities across the U.S. federal government, the Washington Post reported.

Mitre, a federally funded not-for-profit research organization that has supplied U.S. soldiers and spies with exotic technical products since the 1950s, said the project could improve everything from Medicare to taxes.

“There’s huge opportunities for AI to make government more efficient,” said Charles Clancy, senior vice president of Mitre.

“Government is inefficient, it’s bureaucratic, it takes forever to get stuff done. … That’s the grand vision, is how do we do everything from making Medicare sustainable to filing your taxes easier?” he said.

Billionaire cuts his stake in Nvidia

Nvidia shares took a hit earlier this week when the billionaire investor Stanley Druckenmiller said that he'd slashed his big bet in the chipmaker earlier this year. He said the swift AI boom could be overdone in the short run.

Related: Nvidia shares get boost from key supplier ahead of earnings

“We did cut that and a lot of other positions in late March. I just need a break. We’ve had a hell of a run. A lot of what we recognized has become recognized by the marketplace now,” Druckenmiller said on CNBC’s “Squawk Box.”

Druckenmiller said he reduced the bet after “the stock went from $150 to $900.”

“I’m not Warren Buffett — I don’t own things for 10 or 20 years. I wish I was Warren Buffett,” he added.

The financier, who now runs Duquesne Family Office, said he was introduced to Nvidia in the fall of 2022 by his young partner, who believed that the excitement about blockchain was going to be far outweighed by AI.

“I didn’t even know how to spell it,” Druckenmiller said. “I bought it. Then a month later, ChatGPT happened. Even an old guy like me could figure out, okay, what that meant, so I increased the position substantially.”

He added that AI "might be a little overhyped now but underhyped long term.”

“AI could rhyme with the internet," he said. "As we go through all this capital spending, we need to do the payoff while it’s incrementally coming in by the day. The big payoff might be four to five years from now.”

Analyst affirms Nvidia on Conviction List

TheStreet Pro's Stephen Guilfoyle has similar feelings about Nvidia, noting that the company "has rallied into its upcoming quarterly earnings release, and the stock price climbs closer to those levels seen a couple of months ago."

He said that "it was reaffirming for me as a trader/investor that someone I think of as possibly the industry GOAT was thinking along the same lines ... protecting profits near highs going into what seemed like a rough patch. ... I remain long the name, and the name remains for me a top 10 holding."

Nvidia is scheduled to report first-quarter earnings on May 22. Analysts surveyed by FactSet expect the company to report a profit of $5.60 a share on revenue of $24.75 billion.

More AI Stocks:

- Analyst unveils eye-popping Palantir stock price target after Oracle deal

- Veteran analyst delivers blunt warning about Nvidia's stock

- Analysts revamp Microsoft stock price target amid OpenAI reports

A year earlier Nvidia posted earnings of $1.09 per share on revenue of $7.19 billion.

On Feb. 21, Nvidia beat Wall Street's fiscal fourth-quarter targets, delivering its third quarter of triple-digit percentage growth in sales and earnings.

Analysts at Goldman Sachs raised the firm's price target on Nvidia to $1,100 from $1,000 and affirmed a buy rating on the shares, which remain on the firm's Conviction List.

The firm increased its 2025-2027 non-GAAP earnings-per-share estimates by an average of 8% to reflect intra-quarter industry data points indicating continued robust AI server demand and improving supply.

Related: Analysts adjust Amazon stock price target after earnings

Nvidia stock still trades at a relatively attractive valuation compared with its peers, given how quickly it is growing and how durable those growth trends look in the coming years, Goldman Sachs said. (The current price-to-earnings multiple on NVDA is 75.)

Despite the stock's year-to-date outperformance, Goldman said that it saw positive earnings-per-share revisions driving another leg up in the stock, the analyst tells investors.

The investment firm said it was specifically encouraged by recent comments from the megacap tech giants, which suggested on their earnings calls that they would be spending even more money on AI infrastructure in 2025, following elevated investment in 2024.

Related: Veteran fund manager picks favorite stocks for 2024