Five Below (NASDAQ:FIVE) is gearing up to announce its quarterly earnings on Wednesday, 2024-12-04. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Five Below will report an earnings per share (EPS) of $0.16.

Investors in Five Below are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

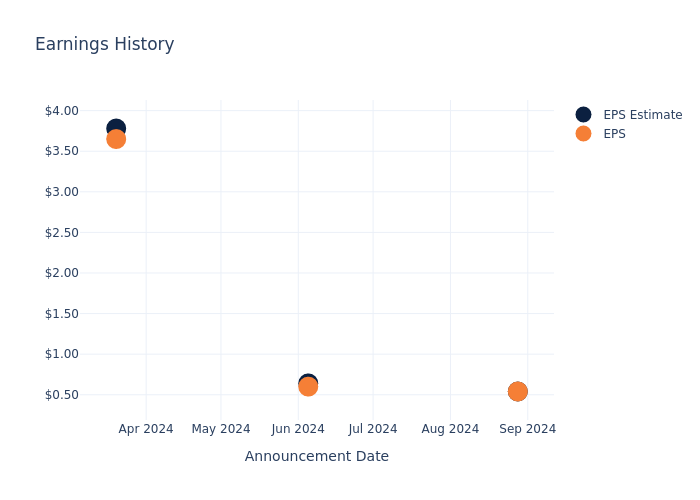

Past Earnings Performance

During the last quarter, the company reported an EPS missed by $0.00, leading to a 0.89% drop in the share price on the subsequent day.

Here's a look at Five Below's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.54 | 0.64 | 3.78 | 0.24 |

| EPS Actual | 0.54 | 0.60 | 3.65 | 0.26 |

| Price Change % | -1.0% | -11.0% | -15.0% | 0.0% |

Analyst Views on Five Below

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Five Below.

Analysts have provided Five Below with 11 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $95.55, suggesting a potential 3.68% downside.

Comparing Ratings with Competitors

The following analysis focuses on the analyst ratings and average 1-year price targets of Signet Jewelers, Academy Sports and Warby Parker, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Signet Jewelers, with an average 1-year price target of $97.62, suggesting a potential 1.59% downside.

- The prevailing sentiment among analysts is an Neutral trajectory for Academy Sports, with an average 1-year price target of $62.0, implying a potential 37.5% downside.

- The consensus among analysts is an Outperform trajectory for Warby Parker, with an average 1-year price target of $21.12, indicating a potential 78.71% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Signet Jewelers, Academy Sports and Warby Parker, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Five Below | Neutral | 9.37% | $271.79M | 2.07% |

| Signet Jewelers | Neutral | -7.60% | $566.30M | -5.08% |

| Academy Sports | Neutral | -2.15% | $558.73M | 7.39% |

| Warby Parker | Outperform | 13.30% | $104.87M | -1.22% |

Key Takeaway:

Five Below ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

Discovering Five Below: A Closer Look

Five Below Inc is a specialty value retailer offering merchandise targeted at the tween and teen demographic. The Company's edited assortment of products includes select brands and licensed merchandise.

Unraveling the Financial Story of Five Below

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Five Below showcased positive performance, achieving a revenue growth rate of 9.37% as of 31 July, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Five Below's net margin excels beyond industry benchmarks, reaching 3.98%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.07%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Five Below's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.83% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Five Below's debt-to-equity ratio is below the industry average at 1.18, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Five Below visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.