With the economy of the United States at a standstill during the Covid-19 pandemic, the efforts to stimulate the economy brought many opportunities to people who may have not had them otherwise.

However, the extension of these opportunities to those who took advantage of the times has had its consequences.

Related: American Express reveals record profits, 'robust' spending in Q3 earnings report

Credit Crunch

A report by the Financial Times states that borrowers in the United States that took advantage of lending opportunities during the Covid-19 pandemic are falling behind on actually paying back their debt.

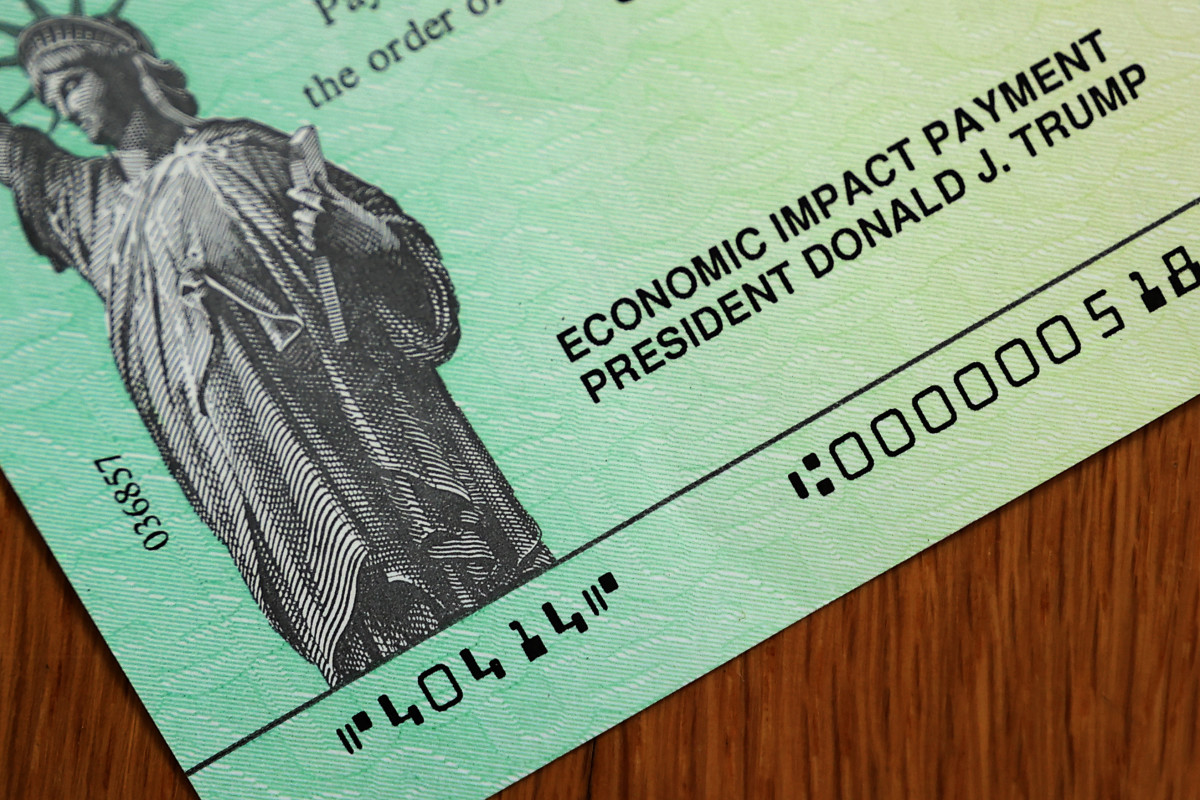

At a time when stimulus checks were handed out and loan repayments were frozen to help those affected by the economic shock of Covid-19, many consumers in the States saw that lenders became more willing to provide consumer credit.

According to a report by credit reporting agency TransUnion, the median consumer credit score jumped 20% to a peak of 676 in the first quarter of 2021, allowing many to finally have “good” credit scores. However, their data also showed that those who took out loans and credit from 2021 to early 2023 are having an hard time managing these debts.

“Consumer finance companies used this opportunity to juice up their growth at a time when funding was ample and consumers’ finances had gotten an artificial boost,” Chief economist of Moody’s Analytics Mark Zandi told FT. “Certainly a lot of lower-income households that got caught up in all of this will feel financial pain.”

Moody’s data shows that new credit cards accounts that were opened in the first quarter of 2023 have a 4% delinquency rate, while the same rate in September 2022 was 4.5%. According to the analysts, these levels were the highest for the same point of the year since 2008.

Additionally, a study by credit scoring company VantageScore found that credit cards issued in March 2022 had higher delinquency rates than cards issued at the same time during the prior four years.

More Investing:

- Why the recession never really hit -- and what indicates that it still could

- Jim Cramer and Dan Ives say a powerful technology will give the markets a boost

- Here's what companies Nvidia is joining in the $1 Trillion market cap club

Credit cards were not the only debts that American consumers took on. As per S&P Global Ratings data, riskier car loans taken on during the height of the pandemic have more repayment problems than in previous years. In 2022, subprime borrowers were becoming delinquent on new cars loans at twice the rate of pre-pandemic levels.

S&P auto loan tracker Amy Martin told FT that lenders during the pandemic were “rather aggressive” in terms of signing new loans.

Bill Moreland of research group BankRegData has warned about these rising delinquencies in the past and had recently estimated that by late 2022, there were hundreds of billions of dollars in what he calls “excess lending based upon artificially inflated credit scores”.

The Government's Role

Because so many are failing to pay their bills, many are wary that the government assistance may have been a financial double-edged sword; as they were meant to alleviate financial stress during lockdown, while it led some of them to financial difficulty.

The $2.2 trillion Cares Act federal aid package passed in the early stages of the pandemic not only put cash in the American consumer’s pocket, but also protected borrowers from foreclosure, default and in some instances, lenders were barred from reporting late payments to credit bureaus.

Yeshiva University law professor Pam Foohey specializes in consumer bankruptcy and believes that the Cares Act was good policy, however she shifts the blame away from the consumers and borrowers.

“I fault lenders and the market structure for not having a longer-term perspective. That’s not something that the Cares Act should have solved and it still exists and still needs to be addressed.”

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.