Americans are accustomed to charging expenses. When they don’t have enough cash to pay, they turn to credit cards to cover the difference. Credit card usage has increased over the years, and in 2024, it reached a record amount, exceeding $1 trillion.

Consumer credit is big business for commercial banks, which can set borrowing rates on credit cards at double-digit rates — higher than those for other types of consumer loans.

Related: How much do you have to make to file taxes in the U.S.?

How much credit card debt is there?

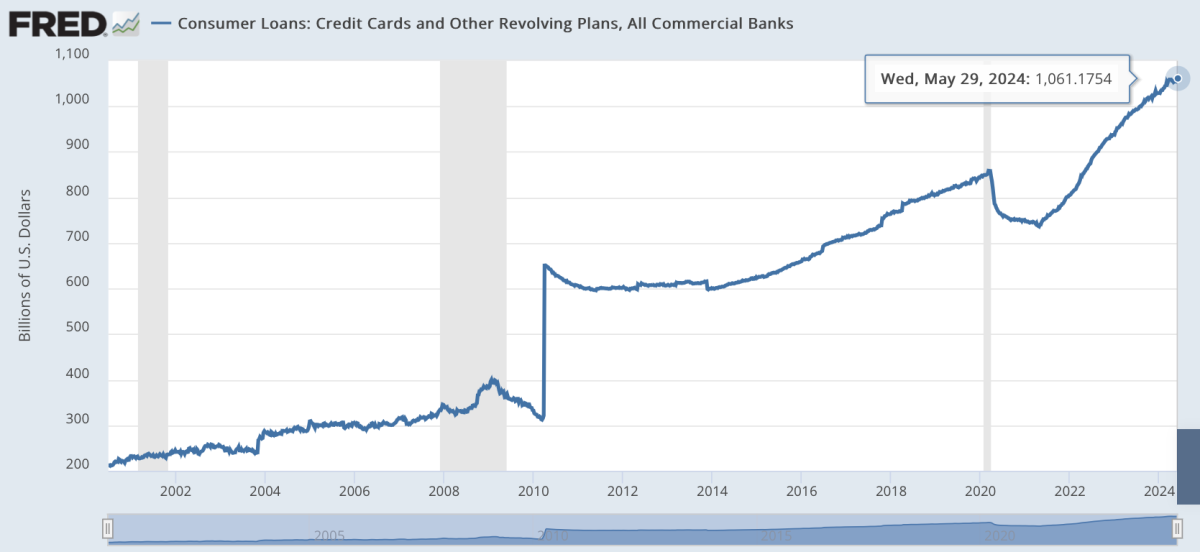

Commercial banks are the biggest providers of credit cards to consumers, and the Federal Reserve keeps track of this data. Over the past few decades, balances on credit cards have risen considerably. Credit card debts and other lines of credit extended to consumers from commercial banks surged from around $200 billion in 2000 to more than $1 trillion in 2024.

At the end of May 2024, there was a record amount of consumer credit card debt, at $1.061 trillion, according to data compiled by FRED (Federal Reserve Economic Data), a storehouse of financial data maintained by the Federal Reserve Bank of St. Louis.

The data showed that credit card users paid their debt in 2020–2021 during the COVID-19 pandemic as stimulus payments were issued and Americans turned to saving, but they resumed borrowing as the economy reopened in 2022, and that borrowing was significant.

Some Americans — stifled by slow wage growth, accelerating inflation, and low savings — turned to borrowing on their credit cards to make payments on everyday living expenses, such as groceries, transportation, and utility bills.

Screenshot via Board of Governors of the Federal Reserve System

What’s the average amount of credit card debt?

In 2022, the average U.S. household with credit card debt had a balance of around $7,226, according to the Fed. Its 2022 Survey of Consumer Finances showed that 51% of American households held credit card debt in 2022.

How delinquent are Americans on their loans?

Some Americans may not be able to make credit card payments on time due to not having enough cash on hand, loss of income, or just forgetting the deadline. The Fed pointed out that borrowers who tend to use up most of the credit available to them were also most likely to be behind on their monthly payments.

The central bank also reported that in the first quarter of 2024, borrowers who were delinquent had a median utilization rate of 90%, which meant that they were using 90% of the credit available to them.

Younger credit card holders and those living in low-income areas were more likely to take on higher balances relative to their credit limit, according to the Fed. In the first quarter of 2024, Generation Z (those born from 1995 to 2011) had a median balance of $760 against a median credit limit of $4,500, which translated to a percentage maxed-out rate of 15.3% — compared to rates of 12.1% for Millennials (1980 to 1994), 9.6% for Generation X (1965 to 1979), and 4.8% for Baby Boomers (1946 to 1964).

Those in the lowest-income quartile had a percentage maxed-out rate of 12.3%, compared to 5.5% in the highest quartile. (Banks tend to set credit limits based on the risk of a borrower’s ability to pay such as income and other forms of debt. Those with higher incomes tend to get higher lines of credit from banks than those with lower incomes.)

| Median Balance | Median Credit Limit | Percentage Maxed-Out | |

|---|---|---|---|

Income quartile |

|||

1st (lowest) |

$1,410 |

$11,300 |

12.3% |

2nd |

$1,597 |

$15,000 |

10.2% |

3rd |

$1,817 |

$18,600 |

8.1% |

4th (highest) |

$2,099 |

$25,800 |

5.5% |

Generation |

|||

Gen Z |

$760 |

$4,500 |

15.3% |

Millennials |

$2,378 |

$16,300 |

12.1% |

Gen X |

$3,017 |

$21,800 |

9.6% |

Baby boomers |

$1,599 |

$22,000 |

4.8% |

What are the interest rates on credit cards?

Interest rates on credit cards tend to be among the highest for credit available to consumers. A monthly interest rate of 1%, for instance, equates to an annual percentage rate of 12%, which isn’t uncommon. And the higher the Fed funds rate imposed by the Federal Reserve, the higher the borrowing rates imposed by commercial banks for credit cards and other lines of credit tend to be.

A missed monthly payment could also lead to higher interest rates as a penalty imposed by the lender. Conversely, a record of timely payments and paying more than the minimum monthly payment could lead to the lender offering lower interest rates to the borrower.

Interest rates can jump significantly in a matter of years. The Fed reported that the typical annual interest rate in 2021 was 15%, and by 2023, that rose to around 21%. So, if a household had a credit card balance of $10,000 in 2021, the yearly interest would amount to $1,500 in 2021 but would jump to $2,100 in 2023.

More on economics:

- Why are groceries so expensive? A look at post-pandemic food price inflation

- How much have fast-food prices gone up since 2020? Price hikes at 6 popular chains

- What is sticky inflation? Definition, measurement & example

How does credit card delinquency affect borrowers?

Typically, a missed monthly payment will automatically render a credit card account delinquent, and that can have negative consequences for the borrower.

A missed payment could lead to a lower credit score, and a poor credit history can make it difficult to borrow or take out loans for a car or a mortgage on a house. Poor credit amounts to a difficult-to-remove stain on one’s financial record.

A lengthy period of nonpayment puts the borrower into default, and banks have to set aside money to cover those unpaid debts. Higher provisions could be problematic for banks, and a systemwide increase in nonperforming loans to total loans could indicate issues for the U.S. economy.

Buy now, pay later

Lenders such as PayPal (PYPL) and Shopify allow borrowers to take out unsecured loans to purchase goods and repay that debt in installments. When consumers have maxed out the limits on their credit cards, some turn to these “buy now, pay later” lending plans. However, these aren’t credit cards, and this type of loan isn’t tracked by the Federal Reserve.

Related: Veteran fund manager picks favorite stocks for 2024