Tomoka Casks is a Business Reporter client

The rapidly emerging Irish and American markets could overtake Scotch within the next decade

Whisky has been generating quite a buzz in the alternative investment sphere in recent years. With its excellent return on investment and exemption from capital gains, this highly sought-after alternative asset class continues to see reliable and consistent growth year after year.

With the whisky market on a reassuring rise, it’s no wonder more and more investors are jumping on the bandwagon and investing in these luxury-liquid assets.

But as with any investment, there are always risks. Markets see ups and downs and unpredictable economic fluctuations, so it’s always best to have your wits about you and do your research before investing your hard-earned cash.

Has the Scotch market become saturated?

When most people think of whisky, they usually think of the Scottish variety. And it’s no surprise, given that the country has been producing the drink since the 15th century, and remains the biggest whisky producer in the world.

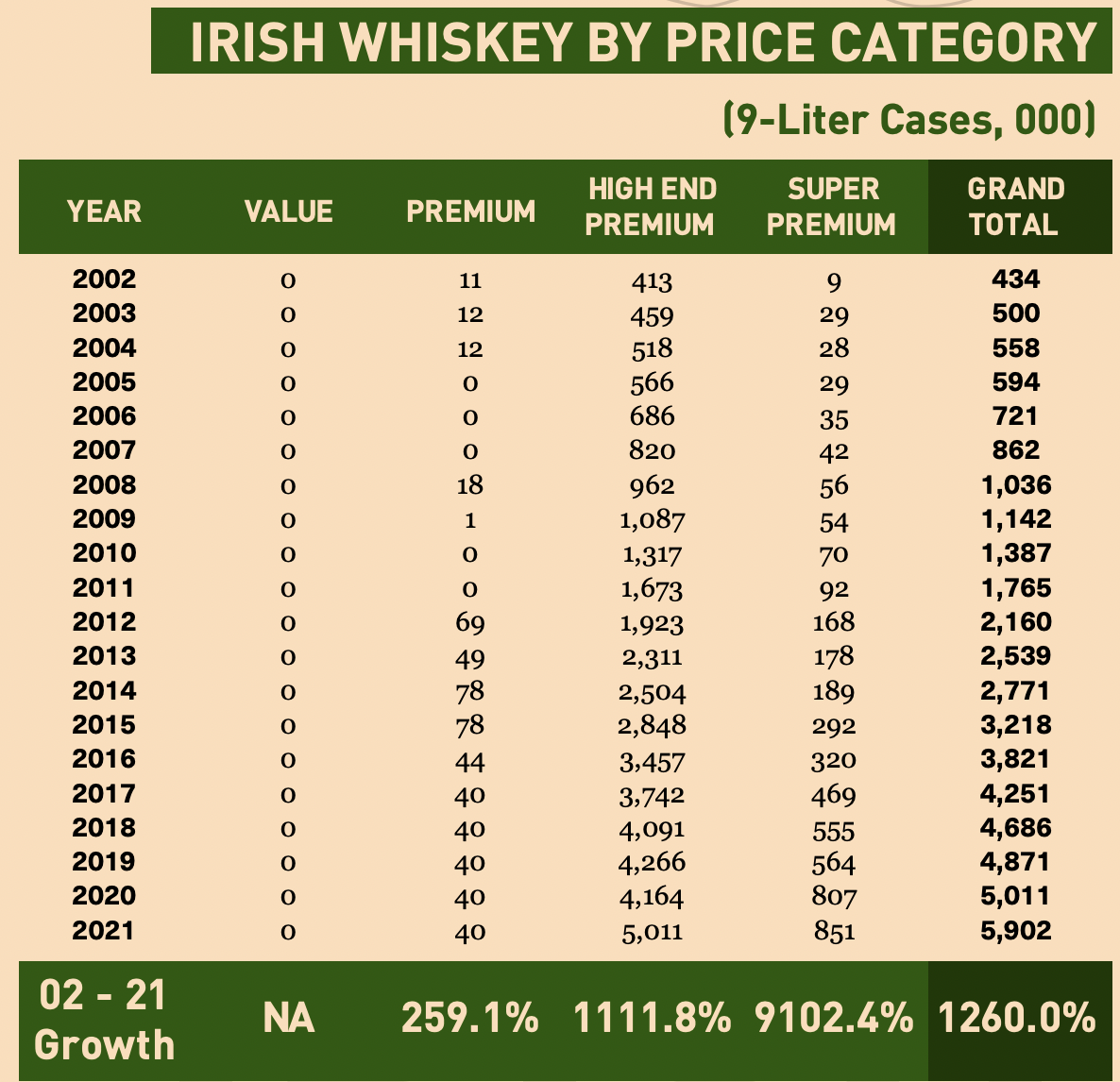

But while Scotland may have become synonymous with whisky, it isn’t the only country to produce it. Its popularity has meant the Scotch market has become saturated, and with investors searching for alternatives, the landscape is changing dramatically. Irish and American markets are emerging rapidly, with the growth of Irish whiskey in the US market especially strong. According to new figures published by the Distilled Spirits Council, Irish whiskey was the fastest-growing category by revenue in the US last year, rising 16.3 per cent ($185 million) to a staggering record of $1.3 billion. If this trend continues, Irish whiskey is set to overtake Scotch by 2030.

The Irish market

Perhaps surprisingly, in the 19th century, it was Irish whiskey, not Scotch, that dominated the market, with two-thirds of all whiskey sold in London originating in Ireland and accounting for 60 per cent of global sales of the drink. However, after a tumultuous period in the country’s history that took in revolution, independence and civil war, and one of Irish whiskey’s biggest importers, the United States, introducing Prohibition in 1920, a steady period of decline was inevitable. By the 1960s, only three distilleries were operating in the country.

Fast forward to 2023, and Irish whiskey is making a comeback. Ireland is now selling 12 million cases a year, up from 200,000 in 1990, and the figure is forecast to double by 2030, overtaking Scotch.

Globally, Irish whiskey’s sales climbed by almost half a million nine-litre cases in one year, with 11.9 million case sales reported by the end of 2022. Irish whiskey is forecast to reach 12.6 million case sales in 2023.

Aside from the US, which accounts for the largest share of Irish whiskey sales in the past year, India is also developing a taste for Irish, and is on the way towards becoming its third-largest market.

Source: Distilled Spirits Council, Econ & Strategic Analysis

Of course, Irish whiskey is still not without its obstacles to growth. According to the Irish Whiskey Association (IWA), the war in Ukraine is expected to negatively impact export sales. In 2021, Russia and Ukraine cumulatively accounted for 7 per cent of global exports. There are also rising costs and supply chain issues slowing down production. However, IWA head William Lavelle said that despite the war’s impact, he still expects “robust growth” in the next year.

The American market

Another market climbing to the forefront is American whiskey, projected to grow by $824.75 million and register a 3.59 per cent spike in CAGR by 2027.

Unlike other whiskey markets, which were not so severely affected by the impact of Covid-19, the American market was hit hard, affecting the overall growth of the industry from 2020 until the start of 2021. Lockdown regulations and disrupted import and export activities slowed down production and operational capabilities.

Post-pandemic, the American market is recovering well, increasing steadily, and is forecast to witness healthy growth over the next ten years in North America itself, Europe, Asia-Pacific, South America and the Middle East.

Why are investors choosing casks over bottles?

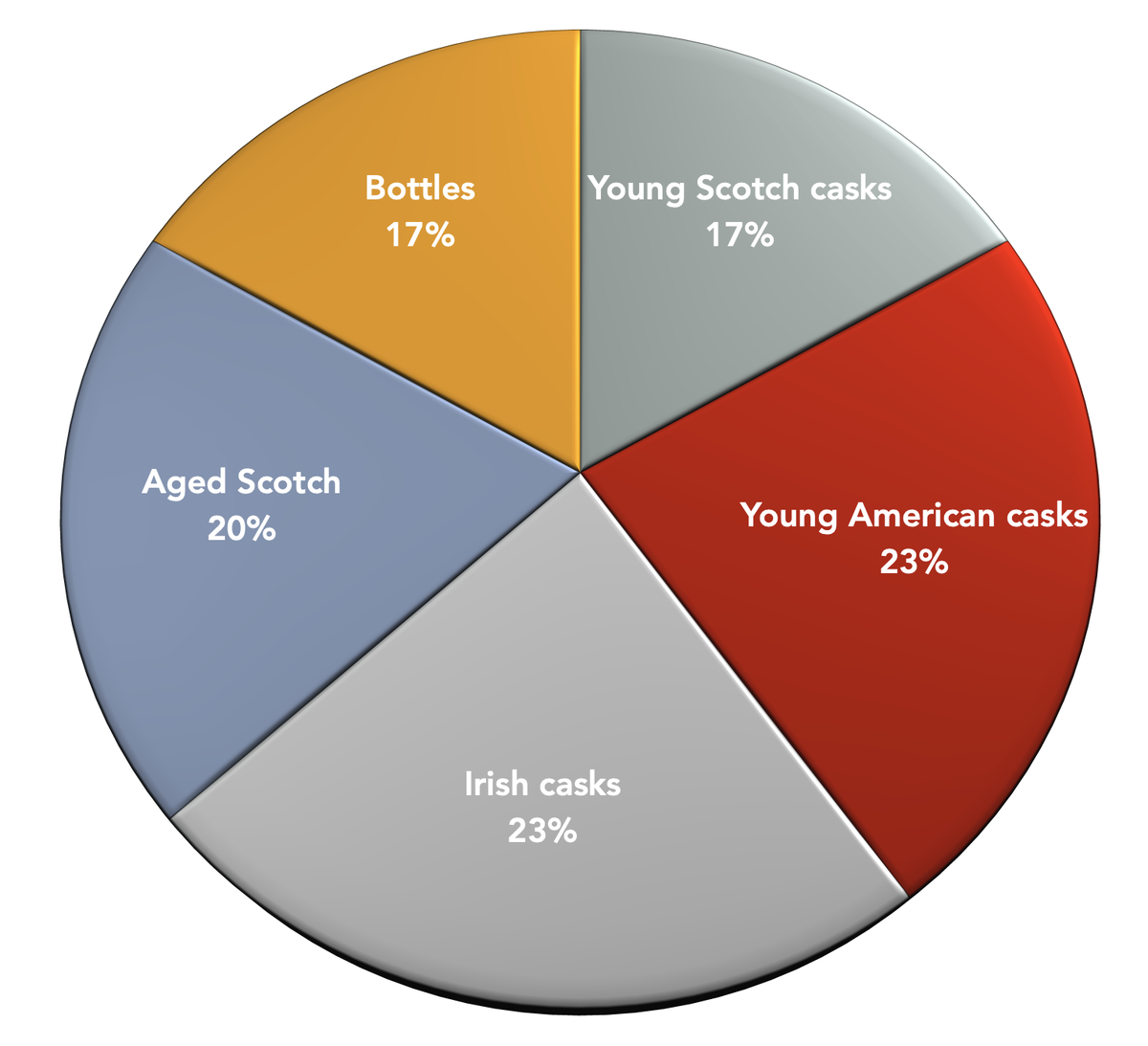

If you have upfront capital that you don’t mind having tied up for 10-plus years, then buying a whisky cask is worthwhile and rewarding. Younger casks have the potential for outstanding returns and start at a more accessible price point, making them a fantastic, longer-term investment strategy.

The market for young American casks is growing rapidly in the same way Scotch saw growth 10 years ago, with the price of a four-year-old barrel going from $1,500 to over $5,000 in five years. We expect this trend to continue.

Although casks are a much better option in terms of maximum returns, rare collectable bottles are also worth noting. We have seen increases of around 20 per cent on some of our clients’ bottles, with some collectables showing significantly more.

But what’s important is choosing the right bottle or cask to invest in. Predicting which distilleries will be popular in the future and knowing the ideal time to liquidate a rare collectable can make or break an investor.

The team at Tomoka provide expert advice to help clients avoid the common pitfalls in the market, recommend the most exceptional selection of whisky to invest in, inform you of the best times to sell and ensure your investment journey is a smooth, enjoyable and, of course, profitable one.

Request your free investment brochure to find out how you can profit from this rewarding alternative asset.

Originally published on Business Reporter