AMD stock surged on Tuesday, reaching a 52-week high of $158.74. Long-term stockholders were already enjoying riding a steady uptrend, but news of strong AI demand and price target increases from big-name analysts converged to boost the stock by 8% in a single day. AMD’s all-time high was $164.46 back in November 2021, and it has moved to within striking distance of breaking that record.

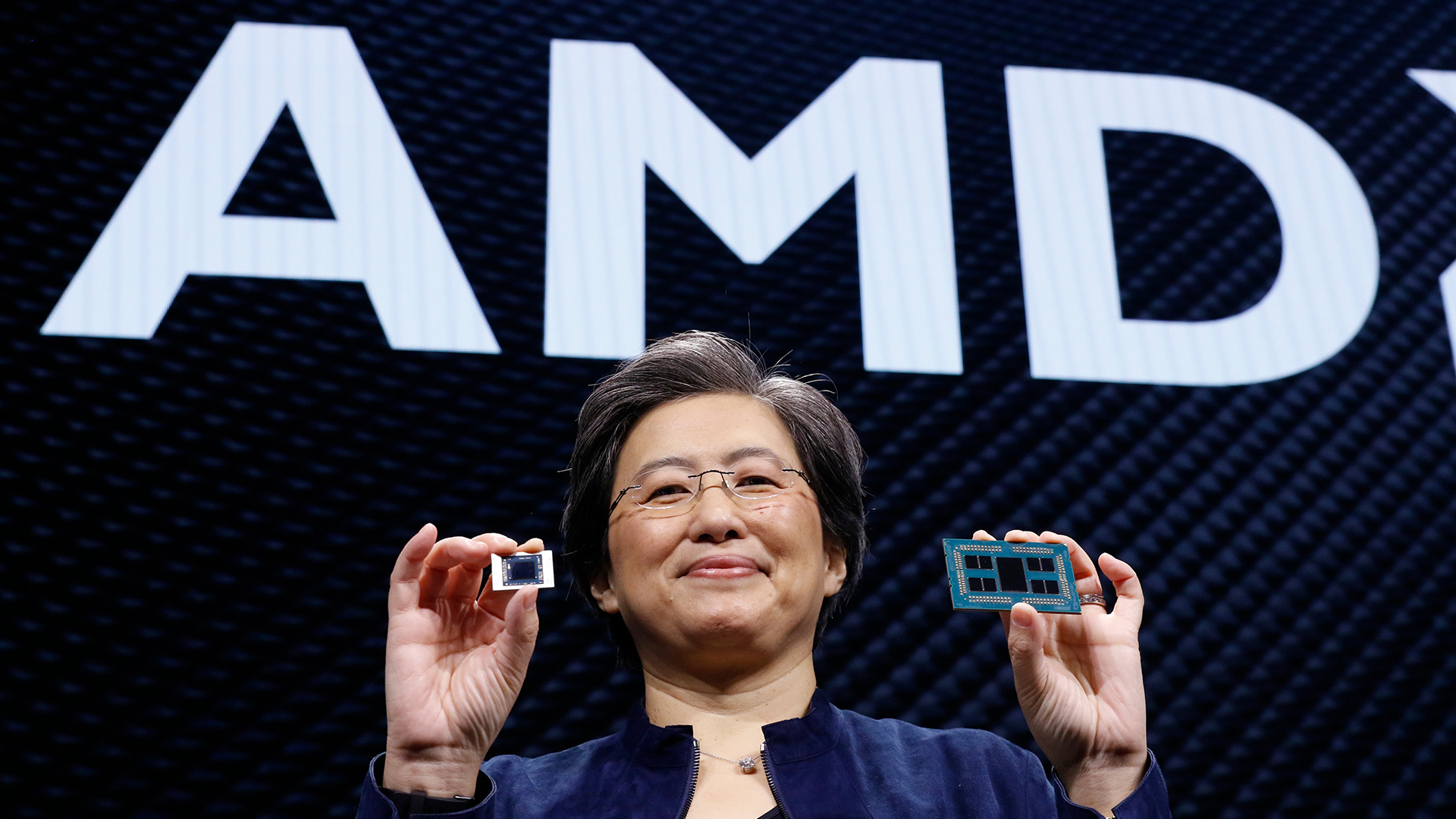

In addition to the overall optimism regarding greater demand for advanced AI chips, AMD was put in the spotlight via an investor note from Barclays. It suggested that while Nvidia is the dominant player as we enter 2024, AMD is going to gain ground as it ramps up deliveries of chips to enterprise customers. The red team revealed some new AI data center products just a few weeks ago: the Instinct MI300X AI accelerator and the Instinct MI300A.

It was therefore implied by Barclays that firms like AMD could get a whiff of the kinds of gains Nvidia achieved last year. This seems to be reflected in the updated target price for AMD stock touted by Barclays. It hiked AMD’s target price from its totally-eclipsed $120 to a confident $200.

Other big-name investment analysts with positive re-ratings for AMD stock yesterday included KeyBanc Capital Markets, which moved its price target from $170 to $195, and Susquehanna Financial Group, raising its target from $130 to $170.

The last time we wrote about the good fortunes of AMD stockholders was four years ago when AMD hit an all-time high and was trading at just under the $50 mark. At the time, AMD was being lifted by the greater confidence that successive Zen CPU architectures had given to industry watchers. Coincidentally, significant gains were seen shortly after re-ratings by investment analysts like Nomura.

Nvidia also got a little AI love on Tuesday

Nvidia stock also enjoyed a good Tuesday, moving up over 3% to reach a record high of $568.35 in intraday trading. Remember, the value of Nvidia stock tripled last year, propelled by its key role in accelerating AI businesses of all shapes and sizes. Reuters reports that the average price target for Nvidia, across 53 analyst ratings, actually fell slightly from $627.50 to $625. It is still rated as a ‘buy’ but for now its AI achievements seem to be priced in.

We wouldn’t be surprised if the momentum behind both AMD and Nvidia continues for some time – but no advice is intended, and stock prices can fall and make owners very unhappy. Nvidia and AMD will probably continue to face hurdles in making the most of AI chip demand from Chinese organizations, for example. Also, AI might turn out to be a passing fad, another tech bubble…