Semiconductor bulls were looking for Advanced Micro Devices (AMD) to rally when it reported earnings on Tuesday after the close.

They got the opposite: At last check the shares were off 8.7%. At Wednesday’s low, AMD stock was down about 9%.

That’s on a day when the market indexes are about flat and even as AMD reported a top- and bottom-line beat.

Don't Miss: Take a Bite of Chipotle Stock? Here's Where to Buy the Dip (With or Without Chips).

The problem? Guidance was a bit short of investors’ expectations.

The reaction is weighing on Nvidia (NVDA), which is down about 1% so far on the day, while the VanEck Semiconductor ETF (SMH) is holding up a bit better, down 0.75%.

And investors are wondering whether they should buy the dip in AMD.

Trading AMD Stock

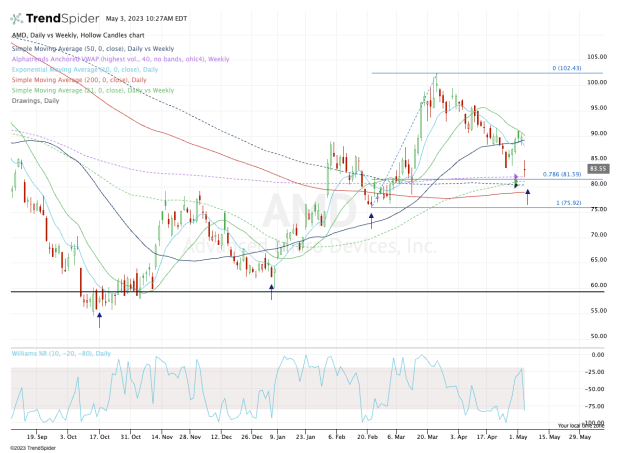

Chart courtesy of TrendSpider.com

AMD stock rode a five-day win streak into its earnings report and then hit a wall.

On the plus side, the shares are holding a key area on the chart, between $80 and $82. In that zone, the stock finds its 78.6% retracement of the current rally, the weekly VWAP measure, and the 50-week and 21-week moving averages.

Just below this zone is the 200-day moving average, near $79.

In other words, this is a key $3 range for AMD stock to stay above. If it fails to hold above this area, then it could trade down to the gap-fill area at $75.20.

Below that and AMD could be vulnerable down to about $70.

Don't Miss: Regional Banks Tumble to 52-Week Lows. Here's the Chart View.

Obviously, this is not the reaction that AMD bulls were looking for. That said, as long as the stock can hold the $80 area, investors waiting for a dip — and AMD is now down about 20% from its recent high — can justify a long position.

If it does hold, let’s see whether AMD stock can fill the earnings gap back up toward $88. Above that and the $92 to $95 area is a potential upside target for longs.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.