With demand for its CPUs and GPUs still running very strong, AMD bulls are looking for the company to issue strong full-year guidance in its fourth-quarter earnings report.

Currently, the consensus among analysts polled by FactSet is for AMD to report fourth-quarter revenue of $4.52 billion (up 39% annually), GAAP EPS of $0.70 and non-GAAP EPS of $0.76.

AMD typically provides quarterly sales guidance and full-year revenue growth guidance in its report. The FactSet consensus is for AMD to post Q1 sales of $4.35 billion (up 26%) and to grow revenue 20% in 2022 to $19.29 billion.

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging AMD’s earnings report, which is typically published at 4:15 P.M. Eastern Time, along with an earnings call scheduled for 5:00 P.M. Eastern Time. Please refresh your browser for updates.

6:01 PM ET: AMD's call has ended. Shares are up 10.7% after-hours to $129.30 after the company comfortably beat Q4 estimates, guided Q1 sales $650M above consensus at the midpoint of its guidance range and issued full-year sales guidance that's $2.2B above consensus.

On its call, AMD disclosed that GPU and server CPU sales more than doubled Y/Y once again in Q4, and that PC CPU sales saw double-digit growth. The company also forecast that all of its businesses will grow this year (with server CPUs leading the way), and disclosed that (following $1.8B worth of buybacks in 2021) it has bought back another $1B worth of stock thus far in Q1.

Thanks for joining us.

5:55 PM ET: A question about AMD's embedded processor sales. How does AMD see this opportunity over the next several years?

Su: I've always liked the embedded business. It's a smaller business, but has grown nicely. We have design wins in automotive and networking/storage. There are synergies with Xilinx. And there's very good IP reuse from our server and client products.

5:53 PM ET: Another supply question. Are the capacity commitments backed up by customer commitments? Could AMD procure more supply if needed?

Su: We've set a roadmap for 2022 and beyond that involves very aggressive growth goals. We have better visibility than we've ever had in terms of customer demand. We'll work with customers as their demand evolves.

5:51 PM ET: A question about the upcoming launches of AMD's Milan-X and Bergamo Epyc CPUs.

Su: As we've added scale, we've found new ways to differentiate our portfolio. Milan-X is a very high-end product, Bergamo is cloud-optimized. There are so many data center workloads, so there's a lot of room to optimize.

5:50 PM ET: A question about enterprise Epyc growth.

Su: Enterprise has grown nicely. Server CPU sales are still cloud-weighted, but we're making good enterprise progress.

5:49 PM ET: A question about shortages. Are they especially high for certain products?

Su: Supply is definitely tight right now for many products. As we go through the year, it should loosen up a bit.

5:48 PM ET: A question about buybacks. Is AMD just looking at them opportunistically, or does it plan to have a more formal capital-return policy?

Kumar: In terms of having a policy, I don't think we're quite there yet. We'll evaluate the performance of our business and our confidence in it, and take things from there.

5:47 PM ET: A question about AMD's semi-custom efforts in the data center.

Su: Semi-custom work is "the next leg of the stool" for our customer engagements in the data center. We already customize products for clients, but there's room for deeper engagement.

5:45 PM ET: Another question about pricing. How much of a tailwind is it in 2022?

Su: We're sharing the cost increases that are taking place across the supply chain. 2022 growth should be driven more by unit sales and the ASP growth created by improved product mix.

5:42 PM ET: A question about Q1 expectations for console SoC sales.

Su: Semi-custom sales are normally significantly down Q/Q in Q1 due to seasonality. But this year, they're expected to be flattish.

5:41 PM ET: A question about AMD's traction in the telco infrastructure market and recent partnership with Nokia.

Su: I'm pleased with the Nokia partnership. We're building out relationships in this space. This is an area where it's still quite early for us. Xilinx's telco customer relationships should help us.

5:40 PM ET: A question about data center GPU sales expectations.

Su: 2021 was a strong year for data center GPUs, fueled by HPC wins. This year is more about cloud growth. Epyc's momentum helps the data center GPU business. But this is a long-term effort for us. But I'm pleased with the effort we're making.

5:39 PM ET: A question about whether AMD could adjust its supply chain if PC demand is weaker than expected.

Su: We've worked to create fungibility for our supply chain resources. It's not 100% fungible, but there is some flexibility to move around resources. We have a pretty good pulse on the market right now.

5:37 PM ET: A question about Xilinx. How has AMD's views about potential synergies with Xilinx evolved?

Su: I'm extremely excited about Xilinx. We've been planning for integration for a while. We've been talking to customers about combined roadmaps. We look forward to telling you more about it as we get to the deal's close and beyond.

5:36 PM ET: A question about whether AMD (like Intel) is seeing PC CPU channel inventory corrections.

Su: We don't believe there's any significant inventory of our PC or server CPUs at customers. We believe we're matched to end-user demand.

5:34 PM ET: A question about chip shortages and how they've impacted AMD.

Su: The most important thing we're working on with customers is consistent execution. We're doing capacity planning multiple years out. We've tightened relationships with both customers and supply chain partners.

5:33 PM ET: A question about 2022 server CPU competition. Intel is launching Sapphire Rapids later this year. How does AMD feel about its ability to gain share?

Su: We always expect the competitive environment to be strong. We're very happy with the Epyc growth we're seeing across cloud and enterprise. Hyperscalers are expanding AMD deployments as they get familiar with us over generations. We're confident we can grow significantly faster than the market.

5:31 PM ET: A question about how much price increases are a margin tailwind.

Su: The industry has seen price increases across the supply chain. We're in this for the long-term. We work with customers and supply chain partners to share the additional cost. But our focus is on securing supply to meet additional demand. We feel our products are still underrepresented in key partners, which gives us confidence we can keep growing.

5:29 PM ET: A question about PC CPU strength.

Su: We try to be closely aligned with our customers. We monitor sell-in and sell-through carefully. Demand from the premium PC market remains strong. Our view is that PC unit sales will be "roughly flattish" in 2022, but there'll be a mix shift towards premium and enterprise segments, which benefits us. We'll continue to ensure sell-in matches sell-through, so that there aren't inventory builds.

5:26 PM ET: A follow-up question about CPU/GPU solutions leveraging the Infinity Fabric interconnect.

Su: Infinity Fabric lets us create optimized solutions for both PCs and servers. It's an important part of our strategy, and a way for us to differentiate.

5:25 PM ET: A question about AMD's supply chain efforts to address shortages.

Su: We've been working on the supply chain for the last 4 or 5 quarters. We made significant investments in wafer and substrate capacity. Our capacity investments are for 2022 and beyond.

5:23 PM ET: First question is about full-year guidance. How much of the growth will come from data center products?

Su: We see strong demand for all of our products. 2022 growth will be led by server CPUs, based on what we're seeing, but we also expect growth from other businesses. Data center is expected to continue growing as a % of revenue.

5:21 PM ET: The Q&A session is starting.

5:21 PM ET: AMD has added a bit to its AH gains since the call started: Shares are now up 10.9% to $129.45.

5:20 PM ET: Regarding Q1 sales guidance, Kumar says expected Y/Y growth of 45% will be driven by growth across all businesses, while expected Q/Q growth of 4% will be driven by server and PC CPU sales.

Full-year revenue growth (guided at 31%) is expected to be driven by all businesses.

5:17 PM ET: After recapping AMD's Q4 performance, Kumar noted AMD has repurchased another $1B worth of stock thus far in Q1.

5:14 PM ET: Devinder Kumar is now talking.

5:13 PM ET: Su says AMD has made significant investments to secure the capacity it needs to drive growth in 2022 and beyond. The company mentioned in its slide deck that it made $1B worth of capacity-related investments in 2021.

5:11 PM ET: Su says AMD has begun sampling Zen 4 Epyc CPUs (Genoa) ahead of launches later this year. She also reiterates (following Chinese regulatory approval) that AMD is on track to close the Xilinx deal in Q1.

5:10 PM ET: Both cloud and enterprise server CPU sales more than doubled Y/Y. Production of AMD's 3D V-Cache Epyc CPUs (Milan-X) started this quarter.

Also mentioned: Data center revenue (server CPUs and GPUs) is now a mid-20s % of total revenue.

5:08 PM ET: Su adds data center GPU revenue more than doubled Y/Y. Semi-custom (console SoC) sales are said to be have grown Y/Y by an undisclosed amount, and are forecast to grow in 2022.

Server CPU sales more than doubled Y/Y and grew by a double-digit % Q/Q.

5:06 PM ET: Su: GPU sales more than doubled Y/Y for the third straight quarter.

5:05 PM ET: Su says PC CPU revenue rose by a double-digit % Y/Y, led by notebook CPU sales. Ryzen shipments rose double-digits Q/Q, which leads AMD to believe it gained PC CPU share again.

5:04 PM ET: Su says data center revenue more than doubled Y/Y in 2021.

5:03 PM ET: Lisa Su is talking.

5:02 PM ET: AMD is going over its safe-harbor statement. Typically, AMD's call features prepared remarks from CEO Lisa Su and CFO Devinder Kumar, after which both execs field questions from analysts.

5:01 PM ET: The call is starting.

4:59 PM ET: Among the things to look for on the call: Any comments about full-year growth expectations for individual businesses (PC CPUs, GPUs, server CPUs, console SoCs). 2022 is widely expected to be another very good year for Epyc server CPU sales, which from the looks of things were AMD's biggest growth driver in 2021.

4:57 PM ET: AMD's call should be starting in a few minutes. Here's the webcast link, for those looking to tune in.

4:56 PM ET: AMD's quarterly revenue trend over the last 2 years. Worth adding that Q4 revenue of $4.83B represents 127% growth relative to Q4 2019 revenue of $2.13B.

4:50 PM ET: Notably, the lion's share of AMD's 100% Y/Y operating income growth came from the Enterprise, Embedded & Semi-Custom segment, which saw op. income more than triple Y/Y to $762M. As a result, the segment now accounts for a solid majority of AMD's op. profit.

4:47 PM ET: AMD's numbers are giving a boost to GPU archrival Nvidia (up 4.2% AH) and foundry partner TSMC (up 1.2%).

On the other hand, Intel's stock is down 0.4%, as markets take AMD's guidance as a sign that more CPU share gains are on tap.

4:41 PM ET: Non-GAAP op. margin came in at 27% (up 7 points Y/Y), while free cash flow totaled $736M (+53%).

Thanks to the FCF, AMD ended 2021 with $3.61B in cash (roughly flat Q/Q in spite of the buybacks). Debt remained at $313M.

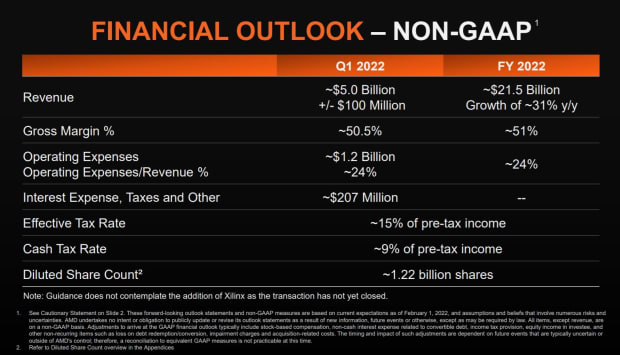

4:36 PM ET: Also helping EPS a bit: Non-GAAP operating expenses totaled $1.1B, up 40% Y/Y but a little below guidance of ~$1.15B. Opex is guided to rise to ~$1.2B in Q1.

4:34 PM ET: Giving Q4 EPS a boost: AMD spent $756M on buybacks. That follows $750M worth of buybacks in Q3 and brought the full-year total to $1.8B.

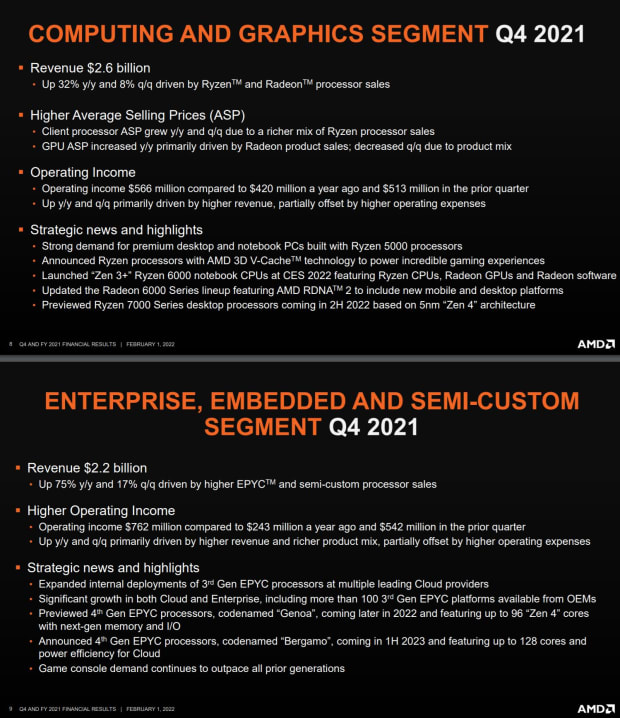

4:31 PM ET: The slides for AMD's operating segments. The company notes PC CPU ASP rose Q/Q and Y/Y, while GPU ASP fell Q/Q but rose Y/Y. Also mentioned: There are now 100+ 3rd-gen Epyc (Milan) servers available from OEMs.

4:27 PM ET: AMD's full guidance, via its slide deck. The company plans to keep investing aggressively this year: Non-GAAP operating expenses are expected to be at 24% of revenue (even with 2021), in spite of guidance for 31% revenue growth.

4:24 PM ET: AMD's stock is now up 8.8% AH. Xilinx, which AMD is set to buy in an all-stock deal, is up a similar amount.

4:22 PM ET: Here's the earnings release.

4:22 PM ET: AMD's Computing & Graphics segment (it covers GPUs and PC CPUs) saw revenue grow 8% Q/Q and 32% Y/Y to $2.6B, topping a $2.42B consensus.

The Enterprise, Embedded & Semi-Custom segment (covers server CPUs and game console SoCs) saw revenue grow 17% Q/Q and 75% Y/Y to $2.2B, beating a $2.1B consensus.

4:19 PM ET: AMD's Q4 non-GAAP gross margin was 50% -- up from 48% in Q3, 45% a year ago and slightly above guidance of 49.5%.

Q1 non-GAAP GM guidance is at 50.5%. Full-year guidance is at 51%.

4:18 PM ET: Shares are up 4.9% after-hours to $122.50.

4:17 PM ET: AMD guides for Q1 revenue of $5B, +/- $100M. That's above a $4.35B consensus.

The company guides for full-year revenue of $21.5B (+31%), above a $19.29B consensus.

4:15 PM ET: Results are out. Q4 revenue of $4.83B beats a $4.52B consensus. GAAP EPS of $0.80 beats a $0.70 consensus. Non-GAAP EPS of $0.92 beats a $0.76 consensus.

4:08 PM ET: Ahead of AMD's report, Alphabet is up 4.4% AH following a strong Q4 beat.

4:01 PM ET: AMD closed up 2.2%. As a reminder, the company typically releases earnings at 4:15 ET.

3:58 PM ET: AMD's stock is up 2.3% today heading into its report. Shares are down 18% YTD thanks to broader tech-stock weakness, but remain up 33% over the last 12 months.

3:55 PM ET: AMD's Q1 revenue consensus is at $4.35B, while its full-year revenue consensus is at $19.29B (+20%). Full-year guidance is bound to be closely-watched.

3:54 PM ET: The FactSet consensus is for AMD to post Q4 revenue of $4.52B (slightly above a guidance midpoint of $4.5B) and non-GAAP EPS of $0.76. Informal expectations are probably higher, given how strong demand has been for AMD's server CPUs, GPUs and game console SoCs.

3:52 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging AMD's earnings report and call.