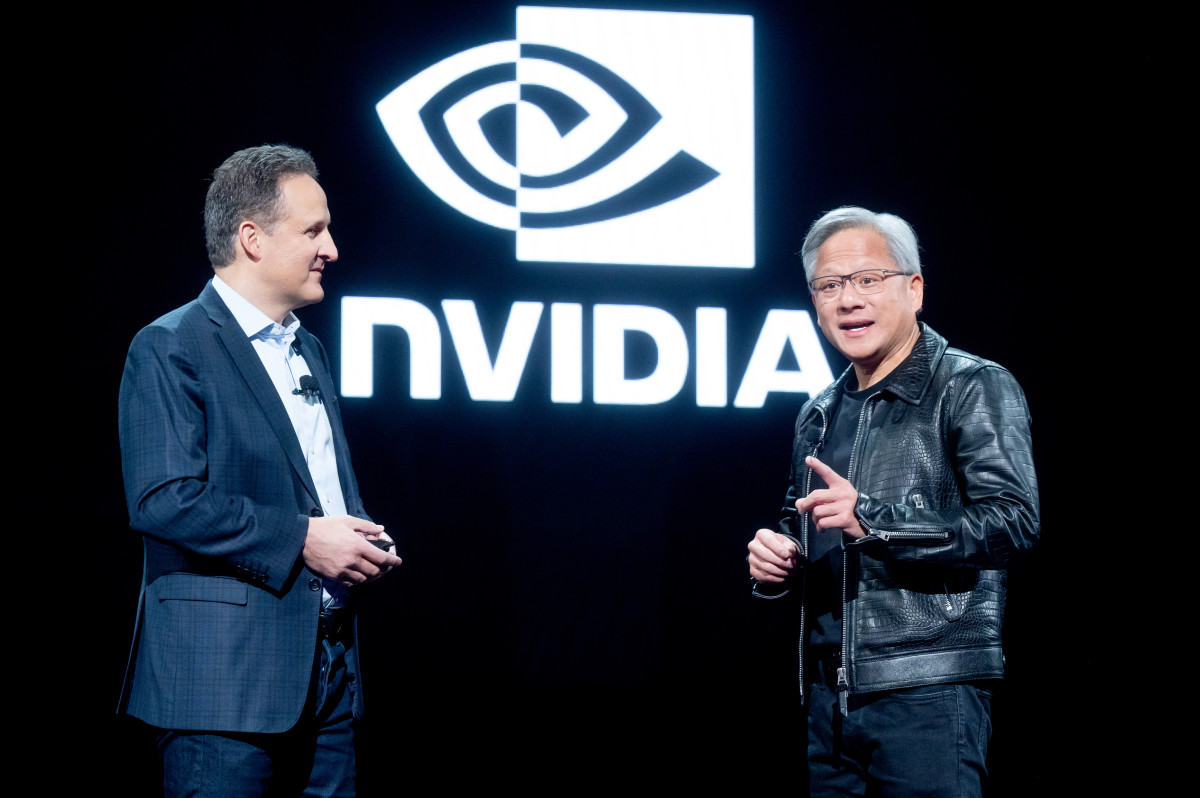

Nvidia now dominates artificial intelligence hardware, but Amazon Web Services is taking steps to become a strong alternative.

“Today, there’s really only one choice on the [graphics-processingin-unit] side, and it’s just Nvidia,” AWS Chief Executive Matt Garman said. “We think that customers would appreciate having multiple choices.”

On Dec. 3 at AWS's annual re:Invent conference, the e-retail and tech giant's cloud unit said it planned what it called an Ultracluster: a massive AI supercomputer built with hundreds of thousands of its home-built Trainium chips.

AWS also introduced the Ultraserver, a new server featuring 64 interconnected Trainium chips.

🚨Don’t Miss This Amazing Cyber Week Move! Get 60% off TheStreet Pro. Act Now Before It’s Gone.😲

These announcements reinforce AWS's push to position its Trainium chips as a cost-effective alternative to Nvidia's GPUs, which International Data Corp.'s data pulled by The Wall Street Journal show currently dominate 95% of the AI-chip market.

Most AI training uses costly Nvidia GPUs. Amazon aims to enhance its custom chips to cut customer costs, boost supply-chain control, and reduce its reliance on Nvidia, a key cloud partner.

Apple embraces Amazon AI chips

Apple is one of the customers of AWS’s Trainium chips, a move suggesting that non-Nvidia-training approaches can work on data processing.

“In early stages of evaluating Trainium2 we expect early numbers up to 50% improvement in efficiency with pretraining,” said Benoit Dupin, Apple’s senior director of machine learning and AI.

He added that Apple had used AWS for more than a decade for services including Siri, Apple Maps and Apple Music.

Related: Holiday shopping season may catapult this formerly battered Amazon rival

AWS said the Trainium2 chip was generally available now, while the new Trainium3 chip will become available next year.

AWS's Garman suggests that Nvidia will probably hold its market dominance for a long time. “But, hopefully, Trainium can carve out a good niche where I actually think it’s going to be a great option for many workloads,” he added.

AWS powers Amazon’s Q3 performance

In the third quarter of 2024, Amazon.com (AMZN) reported net income rose to $15.3 billion, or $1.43 aq share, from $9.9 billion, or 94 cents, in the year-earlier period. Net sales of $158.9 billion rose 11% from $143.1 billion a year earlier.

AWS contributed significantly to the results, with sales increasing 19% year-over-year to $27.5 billion, driven by rising demand for generative AI.

Related: Legendary billionaire tech investor makes an amazing claim about Nvidia's stock

AWS is Amazon’s cloud-computing service, built to help customers — startups, enterprises and government agencies — lower IT costs and operate more efficiently.

According to estimates from Synergy Research Group, AWS is now the world’s largest provider of cloud services, with a market share of 31% in Q3 2024.

But Amazon’s cloud business faces increasing competition. Microsoft Azure captured 20% of the market in Q3 2024, while Google Cloud's share climbed to 13% from 12% in the previous quarter.

Analyst: AWS to benefit as workloads shift to cloud

Following the AWS event BMO Capital highlighted the "Ongoing Shift from On-Prem to Cloud Workloads."

The investment firm sees AWS benefiting from near-term growth in cloud/AI workloads, thefly.com reported.

BMO says Amazon's rollout of lower-cost same-day buildings is enhancing customers' experience and is likely to boost retail free cash flow by 2025.

More Tech Stocks:

- Super Micro's stock price surges after key ruling

- Veteran trader takes a fresh look at Sofi Technologies

- Druckenmiller predicted Nvidia's rally, now has new AI target

BMO Capital affirmed an outperform rating and a $236 price target on Amazon shares. Amazon stock closed at $213.44 on Dec. 3 and is up more than 40% year-to-date.

Related: Veteran fund manager sees world of pain coming for stocks