Owning FAANG has been a tremendous trade this year — Amazon (AMZN) included. So far for 2023, the stock of the e-retailer and cloud provider is up more than 37%.

In fact, the weakest performer among the FAANG stocks is Netflix (NFLX) -- which is still up 25% so far this year and besting the notable U.S. stock indexes.

It’s why one could argue that the streaming giant's shares still have more upside in the “catchup trade.”

It also makes me wonder whether Amazon could play catchup to some of its megacap peers.

Don't Miss: Can AI Power Nvidia Stock to All-Time Highs?

Despite its strong year-to-date performance, Amazon is lagging its peers over more recent time frames. While its performance relative to the market is impressive, it’s lackluster vs. other FAANG components.

For instance, Amazon is the fourth-best performer of the group over the past month and the third-best performer over the past three months.

All of that is to say: Where should we buy the dip in Amazon?

Trading Amazon Stock

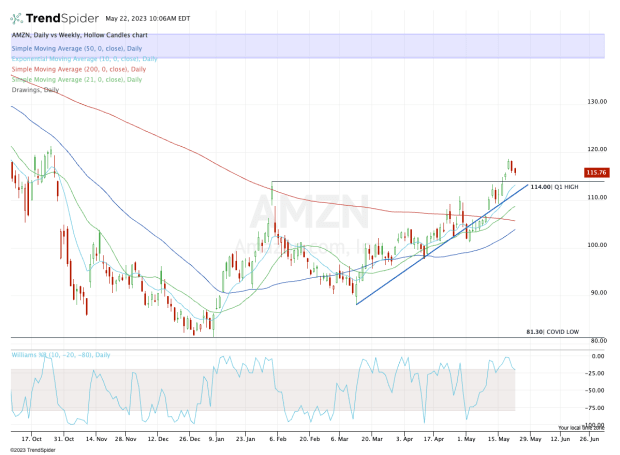

Chart courtesy of TrendSpider.com

After rallying in three straight weeks and in five of the past six weeks, Amazon shares are under pressure for a second day, off 1.2% at $114.82 at last check.

If we get a pullback into the $112 to $114 area, active bulls ought to pay attention.

A dip to this area would retest the first-quarter high ($114), as well as the rising 10-day moving average and uptrend support (blue line).

While uptrend support has wavered a bit from the early March low, it’s played a notable role in the price action of Amazon stock amid the current rally.

The 10-day moving average is often viewed as active support in a bullish sequence, while a retest of a prior high (or prior resistance) can often act as current support.

When you put it all together, this would be a reasonable risk/reward buying opportunity should it arise.

Don't Miss: On Holding Stock: Time for Bulls to Run With the Popular Shoe Brand?

In that scenario, active bulls may consider trimming their positions in the $116 area, but most will likely wait for a retest of the highs around $118.50.

If Amazon stock can’t hold the lower portion of this zone near $112, then it’s possible we see a dip down to the $110 level and the 21-day moving average.

For now, though, the bulls seem to have control of Amazon stock, so traders will want to be buyers on the dip.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.