Amazon (AMZN) is a FAANG stock that’s having quite a renaissance this year. After falling by nearly 50% in 2022, Amazon’s shares have rebounded 52% in 2023. The rapid recovery in Amazon’s stock likely has many scratching their head, given ongoing economic worry that could crimp retail sales and slow cloud-computing demand for Amazon Web Services (AWS).

Can Amazon’s stock continue climbing, or has it seen its highs for this year?

Amazon’s Financials Remain Strong

Amazon may have begun as an online bookseller during the Internet Boom. Still, it’s matured into one of the world’s biggest retailers and expanded to become a leader in providing cloud computing services to the biggest companies.

DON'T MISS: This Technology Holds the Key to Amazon's Future; It's Not Robots

Last quarter, Amazon’s revenue rose 9% from the year before, despite ongoing risks that consumer spending will slide because of stubborn inflation. The company’s top-line growth outpaced key competitors, including Walmart (WMT), which grew sales by 8%, and Target (TGT), which saw sales only inched 1% higher in the past year.

Amazon’s profitability also improved in the quarter. Earnings per share, or EPS, surged by 182% versus one year ago. For context, Walmart’s EPS increased by 13% while Target’s fell by 6%.

The reason behind Amazon’s relative outperformance isn’t just low prices. Its insight into consumer shopping behavior drives increasing ad revenue, sales at Whole Foods grocery stores are rising, and demand for cloud-computing services at AWS remains strong.

AWS revenue increased by 29% as more companies shifted data to the cloud, and brick-and-mortar sales totaled $19 billion, up 11% in fiscal 2022 from fiscal 2021. Meanwhile, advertising revenue improved 23% year-over-year to $11.6 billion in the fourth quarter.

Amazon’s Stock Chart Results In A New Price Target

One of the benefits of technical analysis is it provides insight into the aggregate sentiment of all market participants, including major money managers with access to resources individual investors can only dream about.

Investors can often spot trouble early on by charting the price action of stocks. Similarly, price charts can offer insight into potential price targets, particularly if you use point-and-figure charts.

Recently, Real Money technical analyst Bruce Kamich reviewed Amazon’s charts for clues to what may happen next.

Kamich’s evaluated charts for professional investors for over 40 years. He considered the stock’s price action, volume trends, and momentum. Then, he calculated new price targets based on daily and weekly point and figure charting.

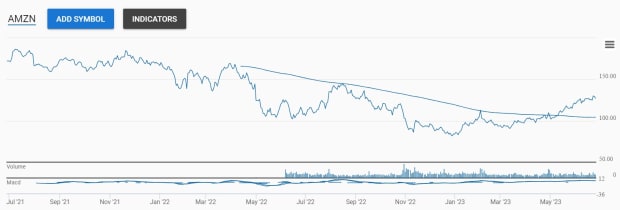

Kamich views the recent action in Amazon favorably, noting that on-balance volume, a running total of up to down day volume, and moving average convergence divergence (MACD) are positive on the weekly price chart.

Importantly, Kamich’s price targets suggest more room for Amazon’s stock to run higher. His daily and weekly point and figure charts suggest shares could climb to $137 and $178, respectively.

Those targets may be particularly assuring because the Federal Trade Commission recently sued Amazon over deceptive sales tactics related to subscriptions.

“You can learn a lot about the marketplace by watching the reaction to news. The latest news about AMZN you would assume to be bearish, but the stock price ignored it. Investors are looking ahead of this bump in the road. Stay long AMZN,” concludes Kamich.

What’s Next For Amazon’s Stock?

Of course, stocks don’t go up or down in a straight line. Point and figure charts can provide price targets but not a timeline to reach them. As a result, it wouldn’t be surprising if Amazon shares took a breather, given they’ve already enjoyed an impressive run-up.

Nevertheless, the charts suggest that pullbacks in Amazon’s stock may present a buying opportunity. If Amazon’s share price remains above $114, Kamich will technically stick with the stock.

Amazon is scheduled to report its second-quarter results in a few weeks on July 27. Analysts have increased their EPS outlook for the quarter to $0.35 from $0.31 60 days ago. They’ve also expanded their full-year EPS outlook to $1.58 from $1.42.

Additional upward earnings revisions are likely if the company can overdeliver on that outlook. However, nobody will confuse Amazon with being a value stock. Its forward price-to-earnings ratio, a standard valuation measure, is nearly 50.

That will make value-oriented investors shudder, but growth investors may not mind paying up to own shares. After all, Amazon’s always been a notoriously expensive stock, yet it’s also been one of Wall Street’s best performers.

There’s no guarantee that Amazon’s positive track record will continue. However, solid second-quarter results could act as an upside catalyst for shares, especially if Amazon’s management highlights strong demand for AWS solutions targeting artificial intelligence.

Amazon is the largest cloud-computing leader, with a 32% market share. Its already announced new semiconductor chips designed to help train and run large-language models or generative AI programs similar to ChatGPT.

“Our Inferentia2 chip, which just launched, offers up to four times higher throughput and ten times lower latency than our first Inferentia processor. With the enormous upcoming growth in machine learning, customers will be able to get a lot more done with AWS’s training and inference chips at a significantly lower cost,” wrote Amazon CEO Andy Jassey in April.

One Stock We Believe Will Win in The AI Race (It's not Nvidia!)