In American business, you can feel good if your company is successful.

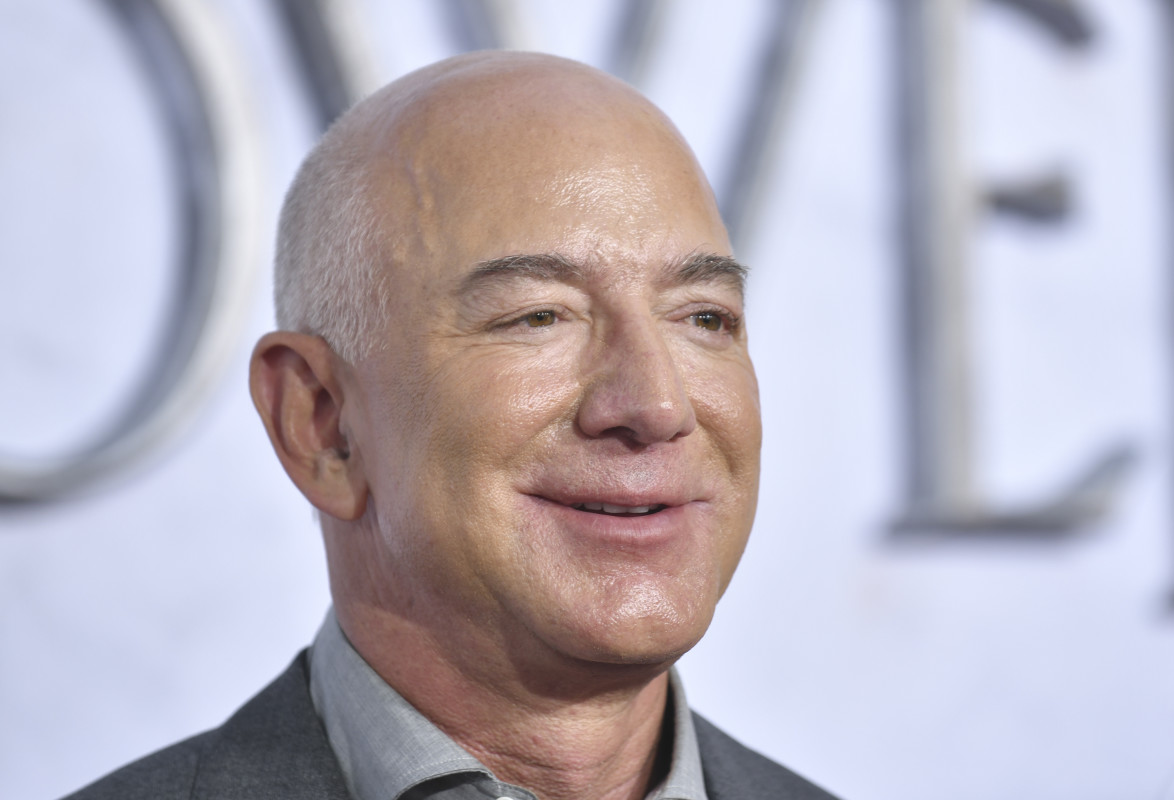

Jeff Bezos, who founded Amazon.com (AMZN) in 1994, does.

You can feel better if your successful company joins the Nasdaq-100 Index and the Standard & Poor's 500 Index and becomes one of the world's biggest stocks. Jeff Bezos does.

You should feel truly fabulous if your successful company is globally ubiquitous, fantastically powerful, and lionized by investors. Then, it joins the Dow Jones Industrial Average.

Jeff Bezos definitely does. Because the company he founded, Amazon.com, is joining Dow.

Brent Lewis/The Denver Post via Getty Images

Why does the Dow 30 matter?

The Dow is the Dow, the second oldest U.S. stock index. Everybody talks about it, even if it has just 30 companies in its roster. That's unlike the Standard & Poor's 500 Index or the Nasdaq Composite Index, which represent huge swaths of U.S. stocks.

But the Dow is the Dow, whose members are all very large companies and very profitable and likely to stay that way.

Related: Get ready for a shakeup in the Dow Jones industrials

Amazon will become a Dow component before the U.S. stock market opens on Monday, Feb. 26. It will replace pharmacy giant Walgreens Boots Alliance (WBA) . Walgreens joined the Dow in 2018, replacing General Electric (GE) , the last original member of the index.

It will be the third company with headquarters in the Seattle area, along with Boeing (BA) and Microsoft (MSFT) ,

There are logical reasons to put Amazon in the Dow.

- It's huge, with $574.8 billion in revenue in 2023. Only Walmart's 2023 revenue is bigger at $611.3 billion.

- It has the 4th largest market capitalization ($1.76 trillion) of any U.S.-domiciled company, after Microsoft, Apple (AAPL,) and Google-parent Alphabet (GOOG) .

- The biggest revenue comes from the Amazon.com site, selling everything from books and CDs to clothes, dish towels, and tools, and being able to deliver to customers in a day, maybe less.

- Its Amazon Web Services, or AWS, is the top player in cloud computing.

- It operates the Amazon Prime subscriber shopping service, whose delivery vehicles are as ubiquitous as Wells Fargo delivery wagons in the 19th century.

- It produces movies, television shows, and even Thursday Night Football.

- Since going public in 1997, the stock has a total percentage change exceeding 183,000%, the Motley Fool estimated in 2023.

- It is reviled by unions and smaller retailers (especially bookstores) for killing businesses and destroying millions of jobs.

In the process, Bezos has become one of the world's three richest people.

Bezos is executive chairman of Amazon these days, now worth nearly $180 billion. He is in the space business, owns The Washington Post, and has been known to toy with the idea of buying an NFL team.

Not bad for a very smart Princeton grad who founded the company with his then-wife Mackenzie in a garage in Bellevue, WA. Bezos had never lived in Bellevue, but he picked it because it was surrounded by a large technology infrastructure.

The pharmacy business has been crushing Walgreens

For the last year or so, Walgreens' days in the Dow were clearly ending.

Brutal competition and regulation in healthcare have slammed pharmacies, big and small. Walgreens has struggled, with the shares falling 28.4% in 2022, 30.1% in 2023 and 14.6% in 2024.

The industry is so bad that competitor Rite Aid, weighed down by a mountain of debt, declared bankruptcy in 2023.

More Wall Street Analysts:

- Analyst who correctly warned Tesla stock could fall unveils new target

- Fund manager of $2 billion portfolio unveils 9 favorite stocks

- Analysts unveil new stock price target for Nvidia ahead of earnings

Walgreens' market cap on Tuesday, based on a closing price of $22.31, was only $19 billion. Amazon's market cap is nearly 914 times bigger.

Amazon's journey to join the Dow Jones Industrials

Amazon's inclusion (maybe anointment) was made possible because Walmart (WMT) decided to split its stock 3-for-1 before the market opened on Monday.

This caused everyone at S&P Dow Jones Indices, which manages the S&P and Dow Jones indices, to consider whether the venerable index needed freshening.

The index has had its existing roster since 2020 when Amgen (AMGN) , Honeywell International (HON) , and Salesforce Inc. (CRM) replaced Exxon Mobil (XOM) , Pfizer (PFE) , and Raytheon Technologies (RTX) .

Really, the only rule to get into the Dow is a company should be profitable, and it must be domiciled in the United States.

Also, any Dow candidate needs to represent a broad look at the current state of U.S. business.

However, the choice to replace Walgreens had to be clever because the Dow is a price-weighted index. The bigger the price, the more influence it has on the index.

The Standard & Poor's 500 and Nasdaq indexes are market-cap weighted and so large they get subdivided into sectors.

Amazon made sense because it split its stock 20-for-1 in 2022. (The shares ended 2021 at a pre-split price of $3,334.)

Its price as of Tuesday was $167.08, which would rank it 17th among the Dow stocks. Walmart, which is in 17th position, now will drop to 26th.

The priciest Dow stock is UnitedHealth Group (UNH) at $521.06. Once Amazon joins, the cheapest Dow stock will be Verizon Communications (VZ) , which was at $40.49 on Tuesday.

Typically, Dow stocks pay dividends. Amazon was given a pass, joining Boeing and Salesforce.com (CRM) as the only non-dividend payers in the Dow.

Maybe a dividend is in the offing.

Uber joins the Dow Transports

S&P Dow Jones also announced a change late Tuesday in the Dow Jones Transportation Average membership.

Ridesharing company Uber Technologies (UBER) will replace JetBlue Airways (JBLU) on Monday. Uber has become a hot stock again because it's profitable. Shares are up 24% this year after soaring 148% in 2023.

JetBlue, struggling against the competition of major carriers, is up 26% this year after falling 14.4% in 2023.

Related: Veteran fund manager picks favorite stocks for 2024