Having your children move out of your home can be a bittersweet moment. However, if you’re forcing your kids to leave the nest with very little warning, things can get very emotionally messy… especially in this economy.

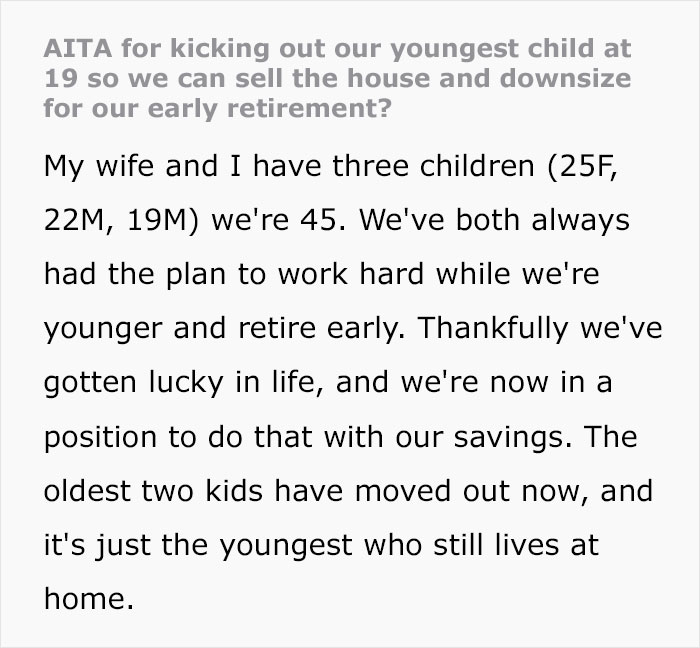

One anonymous redditor shared how they decided to downsize for their early retirement. However, this meant that they were effectively kicking out their youngest child, who was 19 years old at the time. The OP turned to the internet for advice, but a lot of readers were appalled by how they handled the situation. They weren’t against early retirement, just how everything went down. Read on for the full story.

Bored Panda wanted to learn more about raising kids to be more independent and what to keep in mind when retiring early, so we got in touch with personal finance expert Sam Dogen. He is the author of the bestselling severance negotiation book, ‘How To Engineer Your Layoff’ and the host of the ‘Financial Samurai’ blog which kickstarted the FIRE (financial independence, retire early) movement back in 2009.

Many people hope to retire early, which is a great goal. However, it matters a lot how they implement this plan and who else depends on them

Image credits: MART PRODUCTION (not the actual photo)

For example, one couple completely surprised their youngest child when they decided to sell their house

Image credits: Timur Weber (not the actual photo)

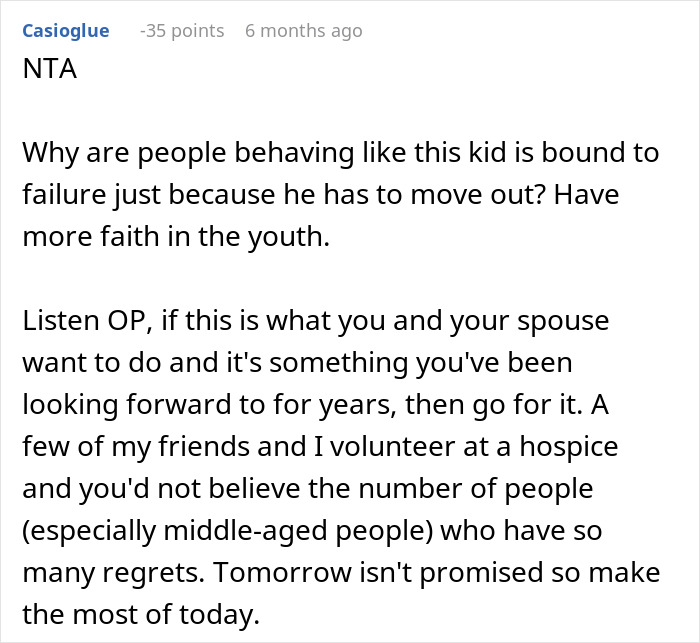

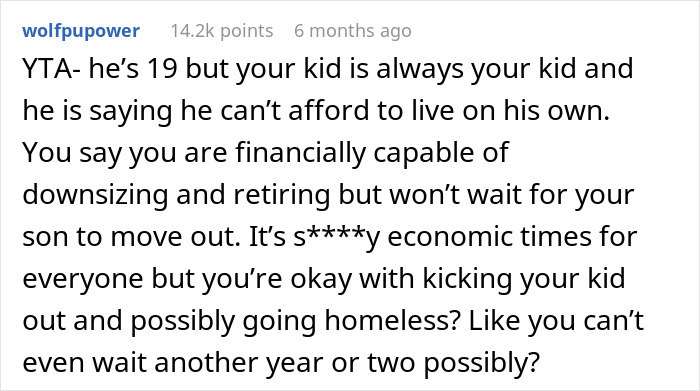

Image credits: Dry-Pen-8084

It’s very useful for kids to learn to be independent early on, but in some cases, it makes sense to live with your parents to save on rent

We asked personal finance expert Dogen about when kids should leave their parents’ homes, as welll as how parents can raise their children to have a sense of financial independence from an early age. According to the host of the ‘Financial Samurai’ blog, there’s no set age when parents should leave.

“However, the sooner they leave after age 18, the sooner children will figure out how to live independently, do their own chores, learn how to cohabitate with others, and make money on their own. Learning adulting is important!” he told Bored Panda via email.

“Going to college is the first step for many young adults figuring out how to live independently. College graduates should be willing to move anywhere they get the best job offer possible. A young adult’s focus should be on finding a career that fits their desires and making as much money as possible to become independent,” he said.

However, Dogen noted that there are some exceptions. “If the adult son or daughter has found a promising job in the same city where their parents live, why not return to their childhood home to save money on rent? After several years of living at home, the son or daughter could amass a healthy nest egg to then go off and live on their own. Relying on The Bank Of Mom & Dad to perpetually provide when they have their own retirement and goals to think about is not a good long-term strategy,” he said.

“After age 18, a parent’s responsibility to raise their children is technically over in America. Hence, the parents who sold their house to retire early and look after their own needs should feel free to do whatever they want. The 19-year-old son should see this situation as great motivation to figure things out on his own,” Dogen referred to the situation in the anonymous internet post.

“If you really want your parents to help you as an adult, here are some tips I’ve devised on how to get your parents to pay for everything as an adult child!”

If you want to retire early, it’s paramount that you’re intentional with everything that you do

We were curious to hear the expert’s thoughts on retiring early. He told us that someone whose goal it is to do this cannot rely purely on luck. “As someone who kickstarted the modern-day FIRE movement in 2009 with the launch of Financial Samurai, trying to retire early is not easy. It takes a tremendous amount of planning, saving, careful investing, and discipline. You can’t achieve financial independence and retire early by winging it. You must be extremely intentional,” Dogen told Bored Panda.

“With a shortened timeline for work and saving, the person trying to retire early has a lot more pressure. As a result, a son or daughter trying to depend on their adult parents after they become adults puts added stress on their parents. If you have FIRE-minded parents, and you love them, then your goal should be to try and be financially independent ASAP to allow them to live out their early retirement goals,” he explained that the situation isn’t always one-sided and that kids should look for ways to help their parents as well.

“If you retire early, you could be looking at decades more of life to provide for without a steady job. As a result, it is imperative to build as many passive income streams as possible. Your investment portfolio, which includes real estate, should ideally outperform inflation each year so your purchasing power continues to increase in retirement. It takes a long time to generate passive income, which is why I highly encourage everyone to start today.”

Proper communication and setting clear expectations are fundamental to good parenting

As we’ve covered on Bored Panda recently, balanced parenting is all about enforcing firm boundaries while also providing unconditional love and support for children. When parents establish clear guidelines for acceptable behavior, their kids live with a sense of security and predictability.

This is incredibly healthy for their growth, as well as their emotional well-being. Parents who do this raise kids who are not only emotionally resilient and mentally healthy, but also excel in academics.

It’s vital to remember that every single child in a family is a unique individual with different wants, needs, goals, and fears. That’s why it’s important to be adaptable and not use a one-size-fits-all approach when raising them.

The core issue in the author’s post is that they and their wife wanted to retire early without properly communicating this to their family. In order to do so, they decided to sell their house and downsize. That way, they could travel more easily and have more funds available for their other passions.

In and of itself, there’s nothing wrong with that: it’s a financial strategy. And retiring early is a dream for many people. However (and this is a big ‘however’), there’s more context here. Yes, they were selling the house, but they still had their youngest child living with them and fully relying on them for room and board.

The problem isn’t the downsizing itself per se—it’s how it was done. The OP explained that they gave their kid barely 3 months’ notice that he’ll have to live completely on his own. Though being independent is a very valuable thing, it might be somewhat unfair to demand that someone radically change their life in a single season.

Few people enjoy being forced to drastically change their lives at the drop of a hat

Not only that but the author’s youngest pointed out that his siblings were able to live at home with their parents until after college. Now, the 19-year-old is forced to find a job, take care of his own education, and find a place to live. That can be overwhelming for anyone. Especially for someone who was lucky enough to have caring, financially stable parents.

It’s a question of unmet expectations. Yes, the OP’s youngest child might legally be an adult. However, there’s something iffy about parents who prioritize their freedom and passions in life over their children. Having kids means that you’re responsible for their welfare. Having kids means that, more often than not, you have to look for compromises and put some of your needs second.

Does this mean that all parents should take care of their children forever and ever? Obviously, not. Children need to learn the importance of being independent. However, this doesn’t happen in a vacuum. If their parents never nurture this spark of independence, they can’t suddenly rush in and demand them to, effectively, sink or swim. If you want to set up your child for success in the future, you need to keep them in the loop about your financial goals and desire to retire early.

Moreover, there’s the time frame to consider. Three months isn’t a lot of time to overhaul your entire life. It’s doable, yes, but it’s likely to be filled with stress and angst and frustration. Setting expectations earlier in life would have been much, much better.

When there’s more time to get used to the new reality, the situation becomes less of a “they kicked me out” kind of drama and more of a “they’re helping me rely more on myself” kind of thing. Again, it’s vital that parents communicate their financial and other expectations with their kids from an earlier age, instead of doing everything at the last minute.

Many young adults still live with their parents. This depends a lot on the economy and local culture

In recent years, there has been a surge of people moving back in to live with their parents, in order to save money… or just to make ends meet. As CBC points out, in 2021, just over a third of all Canadian young adults under 34 years if age were living with at least one of their parents. This was around a 5% increase from 2001 to 2021.

According to the Pew Research Center, in July 2020, a whopping 52% of American 18 to 29-year-olds lived with their parents. This was a stark rise from 47% in February of that same year. This was closely related to the Covid-19 pandemic.

Fast forward to 2021 and around a third of American adults aged 18 to 34 lived in their parents’ homes. The situation was similar in Europe, with just over a third of young adults doing so. However, far from every European country is alike. For instance, 77% of young adults are living with their parents in Croatia and 73% in Greece.

This number is 72% in Portugal, 71% in Serbia, as well as in Italy. On the flip side, barely 18% of young adults lived with their parents in Finland in 2021. Just 17% did so in Sweden and barely 16% in Denmark.

Cultural traditions, as well as the economic climate, have a lot to do with people’s decisions to move out, keep living at home, or move back in.

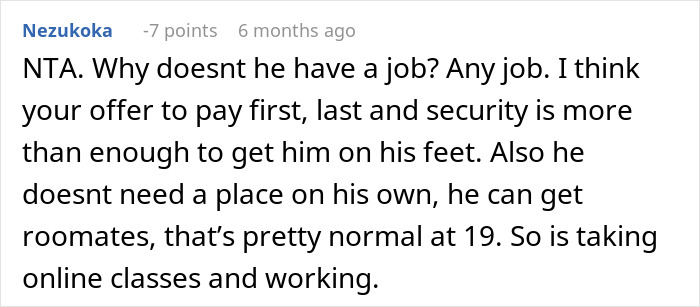

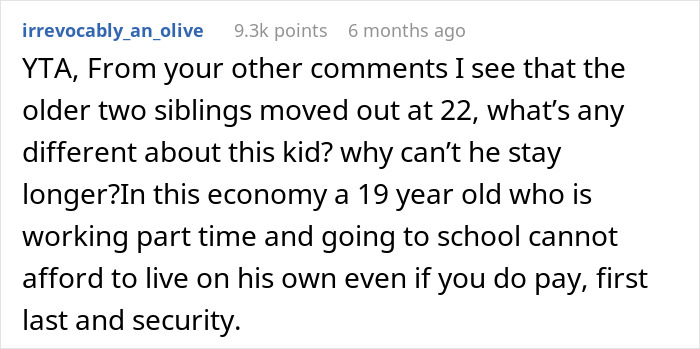

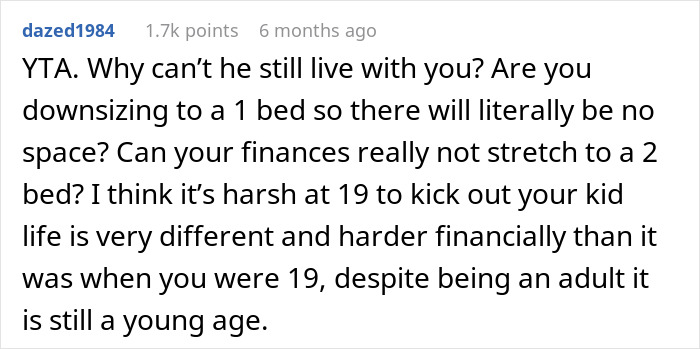

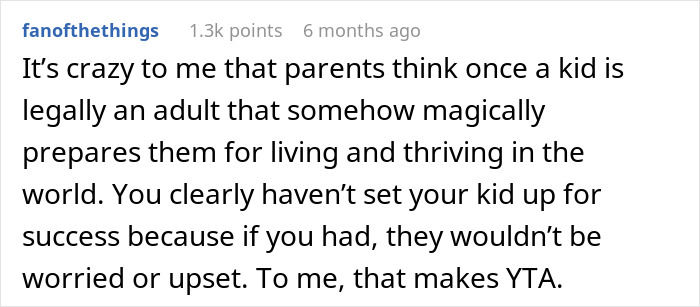

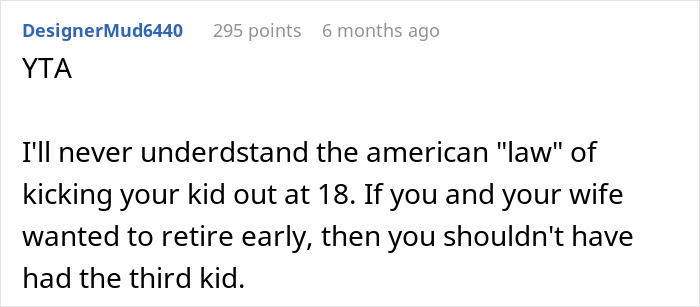

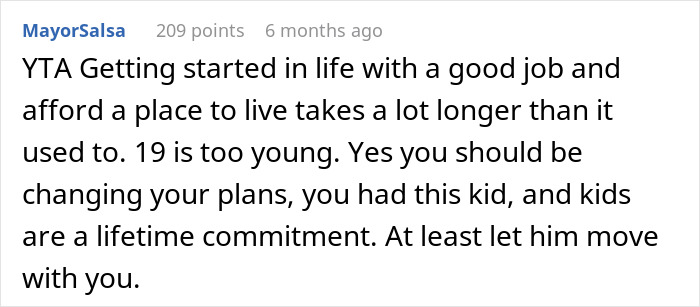

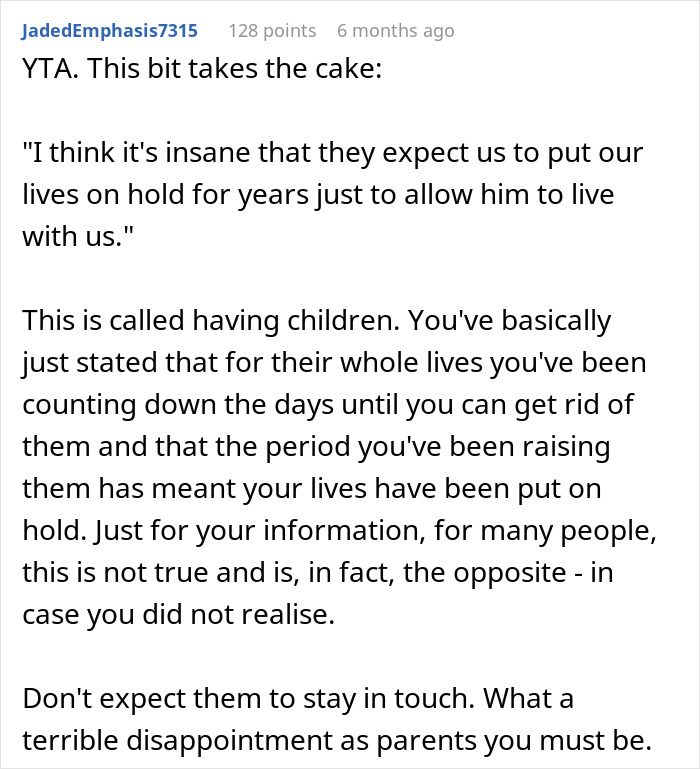

Many internet users were appalled by how the parents handled the situation. Here are a few of their thoughts

Some readers were on the parents’ side, however, their opinions were very unpopular