High-rolling investors have positioned themselves bearish on Alphabet (NASDAQ:GOOGL), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GOOGL often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 10 options trades for Alphabet. This is not a typical pattern.

The sentiment among these major traders is split, with 10% bullish and 80% bearish. Among all the options we identified, there was one put, amounting to $32,492, and 9 calls, totaling $950,556.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $155.0 to $255.0 for Alphabet during the past quarter.

Analyzing Volume & Open Interest

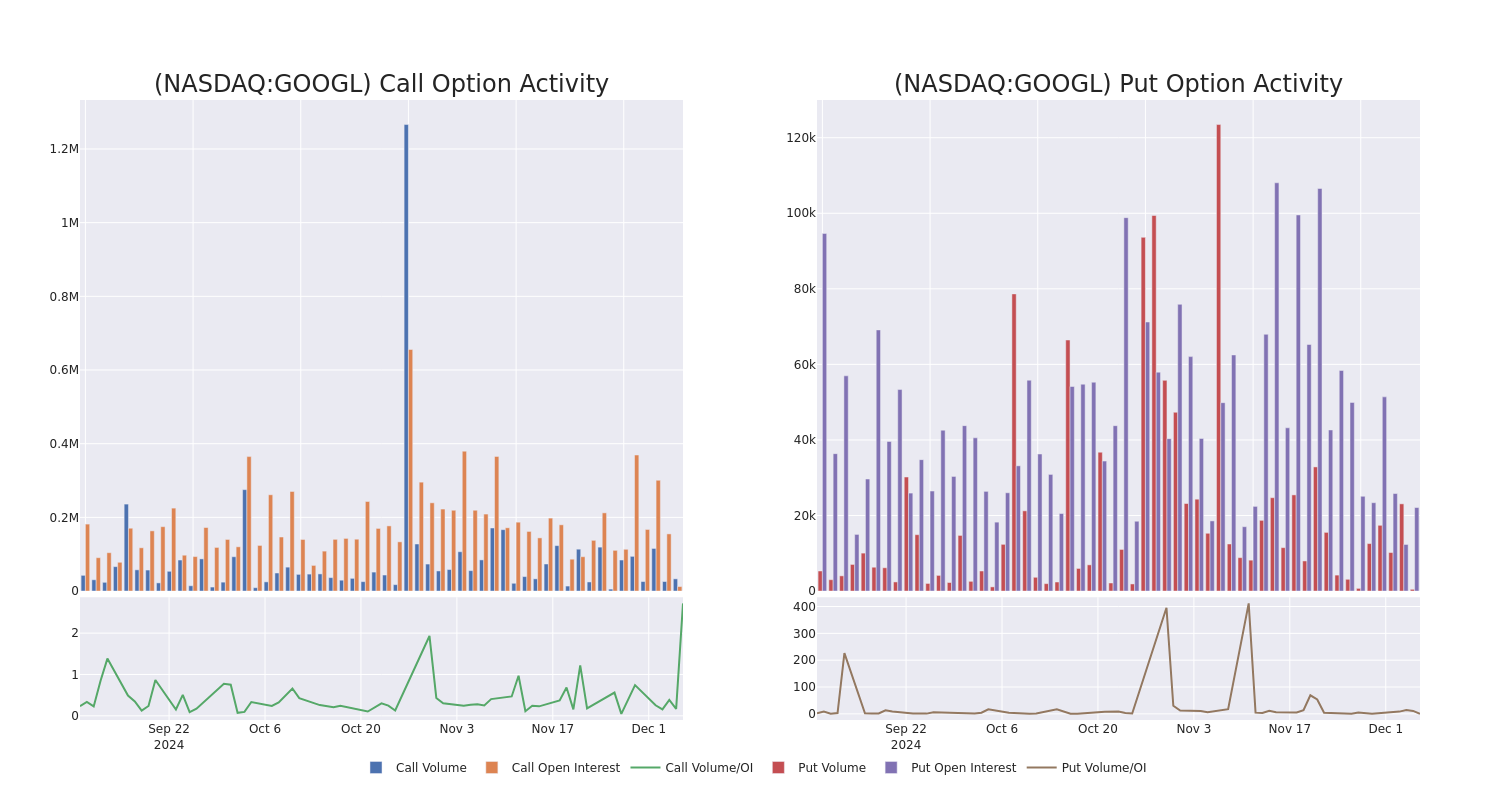

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Alphabet's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Alphabet's substantial trades, within a strike price spectrum from $155.0 to $255.0 over the preceding 30 days.

Alphabet Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | CALL | TRADE | BEARISH | 01/15/27 | $12.1 | $10.55 | $10.63 | $255.00 | $157.3K | 23 | 148 |

| GOOGL | CALL | SWEEP | BEARISH | 12/13/24 | $1.18 | $1.14 | $1.18 | $175.00 | $122.6K | 7.3K | 2.1K |

| GOOGL | CALL | SWEEP | BEARISH | 12/13/24 | $1.19 | $1.16 | $1.16 | $175.00 | $120.2K | 7.3K | 6.4K |

| GOOGL | CALL | SWEEP | BEARISH | 12/13/24 | $1.15 | $1.13 | $1.15 | $175.00 | $118.5K | 7.3K | 9.4K |

| GOOGL | CALL | SWEEP | BEARISH | 12/13/24 | $1.15 | $1.08 | $1.08 | $175.00 | $115.6K | 7.3K | 981 |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google's subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google's cloud computing platform, or GCP, accounts for roughly 10% of Alphabet's revenue with the firm's investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

Present Market Standing of Alphabet

- Trading volume stands at 708,321, with GOOGL's price down by -0.43%, positioned at $171.9.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 53 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Alphabet with Benzinga Pro for real-time alerts.