Whales with a lot of money to spend have taken a noticeably bearish stance on Alphabet.

Looking at options history for Alphabet (NASDAQ:GOOGL) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $96,741 and 6, calls, for a total amount of $360,005.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $140.0 to $195.0 for Alphabet over the last 3 months.

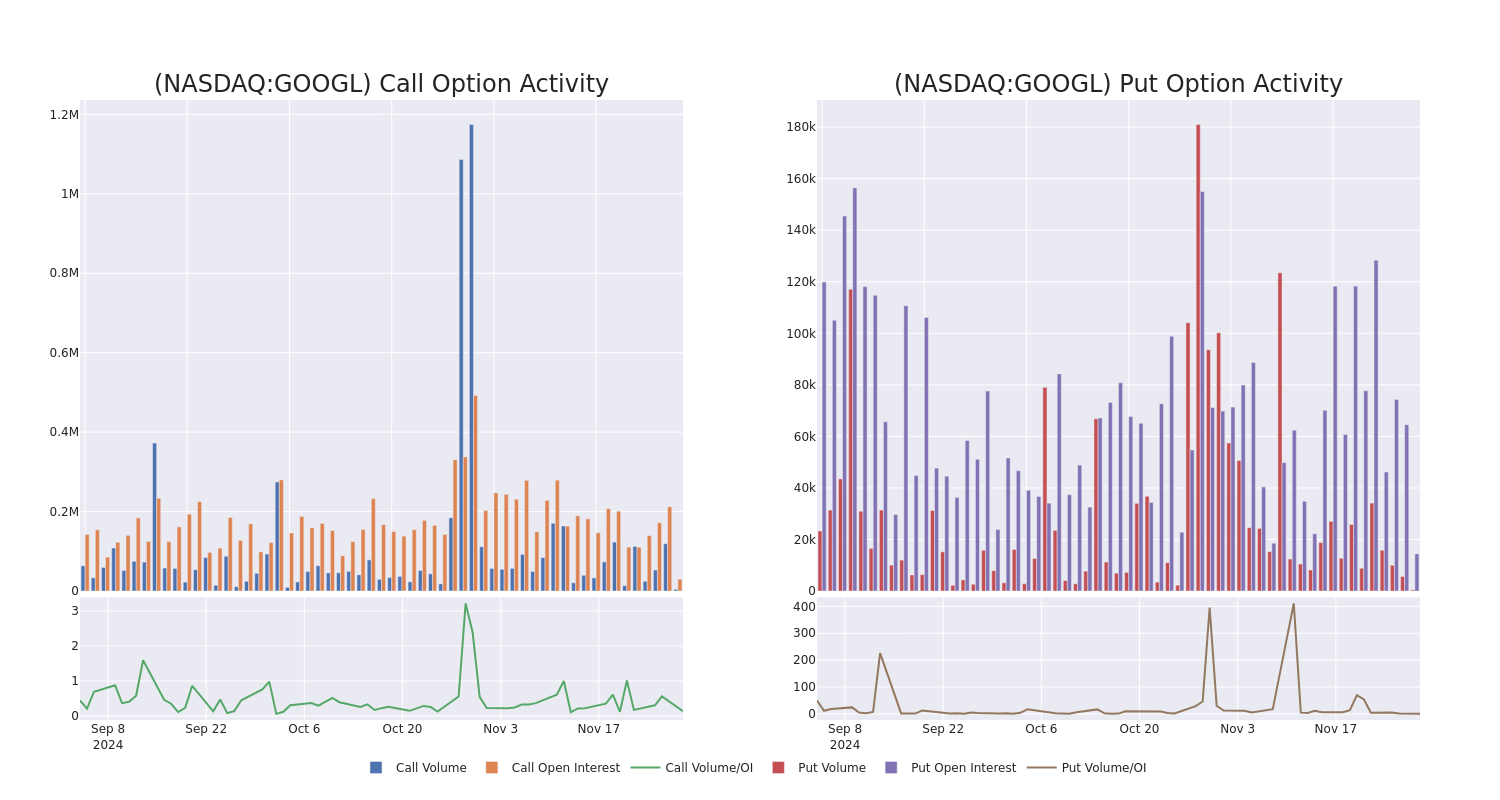

Analyzing Volume & Open Interest

In today's trading context, the average open interest for options of Alphabet stands at 6309.14, with a total volume reaching 4,629.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Alphabet, situated within the strike price corridor from $140.0 to $195.0, throughout the last 30 days.

Alphabet 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOOGL | CALL | SWEEP | BEARISH | 12/06/24 | $0.58 | $0.55 | $0.55 | $172.50 | $118.9K | 9.0K | 2.0K |

| GOOGL | CALL | SWEEP | BULLISH | 12/13/24 | $1.89 | $1.88 | $1.89 | $170.00 | $86.0K | 1.3K | 721 |

| GOOGL | PUT | TRADE | BEARISH | 12/20/24 | $4.55 | $4.4 | $4.55 | $170.00 | $61.4K | 10.2K | 142 |

| GOOGL | CALL | SWEEP | BULLISH | 12/13/24 | $1.89 | $1.88 | $1.89 | $170.00 | $47.6K | 1.3K | 974 |

| GOOGL | CALL | SWEEP | BEARISH | 01/16/26 | $15.9 | $15.45 | $15.45 | $190.00 | $46.3K | 2.0K | 30 |

About Alphabet

Alphabet is a holding company that wholly owns internet giant Google. The California-based company derives slightly less than 90% of its revenue from Google services, the vast majority of which is advertising sales. Alongside online ads, Google services houses sales stemming from Google's subscription services (YouTube TV, YouTube Music among others), platforms (sales and in-app purchases on Play Store), and devices (Chromebooks, Pixel smartphones, and smart home products such as Chromecast). Google's cloud computing platform, or GCP, accounts for roughly 10% of Alphabet's revenue with the firm's investments in up-and-coming technologies such as self-driving cars (Waymo), health (Verily), and internet access (Google Fiber) making up the rest.

Following our analysis of the options activities associated with Alphabet, we pivot to a closer look at the company's own performance.

Current Position of Alphabet

- With a volume of 732,145, the price of GOOGL is down -0.76% at $167.94.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 60 days.

Professional Analyst Ratings for Alphabet

1 market experts have recently issued ratings for this stock, with a consensus target price of $185.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Loop Capital has decided to maintain their Hold rating on Alphabet, which currently sits at a price target of $185.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Alphabet with Benzinga Pro for real-time alerts.