Investors are hoping that mega cap tech will be the ones to save the day, as the market remains volatile and under pressure.

On Tuesday, Microsoft (MSFT) and Alphabet (GOOGL) (GOOG) will report after the close. Later in the week, other FAANG components will report earnings as well.

Alphabet is an interesting one, for several reasons.

First, it has some of the most impressive financials in the entire market. Its balance sheet is robust with an enormous cash balance, a share buyback plan and little debt.

Second, it continues to churn out strong growth. Last quarter, revenue grew by more than 30% year over year, while analysts expect more than 17% growth.

In other words, the company has momentum in its current business and it should be viewed as a flight-to-safety trade, in my opinion. That’s as the stock only trades at 20 times this year’s earnings — cheaper than Procter & Gamble (PG) at 27.5 times earnings, mind you.

Lastly, even during the Nasdaq’s bear market in late February, Alphabet stock momentarily burst to all-time highs on strong earnings results and after announcing a 20-for-1 stock split.

Will it receive the same post-earnings momentum this time? That’s what we don’t know, but we do know some of the key levels to watch.

Trading Alphabet Stock

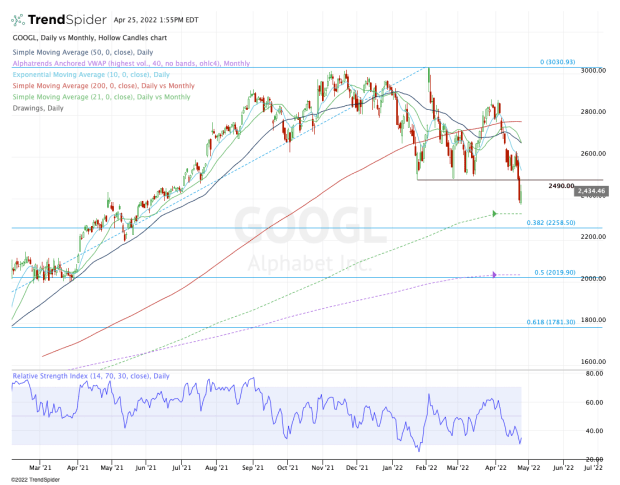

Chart courtesy of TrendSpider.com

Coming into last week, the $2,500 area was a solid support floor of Alphabet stock. It had held all year long, while bulls were hopeful that the company’s strong balance sheet and cash flows would make it a go-to holding during last week’s selloff.

From peak to trough, Alphabet stock fell 9.5% in the final three days of last week, with shares closing 21% below the all-time high from February.

After Alphabet reports earnings, bulls need to see the stock regain the $2,500 level and stay above it. If it can do that, the 21-day and 50-day moving averages are in play next, near $2,665.

Lastly, beyond that opens the door to the 200-day moving average and last month’s high near $2,875. Alphabet stock needs to clear this level in order to revisit resistance near $3,000.

On the downside, the 21-month moving average and the $2,250 area stands out. The latter contains the 38.2% retracement for the full range (from this year’s high to the 2020 Covid low).

Below that could open the door down to the $2,000 area, where the stock would find its 50% retracement and the monthly VWAP measure.

However, keep in mind that this high-quality holding is already down about 20% from the high. To hit the 21-month moving average, Alphabet stock will have to be down 25% from the high, while the second target (~$2,000) would indicate a 33% decline from the highs.