The cost of living is set to rise even higher for households across the country.

This week, it was announced that the energy price cap would rise by 54% from April, meaning millions of households will have to pay hundreds of pounds extra in gas and electricity bills.

On Friday, it was also announced that Scots will see their water charges rise.

READ MORE — Warm Home Discount, Cold Weather Payment and DWP Winter Fuel support that can help with bills

In addition, National Insurance rates are set to increase starting in April, resulting in some people potentially paying hundreds of pounds more in tax.

Here is a roundup of some of the cost-of-living increases that Scots will see this year.

Energy price cap

On February 3, energy regulator Ofgem announced that the energy price cap was increasing, meaning millions of households will be spending hundreds more on their energy bills.

The energy price cap refers to the maximum amount that energy suppliers can charge customers for gas and electricity over a six month period.

Those on default tariffs paying by direct debit will see an increase of £693 from £1,277 to £1,971 per year, while prepayment customers will see an increase of £708 from £1,309 to £2,017.

The increase is a result of a record rise in global gas prices over the last 6 months.

The next price cap review will be in October, which could see prices rise even further.

Chief executive of Ofgem Jonathan Brearley said: “We know this rise will be extremely worrying for many people, especially those who are struggling to make ends meet, and Ofgem will ensure energy companies support their customers in any way they can.

“The energy market has faced a huge challenge due to the unprecedented increase in global gas prices, a once in a 30-year event, and Ofgem’s role as energy regulator is to ensure that, under the price cap, energy companies can only charge a fair price based on the true cost of supplying electricity and gas.

“Ofgem is working to stabilise the market and over the longer term to diversify our sources of energy which will help protect customers from similar price shocks in the future.”

Water bills

In another cost of living blow, it has been announced that people living in Scotland will see their water charges rise by 4.2%.

Public-owned Scottish Water determines the charges after approval from a regulator.

As reported by the Daily Record, Scottish Government Net Zero Cabinet Secretary Michael Matheson informed customers how much extra they would pay in a statement on Friday.

He said: “We remain committed to supporting people facing issues paying their water bills. While UK-wide energy prices rise beyond inflation, in Scotland the increase to water charges for 2022-23 has been set at 4.2% - in line with inflation.

"“In developing the charging principles for the industry for 2021-27, Ministers took the decision to increase the levels of support for those vulnerable customers who have the most difficulty paying.

"The water charges reduction scheme discount has increased from 25% to 35% - protecting thousands of eligible households from higher charges.”

National Insurance

National Insurance is a tax on earnings and self-employed profits used to pay for the NHS, state benefits and the State Pension.

Starting in April, the tax will increase by 10% per month — which will set people back hundreds of pounds each year.

The hike means that employees, employers and the self-employed will pay 1.25 pence more on the pound for National Insurance Contributions.

James Andrews, Senior Personal Finance Editor at money.co.uk, said: “With NI increasing by 1.25% points in April, it’s no surprise that many UK workers think this means their payments are going up by only a fraction.

“However, that figure relates to the rate, and this means that for most people contributions are actually increasing by more than 10%.”

Those earning under £9,564 per year do not need to pay National Insurance and therefore the increase does not apply to them.

However, for everybody else, here are the new rates, as reported by the Daily Record.

- £20,000 - will pay an extra £130 a year (£10.80 per month)

- £30,000 - will pay an extra £255 a year (£21.25 per month)

- £50,000 - will pay an extra £505 a year (£45.80 per month)

- £80,000 - will pay an extra £880 a year (£73.33 per month)

- £100,000 - will pay an extra £1,130 a year (£94.16 per month)

Food prices

A recent report from the Daily Record found that the price of an average food shop rose by almost 20% over the past year.

Comparing the cost of an identical shopping basket at Asda between January 2021 and January 2022, it was found that the price of the same 15 items rose by 19%.

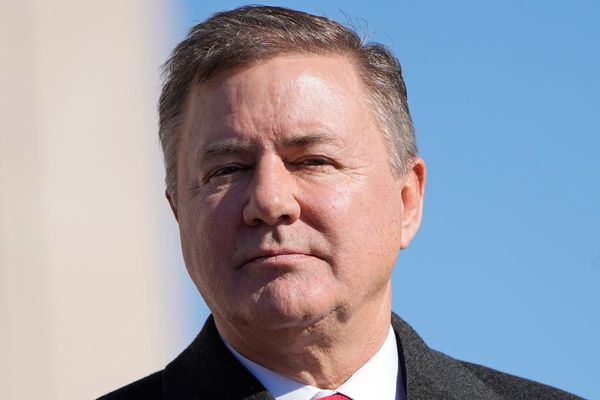

Scottish Lib Dem economy spokesperson Willie Rennie said: “Alongside rising fuel and electricity prices, families have seen the cost of their weekly shop soar."