Every year for more than a decade, Cook County officials billed the Chinatown Square mall for property taxes on its common areas — the plaza, corridors and stairways that connect its restaurants and stores.

Every year for more than a decade, the tax bills went unpaid.

When the mall had amassed a total of more than $2.4 million in past-due property taxes, its owners thought they had the perfect solution: Get the county to bail them out.

And the Cook County Land Bank Authority was ready to do just that. At the mall owners’ request, officials of that county agency were going to take ownership of the tax-delinquent property, wipe out most of the back taxes — and then give them back the 62,000-square-foot property minus the burden of needing to pay most of what they had owed.

There was a problem, though. A lawyer for the agency pointed out that such a deal would be an illegal end-run around the past-due taxes, as the Chicago Sun-Times reported last year.

Then, Chinatown Square’s owners came up with another plan to try to ease the burden of its years of not paying their property taxes. They argued that the property had been overvalued by county officials for years and that, as a result, they’d been overbilled for years.

And, in a move that would bail them out of a chunk of those long-unpaid taxes, Cook County Assessor Fritz Kaegi agreed.

Records show Kaegi slashed the value last year that his office had placed on the mall’s common areas for the previous six years — as far back as he could go — by 60%.

That made more than $500,000 in unpaid taxes vanish, along with $147,000 in interest.

But now the owners of the mall have a new problem: The taxes that had gone unpaid from 2010 to 2015 — totaling $1.5 million — were auctioned off in February to the highest bidder at Cook County’s annual scavenger tax sale.

A used-car dealer in Burr Ridge paid $9,000 in cash — a little over half a cent for each dollar the mall owed — to settle those delinquent taxes and interest and give him the right to take ownership of the mall’s plaza, corridors and stairways.

That’s a turn of events that worries the mall’s owners, according to Ald. Byron Sigcho-Lopez (25th).

“They’re afraid also this can be another issue they have to overcome,” Sigcho-Lopez says.

The car dealer, Ang Li, says he has no plans to interfere with their business — just to make a profit by getting them to pay a premium for his investment.

“We know that’s an important piece of real estate for Chinatown,” Li says. “We’re not trying to interrupt any current operation. But we think, as investors, we want to make sure our interests are protected.”

Li, who had never taken part in the scavenger sale before, says he has partners in the deal but won’t identify them.

Nor will he say whether he plans to ask a Cook County judge to give him the deed to the mall property.

“I might end up selling the rights,” he says. “I cannot disclose…It’s in Chinatown, and I’m Chinese, and I might want to sell the rights.”

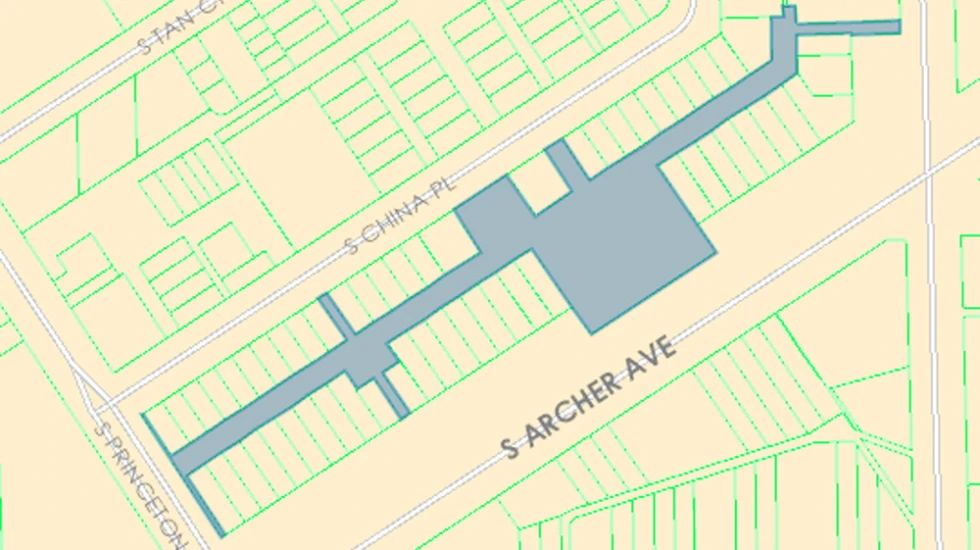

Li says he isn’t involved with the Chinatown Square Association, which owns and oversees the common areas of the mall at 2002 S. Wentworth Ave.

Scavenger sale rules bar property owners from bidding on their own outstanding taxes or making deals with tax buyers ahead of the sale to erase their debts.

If Li does get a judge to give him the deed for the mall property, he could then sell it to anyone he wants, including the mall association, according to Cook County officials.

Mall officials could block Li from taking ownership of the property by redeeming the taxes — paying the $1.5 million in taxes and interest that’s owed for 2010 through 2015.

That’s what the Chinatown Square owners plan to do, according to Paul K. Lee, their lawyer, who says, “I can confirm that the association is in the process of redeeming the taxes.”

Cook County taxpayers would still come up short, though. Between the tax break Kaegi provided by lowering the assessment on the property and the money Li paid in the scavenger sale, taxpayers have now collected about a fifth of the amount the mall owed in back taxes and interest since 2010 — $493,000 of the $2.4 million in arrears.

The rest of the debt would be wiped out if a judge ends up granting Li a tax deed for the property.

Li has a financial interest in seeking the deed because, if he doesn’t, he’d lose his $9,000 payment. Then, at the next tax sale, the outstanding taxes and interest would be offered once again to the high bidder.

Representatives of the Chinatown Square previously have said they were unaware they had to pay taxes on the common space. They told county officials they never received any of the tax bills from the mall’s opening in 2010 to 2017, when the property ended up in the scavenger sale for the first time.

Though the parcel wasn’t vacant or in a blighted neighborhood, the Cook County Land Bank — which aims to get such properties rehabilitated and paying taxes — claimed it then. That kept anyone else from bidding on it.

After negotiating with the mall’s owners for a year and a half, the land bank had contracts ready to take ownership, erase the long-overdue taxes and then sell the property back to the mall for just $3,500 — enough, they’ve said, to cover the costs of doing the deal.

That’s when a lawyer for the agency canceled the sales contracts, saying the county didn’t have the legal right to sell the property back to the same people who owed the taxes.

By the time the land bank released its claim on the property, it was too late to auction the unpaid taxes at the next scavenger sale, held in 2019.

Then, Chinatown Square’s lawyer appealed to Kaegi to lower his office’s initial estimation of the value of the property, which would reduce the taxes. He argued that the assessor’s office under Kaegi and his predecessor, Joseph Berrios, had overestimated the value of the property for years. Berrios had said no.

But Kaegi ultimately agreed, cutting the assessment and the tax bills for the previous five years. He lowered his office’s estimated value of the property from $3.7 million to just under $1.5 million last year — which resulted in that year’s tax bill falling from $205,653 to $82,427.

Sarah Garza Resnick, Kaegi’s chief of staff, says the value of the plaza and the mall’s oddly shaped corridors is tied to the shops and restaurants, which get their own tax bills.

“Additionally, the value of the parcel is partially already accounted for within the assessed value of the adjoining properties,” she says. “To say it plainly, the small businesses that reside within the mall cannot get into or out of their businesses without using this common area.

“The parcel in question is only land and therefore should not be priced according to the same price per square footage as the other parts of the mall that have both land and a building on them,” Resnick says.

Land Bank officials still won’t say why they moved to acquire the Chinatown property.