Micron (MU) shares are mixed down about 3.5% at last glance after the chipmaking stalwart reported earnings on Wednesday evening.

Although the company beat top-line and revenue expectations for its fiscal third quarter, the company lost $1.43 a share, while revenue of $3.75 billion fell more than 56% year over year.

Further, the midpoint of management’s fourth-quarter revenue and earnings outlook was shy of analysts’ expectations.

Don't Miss: When to Buy Walgreens Stock and Its Near-7% Dividend Yield

At one point in the premarket MU shares were trading higher, although a quick glance at the results above might have investors wondering why. The current intraday dip makes sense considering the outlook.

Investors should consider how the stock reacts from this point forward. Price action often tells the tale of how Wall Street feels about a stock, regardless of whether it aligns with the current narrative.

Buy the Earnings Dip in Micron?

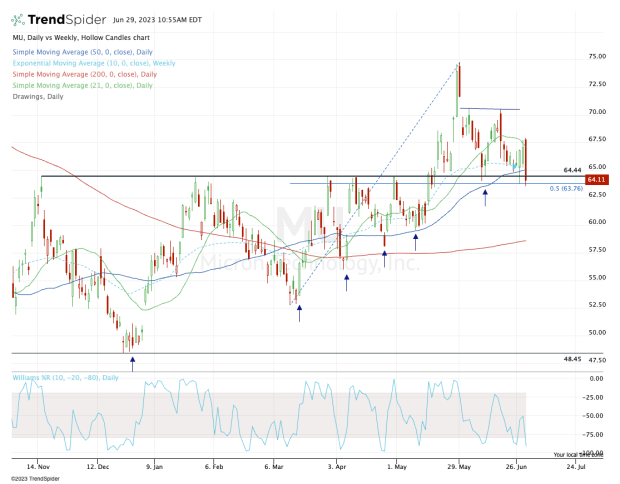

Chart courtesy of TrendSpider.com

The headline numbers beat expectations but they weren’t exactly good. Guidance was uninspiring but holds potential. All that’s up for debate while the charts are pretty straightforward.

Put simply, Micron stock needs to hold the $64 to $65 area.

This area was a giant breakout level in May, as this zone had been resistance multiple times over several quarters.

Further, the 50-day and 10-week moving averages come into play near this zone, while the 50% retracement is just below it, at $63.76.

Don't Miss: When to Buy Walgreens Stock and Its Near-7% Dividend Yield

If the stock can hold this area and regain $65, the bulls would have a reasonable risk/reward setup against the session low, down near $63.50.

A sustained break of this level could flush out traders, who would then wait for either a larger dip — potentially down to the $60 area and the 200-day moving average — or wait for the stock to regain the $64 to $65 zone.

For a sustainable upside move to occur, Micron stock needs to hold this zone and clear the post-earnings high near $68.

July 4th Sale! Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now for 75% off.