Buy now, pay later (BNPL) has redefined shopping, replacing traditional credit with flexible, interest-free payments. Affirm Holdings (AFRM), established in 2012, swiftly ascended the ranks, forging pivotal alliances with retail behemoths. Affirm cemented its status in 2019 by partnering with Walmart (WMT), becoming its exclusive BNPL provider.

But the landscape just shifted. Swedish fintech Klarna has taken over, securing an exclusive BNPL deal through Walmart’s fintech arm, OnePay. Klarna, which recently announced plans to go public in the U.S., will now power Walmart’s BNPL loans both in-store and online, underwriting terms from three to 36 months while OnePay manages the customer experience.

Walmart accounted for 5% of Affirm’s gross merchandise volume (GMV) and 2% of its adjusted operating income during the six months ended Dec. 31, 2024. Still, Affirm remains in Walmart’s ecosystem via its app and card. Despite AFRM stock sliding down on the news, Wall Street analysts are upbeat on the BNPL stock’s prospects, anticipating roughly 60% upside.

To that end, let’s break down the reason behind the optimism.

About Affirm Holdings Stock

San Francisco-based Affirm Holdings (AFRM) is reshaping consumer finance with flexible payment solutions. With a market cap of $15.4 billion, the fintech pioneer connects buyers and sellers through its dynamic network. By offering BNPL services and personalized payment plans, Affirm empowers consumers while driving merchant sales. Its growth stems from an expanding merchant network, innovative financial products, and strategic risk management.

AFRM stock soared to $82.53 on Feb. 18 but has since tumbled 43%. The drop accelerated after Walmart’s Klarna switch, sending shares down 2% in the past month. Yet, AFRM remains resilient, returning 29% over the past year.

From a valuation standpoint, AFRM currently trades at 6.97 times sales, a premium to the industry median and its peers like Block (XYZ). But compared to its historical average, it’s a bargain. With surging GMV and big-name partnerships, the market is betting that this premium fintech still has room to run.

Affirm Holdings Tops Q2 Estimates

AFRM lit up Wall Street with a nearly 22% surge in a single session after its fiscal Q2 earnings report on Feb. 6 shattered expectations. Revenue jumped 46.6% year over year to $866.4 million, while its bottom line flipped from a $0.54 per share loss in the year-ago quarter to a solid $0.23 per share profit.

Financially, Affirm is firing on all cylinders. GMV soared 35% annually in Q2 to $10.1 billion, while active consumers hit 21 million, marking four straight quarters of acceleration. Merchants climbed 21%, reinforcing its ecosystem. Affirm’s profitability is also surging, with adjusted operating income leaping to $238 million in Q2 and funding capacity hitting $22.6 billion, continuing an eight-quarter growth streak.

Affirm thrives on merchant and e-commerce platform partnerships, driving higher GMV and engagement, but that reliance cuts both ways. In Q2, Affirm’s top five partners fueled 51% of GMV, with Amazon (AMZN) alone contributing 25%. A single defection could send shockwaves through growth projections. Aware of this risk, Affirm is playing offense, diversifying its merchant base, and locking in key deals. A fresh five-year deal with a major travel industry player strengthens its footing, adding financing programs and new offerings.

The BNPL leader is doubling down on expansion. Its collaboration with Apple Pay (AAPL) and deeper integration with Shopify (SHOP) and WooCommerce are set to supercharge GMV growth. Meanwhile, its UK launch extends its reach into a booming international BNPL market.

Affirm is charting a strong course for fiscal 2025. Fiscal Q3 GMV is expected to be between $8 billion and $8.3 billion, with revenue landing between $755 million and $785 million and adjusted operating margin between 20% and 22%. Q4 looks even stronger, with GMV projected between $9 billion and $9.3 billion and revenue reaching between $810 million and $840 million. For the full year, management sees GMV between $34.74 billion and $35.34 billion and revenue between $3.13 billion and $3.19 billion, with margins between 22.5% and 23.5%.

Analysts tracking Affirm Holdings expect the company to trim its losses by 91% annually to $0.15 per share in fiscal 2025. Losses are projected to narrow further, and by fiscal 2026, the BNPL giant is expected to flip the script entirely, turning a profit of $0.58 per share.

What Do Analysts Expect for Affirm Stock?

Despite tumbling after losing Walmart's partnership to Klara, brokerage firm Compass is not buying the panic. Upgrading AFRM to a “Buy” from a “Neutral” and raising its target to $64, they argue the selloff is overblown.

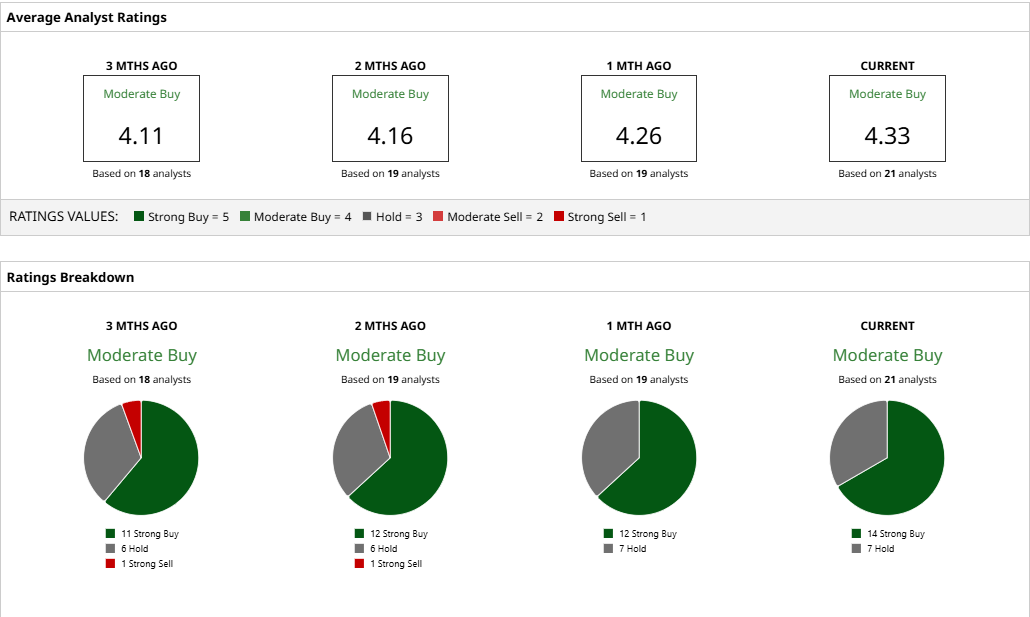

Overall, AFRM has a “Moderate Buy” consensus rating. Out of the 21 analysts in coverage, 14 are all in, recommending a “Strong Buy,” and the remaining seven analysts are cautious, advising a “Hold.”

Despite recent turbulence, the Street still sees upside in this BNPL contender’s future. The mean price target of $74.28 implies 60% upside in play, while the Street-high of $86 suggests AFRM could rally as much as 82% from the current levels.