L3Harris Technologies stock had its Relative Strength (RS) Rating upgraded from 80 to 87 Friday. The Aerospace-Defense stock has been rallying in recent trading days as Russia-Ukraine tension rise.

When looking for the best stocks to buy and watch, one factor to watch closely is relative price strength.

IBD's proprietary RS Rating tracks market leadership by showing how a stock's price movement over the last 52 weeks compares to that of other stocks on the major indexes.

Decades of market research shows that the best stocks tend to have an 80 or higher RS Rating in the early stages of their moves.

Looking For Winning Stocks? Try This Simple Routine

Is L3Harris Technologies Stock A Buy?

L3Harris stock is trying to complete a consolidation with a 246.18 entry. See if the stock can break out in volume at least 40% above average. Read "Looking For The Next Big Stock Market Winners? Start With These 3 Steps" for more tips.

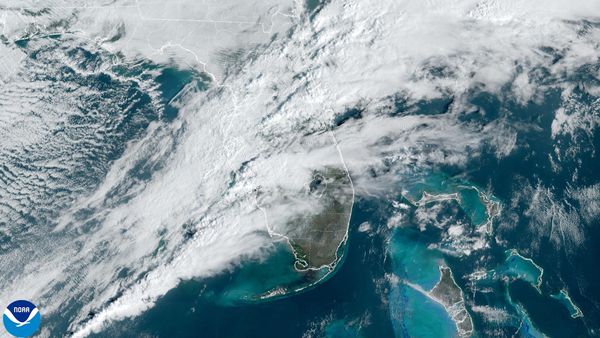

The Florida-based Aerospace company showed 5% earnings growth in the latest quarterly report, while sales growth came in at -7%.

L3Harris stock earns the No. 8 rank among its peers in the Aerospace/Defense industry group. AAR and Elbit Systems are also among the group's highest-rated stocks. For more industry news, check out "Defense & Aerospace Stocks To Watch And Industry News."