Adobe Systems (ADBE) stock is one of the few tech stocks with a bid on Friday. That’s after the company delivered a solid earnings report on Thursday evening.

On Wednesday, the Federal Reserve was more hawkish than expected, which is now sending equities lower for the third straight session.

Adobe is bucking the trend, at least for a day, with the shares up about 3% at last check.

The company’s fourth-quarter earnings beat estimates while revenue was in-line with expectations and grew 10% year over year. Guidance was solid as well.

Given the temperament on Wall Street today, I am a little surprised the market is allowing Adobe stock to rally. That said, investors did sell into this morning’s early strength when the shares were up almost 8% and running into resistance.

Trading Adobe Stock on Earnings

Chart courtesy of TrendSpider.com

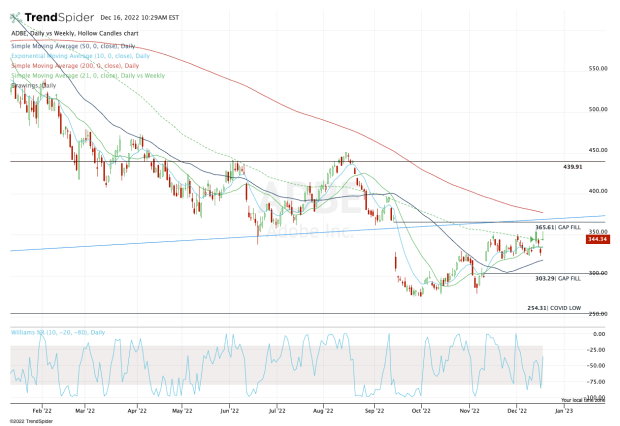

With this morning’s rally, Adobe stock approached this week’s high near $355 and then faded hard. In doing so, the 21-week moving average continues to act as resistance.

Unless Adobe stock can find its footing here and push back to the $355s and continue higher, the safest outcome for the bulls is a simple earnings gap-fill back to $344.50, where the stock also finds its 10-day and 21-day moving averages.

If it can eventually take out $355 and the 21-week moving average — with or without a gap-fill — then it opens the door to the $365 level. That's followed by a potential rally to the declining 200-day moving average.

On the downside, the levels are pretty clear, too.

Should Adobe stock break below the 10-day and 21-day moving averages, it opens the door down to the $320 to $325 zone, which has been decent support the past few weeks and really all the way back to mid-November.

The rising 50-day moving average also comes into play just below this zone.

If all these levels fail to buoy Adobe stock, then the gap-fill level near $303 is on the table. Should the selling pressure become relentless, then the $275 to $277 zone is back in play.

The bottom line: Adobe just reported a solid quarter, but the stock is struggling to maintain its upside momentum. That's as the environment remains very tough for longs.

Respect the levels and go from one zone to the next.