Accenture (ACN) was up nearly 2% at last check, enough to trigger a short-term breakout.

Perhaps it’s riding the coattails of the Nasdaq. Maybe it’s the robust reaction we’re seeing in Oracle (ORCL) as the software stalwart rips to all-time highs on better-than-expected earnings.

The sigh-of-relief reaction we’re seeing from this morning’s inflation report is giving a lift to the broad market.

Accenture has been known for being consistent, but the stock did not glide through the bear market unscathed.

Don't Miss: Tesla Stock: Buy the Dip but Use Caution

It suffered a peak-to-trough decline of almost 42%. Like most tech stocks, shares of Accenture bottomed in the fourth quarter. But unlike most tech names, Accenture retested its October low on March 15.

While the decline was painful for the bulls — the shares fell about 18% in a six-week stretch — it set up a nice undercut of the lows and a strong upside reversal.

With Accenture stock nearing last month’s high, it’s got investors wondering how high this name can go.

Trading Accenture Stock

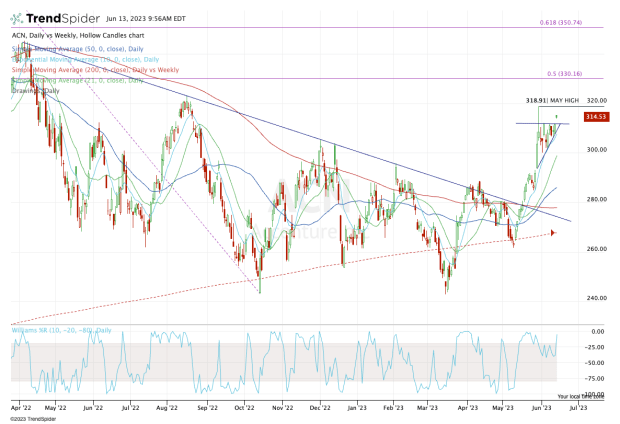

Chart courtesy of TrendSpider.com

After rallying off its March low, Accenture stock struggled with downtrend resistance, ultimately pulling back to the 200-week moving average and cementing a higher low in the process.

That helped lead to the stock’s breakout last month, where it ultimately surged to $318.91.

With Accenture shares breaking out over $312 and out of a small consolidation pattern that has been in play all month, it puts the May high back in play.

If Accenture stock can clear that level, it opens the door up to the 50% retracement of the bear market range at $330.

If that level is achieved, longer term traders will likely shift their focus to the 61.8% retracement at $350.

Don't Miss: Are Growth Stocks Back? Trading Cathie Wood's ARKK ETF

On the downside, the bulls will now look for $312 to flip from resistance to support. They’ll also look for support from the 10-day moving average.

If these measures fail, then $300 and the 21-day moving average could be in play. Below that, the bulls will likely need to reevaluate the stock and consider zooming out (perhaps to the weekly chart) to find potential support areas.

That said, the bottom line is pretty clear — the bulls remain in control of Accenture stock at the moment. Let's see how it handles the May high.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.

.jpg?w=600)