Abercrombie & Fitch (NYSE:ANF) will release its quarterly earnings report on Tuesday, 2024-11-26. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Abercrombie & Fitch to report an earnings per share (EPS) of $2.22.

The market awaits Abercrombie & Fitch's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

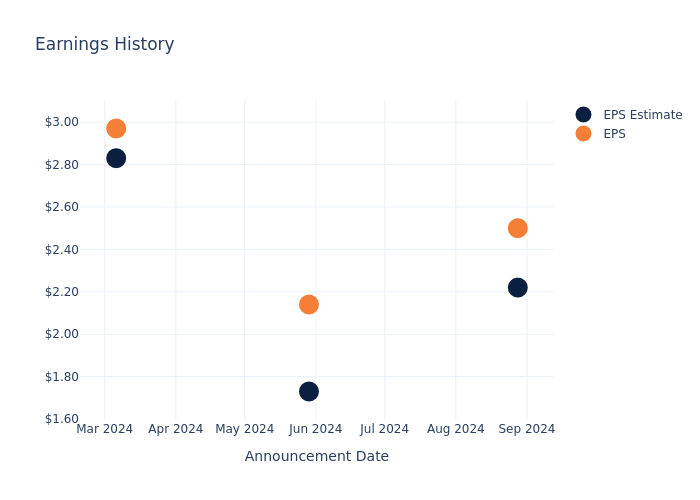

Earnings History Snapshot

The company's EPS beat by $0.28 in the last quarter, leading to a 2.83% increase in the share price on the following day.

Here's a look at Abercrombie & Fitch's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.22 | 1.73 | 2.83 | 1.18 |

| EPS Actual | 2.50 | 2.14 | 2.97 | 1.83 |

| Price Change % | 3.0% | -6.0% | -5.0% | -2.0% |

Tracking Abercrombie & Fitch's Stock Performance

Shares of Abercrombie & Fitch were trading at $151.99 as of November 22. Over the last 52-week period, shares are up 101.36%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Abercrombie & Fitch

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Abercrombie & Fitch.

With 8 analyst ratings, Abercrombie & Fitch has a consensus rating of Neutral. The average one-year price target is $185.62, indicating a potential 22.13% upside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of Gap, Boot Barn Holdings and Urban Outfitters, three key industry players, offering insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Neutral trajectory for Gap, with an average 1-year price target of $27.8, implying a potential 81.71% downside.

- As per analysts' assessments, Boot Barn Holdings is favoring an Buy trajectory, with an average 1-year price target of $171.56, suggesting a potential 12.88% upside.

- Urban Outfitters is maintaining an Neutral status according to analysts, with an average 1-year price target of $43.0, indicating a potential 71.71% downside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Gap, Boot Barn Holdings and Urban Outfitters are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Abercrombie & Fitch | Neutral | 21.24% | $736.26M | 11.65% |

| Gap | Neutral | 2.93% | $1.58B | 9.08% |

| Boot Barn Holdings | Buy | 13.71% | $152.86M | 2.94% |

| Urban Outfitters | Neutral | 6.27% | $493.29M | 5.34% |

Key Takeaway:

Abercrombie & Fitch ranks highest in Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is at the bottom compared to its peers.

Delving into Abercrombie & Fitch's Background

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

Financial Insights: Abercrombie & Fitch

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Abercrombie & Fitch displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 21.24%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Abercrombie & Fitch's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.74% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Abercrombie & Fitch's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 11.65%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Abercrombie & Fitch's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.42% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Abercrombie & Fitch's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.74.

To track all earnings releases for Abercrombie & Fitch visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.