Shares of AbbVie (ABBV) traded up 1% on Wednesday, closing near session highs. But from a technical perspective, yesterday’s action is more than just a bounce.

The rally essentially ignored the prior day’s dip and gave bulls the green light for more potential gains.

Something interesting is happening in the market: A rotation is occurring.

The market has been led higher by tech stocks, mainly megacap tech companies with market capitalizations exceeding $500 billion.

You know the names: Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA) and a few others.

Don't Miss: Buffett's Berkshire Hathaway Is Breaking Out. Here's How to Trade It.

For the past week or two, we’ve seen some hesitancy within tech, denoted by stalled rallies and choppy price action. Now the bearish post-earnings reactions from Netflix (NFLX) and Tesla (TSLA) — particularly the latter — is worsening that observation.

Instead, investments have been quietly flowing into defensive stocks and health-care names. One of those key stocks? AbbVie.

Trading AbbVie Stock

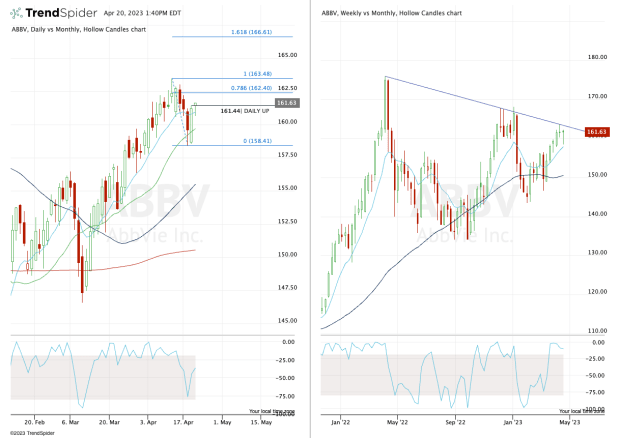

Chart courtesy of TrendSpider.com

On the left, we have the daily chart, while the right side highlights the weekly chart.

AbbVie has been very strong lately, working on its sixth straight weekly gain. Further, it’s up in eight of the past 10 weeks.

On Tuesday the stock temporarily broke below the 21-day moving average, then closed above it. On Wednesday the shares opened near the prior day’s low but quickly stormed higher. This is bullish price action.

As AbbVie stock is now trying to clear Wednesday’s high, investors are looking for more upside.

Specifically, it has the 78.6% retracement in play near $162.50, followed by the recent high near $163.50.

Don't Miss: Boeing Stock Faces Overhead Resistance as It Tries to Take Flight

As we can see on the weekly chart, however, downtrend resistance looms in this area (blue line).

This mark begins from the all-time high, stymied the rally in December and January and again denied AbbVie’s rally last week.

A break out over this level would be significant, potentially opening the door to the $167.50 area — and potentially much higher.

On the downside, the bulls want to keep AbbVie stock above the recent lows near $158. Ideally, it would hold the $157.50 to $158 zone.

If it fails, $155 could be in play, followed by much larger support near $150.