What you need to know

- Intel is a company in turmoil, having laid off thousands of staff this year in attempts to balance its books.

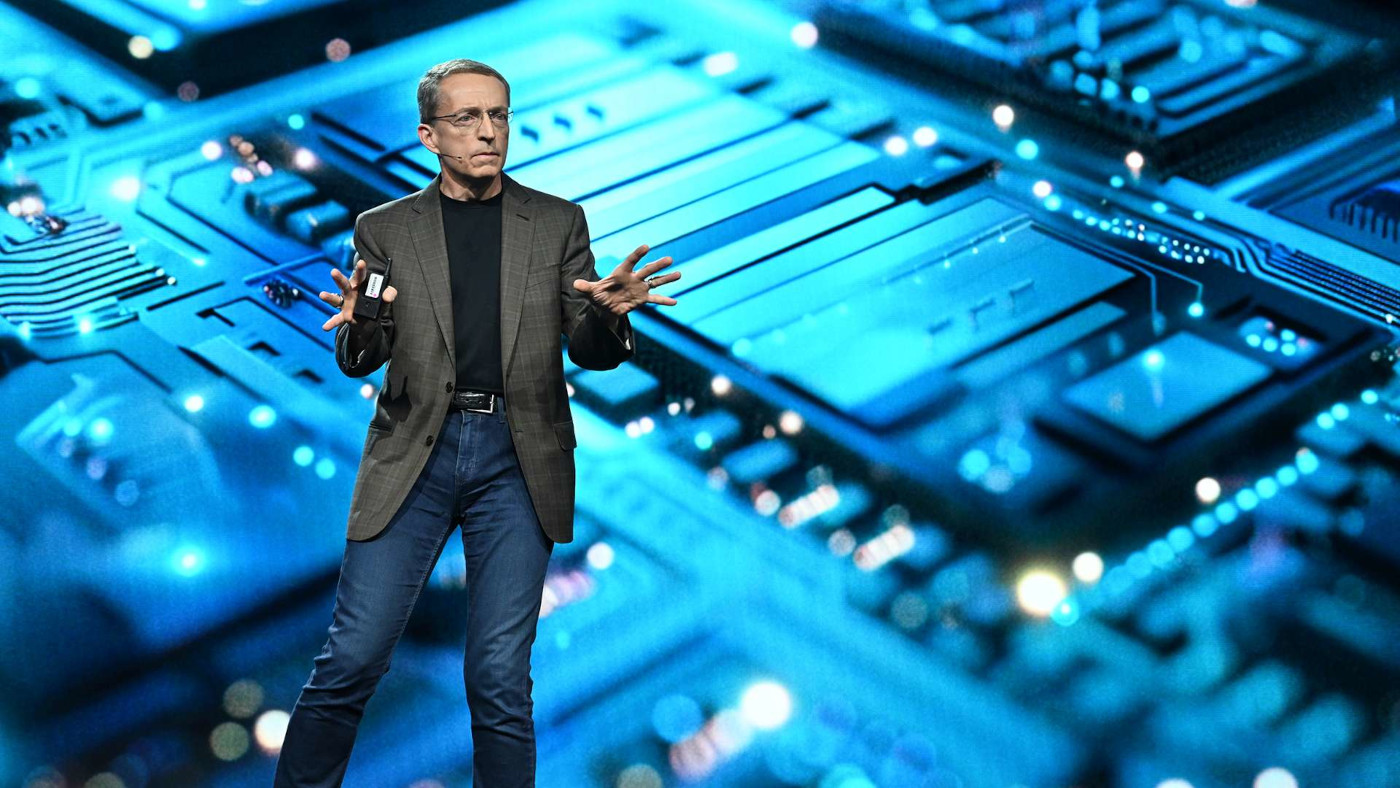

- With billions in losses over the past few years, many have questioned CEO Pat Gelsinger's ability to deliver.

- A new report suggests that ill-advised comments on the sovereignty of Taiwan may have cost the U.S. chip designer millions more following the termination of a lucrative discount on chip wafers.

Intel hasn't had a fun few years.

Earlier in 2024, Intel reported yet another quarter of hard losses following the ongoing failure to set up its own chip fabrication foundries. Intel Foundry, as it is known, is now responsible for billions in losses for the firm. As a result, Intel terminated a record 15,000+ positions from its company a few months ago as it seeks to right its slowly, painfully sinking ship.

Over the past five years, Intel has seen a 60% slide in its market capitalization, while competing chip makers and manufacturers saw runaway success in the AI era. NVIDIA is battling Apple for the world's most valuable company crown, and more and more computer manufacturers are exploring Arm architecture as Intel's designs seem to have hit a power-efficiency roadblock. Microsoft's Copilot+ PC range in partnership with its OEMs relies entirely on Arm-based Qualcomm chips, for example, and Apple has ditched Intel chips for its Macs in favor of home-grown, Arm-based solutions in recent years, too.

Now, a damning new report from Reuters (via TweakTown) suggests that Pat Gelsinger's insensitive comments about the status of Taiwan in relation to China may have cost the firm millions upon millions in discounts with Taiwan Semiconductor Manufacturing Company (TSMC).

In an interview with Fortune magazine, Gelsinger said this of using TSMC to fabricate Intel chip wafers: "You don't want all of your eggs in the basket of a Taiwan fab. [...] Taiwan is not a stable place." As you might expect, the comments went down like a lead balloon in the sovereign nation, which the ruling party of neighboring China claims as its own.

Up until that point, Reuters sources say that Intel had enjoyed a lucrative 40% discount on 3-nanometer wafers. After the comments, TSMC terminated the agreement. TSMC founder Morris Chang had previously called Gelsinger a "very discourteous fellow," noting that "TSMC deals with Intel the way Intel deals with TSMC." Officially, TSMC and Intel are close partners, given that TSMC is responsible for some 60%+ of the chip manufacturing industry. But relationships may have strained as Intel has attempted (and thus far failed) to gain a foothold with its own fabs.

🎃The best early Black Friday deals🦃

- 🎮Lenovo Legion Go (512GB) | $499.99 at Best Buy (Save $200!)

- 🖥️ABS Cyclone Desktop (RTX 4060) | $1,099.99 at Newegg (Save $400!)

- 💻ASUS ROG Zephyrus G14 (RTX 4060) | $1,249.99 at Best Buy (Save $350!)

- 📺HP Omen 27qs (QHD, 240Hz) | $349.99 at Best Buy (Save $80!)

- 🔊2.1ch Soundbar for TVs & Monitors | $44.99 at Walmart (Save $55!)

- 🎧Sennheiser Momentum 4 ANC | $274.95 at Amazon (Save $125!)

- 📺LG C4 OLED 4K TV (42-inches) | $999.99 at Best Buy (Save $400!)

No light on the horizon for Intel

Intel has signaled to investors that it may take years for its Foundry project to materialize profits; technical problems and reliability concerns prevent the division from hitting profitability. The slump in what was one of America's most cherished companies has sparked rumors that Apple may be looking to acquire Intel outright.

Gelsinger relies on America's CHIPS act, which provides subsidies and incentives to set up fabs on U.S. soil. In essence, Gelsinger's comments may have been insensitive, but they weren't exactly wrong given the state of the world right now. China has made no secret of its desire to conquer Taiwan, and war across the Taiwan Strait would have spectacularly dire consequences for the region, while also devastating the global economy. There are trillions of dollars invested in companies that rely, at times, almost entirely on TSMC for their products and services. A disruption in the semiconductor supply chain would upend the entire global economy, given that virtually everything has some form of compute these days.

While Intel has floundered to get the basics down, companies like NVIDIA have stormed ahead and capitalized massively on the AI boom, with its GPUs powering everything from ChatGPT to Microsoft Copilot, to xAI and Meta's Llama. Intel has been practically left behind in this regard, assaulted by NVIDIA at one end and Arm-based chips on the other. It remains to be seen if Intel can cut through the middle and find its footing. It further remains to be seen if CEO Pat Gelsinger is actually the right man for the job.