What are CBDCs?

Central bank digital currencies (CBDCs) are a hot topic in the world of finance and economics. In this blog post, we'll explore the basics of CBDCs, how global central banks and policymakers have approached their regulation, and what implications CBDCs may hold for finance professionals.

As outlined in Module 2 of Oxford’s Fintech Programme, a central bank digital currency (CBDC) is a digital currency issued by a country’s central bank. CBDCs are intended to be used as electronic payment, similar to existing fiat currencies such as the US dollar or the euro.

CBDCs differ from traditional fiat currencies in several key ways. First, CBDCs are typically based on blockchain technology, which allows for greater transparency and security than traditional fiat currencies. Second, CBDCs are often designed to be ‘decentralised’, meaning they are not subject to the same level of control by central banks as traditional fiat currencies. And third, CBDCs may offer users additional features, such as interest-bearing accounts and real-time settlement.

A cautious approach to implementing CBDCs

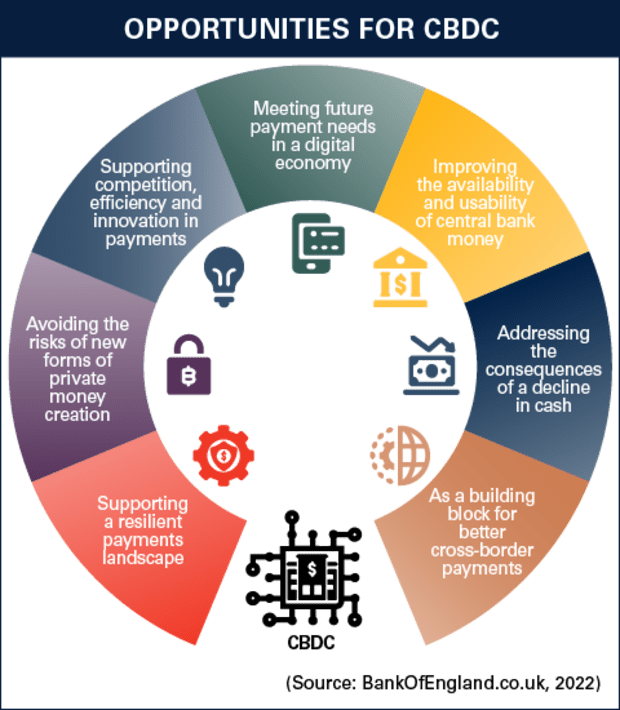

More governments worldwide have concluded that to retain control of their monetary system in an increasingly digital economy, they must design and implement their own digital payment networks with their own digital currency.

However, central banks, mindful of the deep, far-reaching impact CBDCs will have on monetary policy, central banking operations, payment systems, financial stability, and regulation, have approached CBDCs with caution (Adrian & Mancini-Griffoli, 2019).

As Jesse McWaters, Senior Vice President and the Global Head of Regulatory Affairs at Mastercard, explains in Oxford’s Fintech Programme, leaders considering CBDCs must carefully ask themselves the following questions:

- Is a CBDC the right fit for our payment environment and for our preferred policy goals?

- What is the role of the private sector going to be, and how can we leverage competition to drive innovation and efficiency?

- How will the CBDC interoperate seamlessly with other privately provided value stores and payment mechanisms?

- Finally, how will ensure that we keep the CBDC infrastructure and the individuals using it secure and protected?

Case example: the e-CNY CBDC

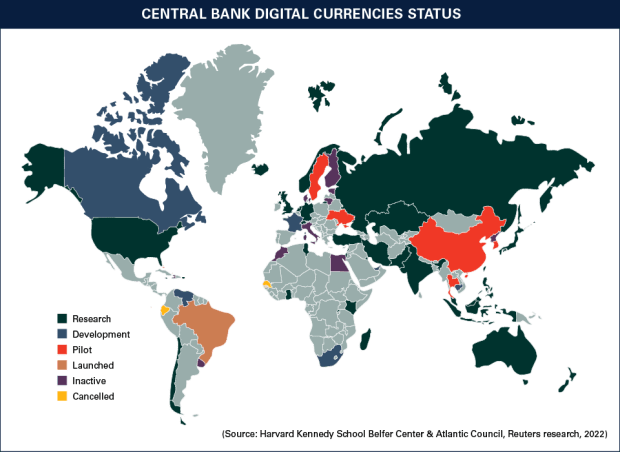

One of the most watched CBDC experiments has been taking place in China, where a digital Yuan (e-CNY) has been in development since at least 2014. The e-CNY is a digital fiat currency issued and maintained by the PBOC but largely operated by authorised banks and institutions (PBOC, 2021).

In recent years, China has conducted advanced pilot studies of the new currency by giving away millions of e-CNY in localised lotteries. Winners were then allowed to download their e-money on an app and spend it at select merchants. During the 2022 Winter Olympics in Beijing, the new digital currency was used to make at least US $315,761 in payments per day by international visitors and Chinese nationals alike (Reuters, 2022).

Increasing pressure to regulate CBDCs

Traditionally, policymakers have been much less focused on drafting specific CBDC regulations (or even proposing regulation), and much more focused on fostering cooperation between countries as central banks analyse and debate how and when to implement CBDCs, what design CBDCs should take, and how CBDCs would eventually encompass cross-border payments.

But several events have sharpened the need to regulate these digital currencies. Before Covid-19 struck, interest in CBDCs was already on the rise, driven first by the rise of cryptocurrencies. In 2019, according to the IMF, the spectre of Facebook’s proposed stablecoin, Libra, and reports that China would launch a digital yuan spooked central banks (Adrian & Mancini-Griffoli, 2019).

Global efforts to regulate CBDCs

In early October 2020, the Bank for International Settlement (BIS), the European Central Bank, and banks from regions including Canada, Japan, Sweden, Switzerland, England, and the US released a report outlining key principles and core features for CBDCs.

Although the international group did not take a position on whether a country should issue a CBDC or how a country should design CBDCs, stating that these were “sovereign decisions to be made by each jurisdiction” (BIS, 2020), the report included three broad guidelines (BIS, 2020).

- Central banks should not compromise monetary or financial stability.

- CBDCs need to coexist with and complement existing forms of money.

- CBDCs should promote innovation and efficiency.

The implications of CBDCs for financial professionals

CBDCs have the potential to revolutionize the way central banks think about money and banking, enabling new levels of financial inclusion, efficiency, and security. Want to learn more about how regulations are shaping and supporting central bank digital currencies? Join Oxford’s Fintech Programme, designed to upskill and accelerate your career in financial technologies.