Then Robillard glimpsed a sign hanging on one of the doors along the corridor: “Struggling to lose weight? You don’t have to do it alone.” Inside, she found a somewhat grim clinic of aged vinyl chairs and wall-to-wall beige that didn’t much look like the birthplace of a wonder drug. But she also learnt that more and more scientists believe obesity is a disease rather than simply resulting from unhealthy habits and that, for the seriously overweight, lifestyle changes will never be entirely effective. Eventually, she joined a trial the clinic was running for a new drug called Wegovy. “I wish I had known sooner that it wasn’t just a lack of willpower,” says Robillard, who is now 55. “The many dollars spent on going to weight-loss [meetings], the years of beating myself up, the years of self-hate. I wish I had known that it wasn’t my fault.”

Wegovy, made by Danish drugmaker Novo Nordisk, is the first in what is shaping up to be a new generation of obesity treatments, which use a hormone to regulate appetite. (The name is the result of a nebulous bureaucratic process involving pharmaceutical regulators and the company’s marketers.) The average patient in the study in which Robillard participated lost 15 per cent of their body weight, about three times more than on previous drugs. Nearly a third of them lost almost as much as they would after weight-loss surgery. Robillard lost 57 pounds. The US Food and Drug Administration approved Wegovy for general use in June 2021.

Wegovy arrived on the market amid a global obesity crisis. Almost half of Americans are expected to be obese by 2030, a Harvard study found, and that could account for up to 18 per cent of healthcare spending on related conditions, ranging from heart disease and stroke to osteoarthritis. Worldwide obesity rates have tripled since 1975, with 650 million adults obese in 2016, according to the World Health Organization. In 2019, the OECD declared that developed countries’ plans to tackle the problem were largely failing. And the Covid-19 pandemic only underscored that obesity puts people at greater risk for infectious disease.

Despite the vast need, many major pharmaceutical companies have held back from developing weight-loss drugs, in part because the category is marred by a long history of quackery and safety scares. From the 1930s to the 1960s, the industry poured money into diet pills based on amphetamines. These eventually fell out of favour because they were highly addictive and had harmful side effects. In the 1990s, fen-phen — a combination of fenfluramine and phentermine — became so popular that weight-loss clinics sprung up across the US just to prescribe it, even though some patients on the drug experienced manic episodes. It was later taken off the market after a study showed up to a third of patients could suffer from heart valve defects. As recently as 2020, US regulators forced the withdrawal of weight-loss drug Belviq because of concerns it increased the risk of cancer. For the most desperate, surgery has become popular, though it is expensive and comes with its own risks and restrictions.

Perhaps unsurprisingly, Wegovy — a weekly injection patients self-administer using a small device that looks a bit like an EpiPen — has plenty of fans. Patients like Robillard, for one. While her day job is still working for a union, she now works part-time as a Novo Nordisk spokesperson, giving motivational speeches to staff. Unpaid celebrity endorsements include venture capitalist Marc Andreessen, who says the drug completely changed his relationship with food, and Elon Musk, who has cited it on Twitter. Novo Nordisk recently more than doubled its sales targets for obesity drugs to $3.7bn by 2025. Its share price has risen 26 per cent in the past year. But before the company can make Wegovy mainstream, it has to convince doctors to prescribe it and insurers and governments to pay for it. It has to persuade patients to sign up for some heinous side effects. And then there’s the small matter of overturning centuries of, as it turns out inaccurate, assumptions embedded in the Latin root of the word obesity: “having eaten until fat”.

Since the second half of the 20th century, the wealthy have tended to stay thin, a benefit of having access to medical care, healthy food and free time to exercise. But for most of human history, scarcity reigned, and the rich flaunted their fat. Corporal excess was proof of a bountiful table and perhaps even genes that would protect offspring in times of famine.

But the story of obesity has always been complicated. The toll it takes was clear to the ancient Greeks, Hippocrates noting that “corpulence is not only a disease itself, but the harbinger of others”. Then Christianity came along and yoked appetite to deadly sins such as gluttony and sloth. In Dante’s inferno, the souls of food addicts are punished by icy rain, representing the damage their overindulgence does to themselves and others.

Novo Nordisk scientists have viewed obesity as a disease for 25 years. It is an unusual pharmaceutical company. Based just outside Copenhagen and almost a century old, it is controlled and part-owned by a charitable foundation that invests in scientific research, start-ups and humanitarian projects. The world’s 17th largest pharmaceutical company by revenue, it generated sales of about $20bn last year.

The company’s staff likes to say Novo Nordisk was born from a love story, because its founder sought out insulin for his diabetic wife, bringing it back to Denmark for her from Canada before building his business. So its scientists paid attention in 1987 when three separate teams of academic researchers — in Copenhagen, Boston and London — simultaneously discovered the effect of a hormone known as GLP-1 on insulin. When we eat, cells in the small intestine secrete GLP-1, causing the release of insulin, which in turn tempers fluctuations in blood sugar levels.

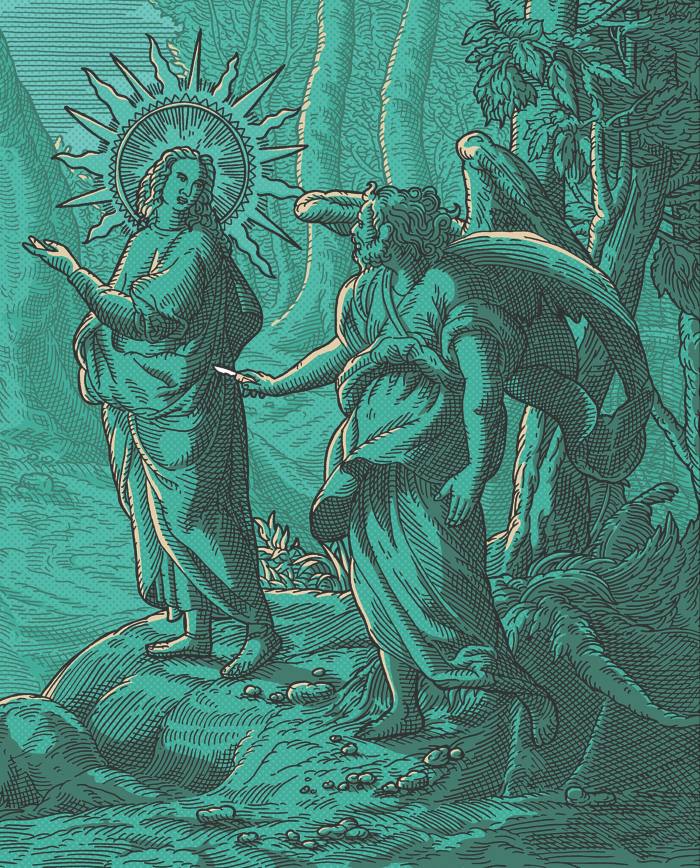

Back then, scientists thought the hormone held promise helping diabetics restore normal insulin production. While experimenting with how to create a new GLP-1-based drug in the 1990s, Novo Nordisk lab scientists noticed their mice and rats began to lose weight. The hormone’s effect on the brain, they discovered, is to reduce appetite and create a feeling of fullness. This is exactly how it worked for Robillard in 2018; she felt her mind freed from its obsession with eating.

Peter Kurtzhals is talking to me over Zoom from a conference room at the company’s Danish headquarters. A senior scientist at Novo Nordisk, he cuts the figure of a no-nonsense researcher but lights up describing why the academics who discovered the hormone should be considered for a Nobel Prize. He says GLP-1 may be the pharmaceutical equivalent of a Swiss army knife because Novo Nordisk is also testing drugs based on the hormone to treat kidney disease, an increasingly prevalent liver condition known as NASH, even Alzheimer’s. “It’s kind of amazing, philosophically, that we have a natural hormone that can be pharmacologically used in such a variety of conditions,” he says.

This natural hormone has a flaw: it is so unstable that it lasts mere minutes in the body. In 2005, one San Diego biotech company marketed a drug based on a similar hormone produced in the venom of Gila monster lizards because it lasted for several hours, rather than minutes. Novo Nordisk’s scientists laboured for years to create a stable version of GLP-1 that could be used as medication.

Testing their potential drugs in animals proved troublesome: a dose that kept a pig satiated might not work in a human, and it proved especially difficult to track important side effects. “It’s hard to ask the dog or the pig whether they feel nauseated,” Kurtzhals says.

In 2009, Novo Nordisk won approval for its first GLP-1-based treatment, a daily drug called Saxenda. But the 5 per cent weight loss it offered patients wasn’t enough to make it a blockbuster. The company’s scientists searched through hundreds of potential drugs until they hit upon semaglutide, christened with the brand name Wegovy when it was approved in the US last year.

Wegovy is very similar to Saxenda. Both are 90 per cent the same as naturally occurring GLP-1, but because of its different chemical side chain, Wegovy can be taken weekly. (The company does not know exactly why it proved so much more effective, but animal studies suggest it is distributed differently in the brain.) When an early Wegovy trial showed the drug’s power, Kurtzhals says it felt “too good to be true”. Then a late-stage trial confirmed the stunning weight loss, and the team celebrated. “They felt like they had won an Olympic medal,” he says.

Meanwhile there is one cardinal mystery about obesity for scientists to solve. Until they do, patients will be on the drug for life. Experts increasingly agree that the tug of war over her weight that Robillard described to her doctor in Virginia is a literal thing for many people. Once it becomes obese, the human body tends to push itself to rebound to its previous highest weight. Scientists don’t fully understand why, or how to stop it. Many speculate that our brains have not adjusted to living in a time of plenty. “There’s been a selection bias towards those people who could better protect body weight during times of famine,” Kurtzhals says. “But now we don’t have a shortage of food.”

When a patient stops taking Wegovy, their appetite returns within weeks and they pack on weight. In the study run by Robillard’s doctor, Domenica Rubino, the patients who came off the drug regained 7 per cent of their body weight. “We used to think that behaviour causes the weight state, but now we think the weight state actually causes the behaviour,” Rubino says. There may be even worse side effects of coming off the drug. Less than a week after Robillard stopped taking it at the end of the trial in November 2019, she started having panic attacks. “Every circuit started thinking about the cravings,” she says. She regained 20 pounds.

Novo Nordisk’s long-term ambition is to cure obesity by discovering how to stop the body bouncing back. Until then, Kurtzhals believes people should think of treating obesity as they do other chronic diseases. “For some reason, many people have an easier time understanding that your blood pressure medication is for life than understanding that your treatment of obesity is also for life,” he says. Part of that reason may be the price tag. Unlike generic blood pressure drugs that now cost $10 a month, Wegovy’s monthly list price in the US is about $1,350.

Many patients know, intuitively, that obesity is a disease, and some were primed for Wegovy’s US approval. Within a week, Kimberley Shoaf, a public health professor at the University of Utah, visited her doctor and discovered she wasn’t the clinic’s first patient to request Wegovy. Scared of the surgery that she saw as the only alternative, she pushed to get a prescription. In the past 11 months, she has lost 70 pounds, more than 20 per cent of her weight, and is still shedding half a pound a week. She can walk for longer, her blood pressure has dropped, and she hopes to soon have the words “pre-diabetic” erased from her medical records. “In spite of turning 60, I feel younger,” she says.

These results are the reason she’s willing to put up with Wegovy’s significant side effects. At first, she threw up every week after taking the injection. Now she suffers constipation. Similar side effects were reported in the trial and on drugs.com, where patients universally praise the resulting weight loss but frequently complain of a constant “morning sickness”. The drug also comes with a warning it could increase the risk of thyroid cancer, though so far that has only been found to be the case in lab animals.

While it is starting with well-informed patients like Shoaf and Andreessen, Novo Nordisk’s next challenge is to convert obese people who never seek treatment. Which is where Queen Latifah comes in. The drugmaker is paying the actor to lead an unbranded campaign called “It’s Bigger Than Me”. In online videos, Latifah plays an emergency room doctor lecturing as an overweight patient is wheeled in suffering from “stigma”, for example. She never explicitly says the drug’s name. At live events with experts in New York, Los Angeles and Houston, Novo Nordisk hopes Latifah succeeded in stirring up demand. A famous black woman, the company hopes, will appeal to the four out of five African American females who are obese.

When we speak over video call, Latifah, who wears a dark blue wrap dress, is poised. “It’s not just about image,” she says. “It’s about science. It’s about genetics. It’s about hormones.” She says she didn’t even understand that she had a weight problem until she asked a personal trainer to help her drop 25 pounds for her role in the 2003 comedy Bringing Down the House. Latifah describes having her measurements taken: “She literally walked me through my butt. She was like, ‘You are obese.’ I had never heard that term apply to me,” the actor says. “So then we started a plan, and it worked.”

When I ask what the plan was, she says diet and exercise, adding “I’ve never really been one for the medical . . . the medicine side of this.” She stops herself, perhaps realising this might not go down well with the PR reps sitting silently on the call. “Well, let me just put it this way . . . I saw people go crazy on a fen-phen bender like I’ve never seen in my life.” Latifah may have inadvertently hit on Wegovy’s biggest obstacle: the deeply entrenched stigma around treating weight problems medically.

This challenge falls, in part, to Vince Lamanna, Novo Nordisk’s newly appointed US sales leader and a walking advertisement for Wegovy. His sleek grey and blue check suit looks like it would not have fit him before he lost 30 pounds, 15 per cent of his body weight, on the drug. Playing with the empty injection pen that he carries to show how easy Wegovy is to self-administer, he says it is “really tough” to sell. “We are still the only company doing it, doing it alone,” he continues.

Doug Langa, an executive vice-president at Novo, has spent 30 years selling drugs for almost every disease. Yet he has never encountered a task like this: a disease for which only one in 10 Americans seek treatment. And when they do, they struggle to find a doctor who will listen. “This is far and away the most challenging, without question,” he says.

Novo Nordisk put “feet on the street” within 72 hours of Wegovy’s approval, sending what it calls “educators” into doctors’ offices around the US. Lamanna anticipates it could take two to three years to change the minds of primary care physicians. Endocrinologists and weight management specialists tend to understand that dieting can’t always compete with the body’s drive to bounce back to a heavier weight. Almost 10 years have passed since the American Medical Association first declared obesity a disease, yet the average doctor barely spent any time learning about it at medical school. “The biggest misconception is that it’s calories in and calories out. So, how much you exercise and how much you eat,” Lamanna explains. Rubino, the doctor who ran the Wegovy trial in Virginia, adds that primary care doctors rarely understand the roles played by nutrition and hormonal regulation, and that that vacuum is filled with society’s stigma against obese people.

While sending sales representatives to doctors is normal practice in American medicine, undertaking a complete re-education is reminiscent of how opioid makers tried to reclass pain as a “fifth vital sign” so that clinicians felt they had to treat it with a drug. Rubino, who was paid by Novo Nordisk to run the trial, accepts people might think the company’s education programme is self-serving. “But, so far, I think people are trying to be very careful about their role,” she says.

Lamanna’s team is unlikely to stay alone in its mission to spread the word. Novo Nordisk’s longtime rival in diabetes treatment, Eli Lilly, recently published what look like even better topline results for its obesity drug, Tirzepatide. Nearly two-thirds of participants trialling its GLP-1-based treatment lost 20 per cent of their body weight. Pfizer, too, is working on a treatment based on the hormone. AstraZeneca and its partner Regeneron, as well as start-ups Versanis and Gelesis are taking different scientific approaches to the same problem. All of them are hoping to break into — and expand — the market for obesity medicines, such as Wegovy. If they succeed, there will be far more pharmaceutical preachers to convert the millions to medical treatment.

Even if Novo Nordisk can win doctors over, it faces a greater challenge to convince reluctant payers. Some 80 million obese Americans do not have insurers who will pay for Wegovy. While it is on most insurers’ lists of officially covered drugs, it is often in a lifestyle category, alongside treatments for issues such as erectile dysfunction. Payers also put up hurdles so patients must obtain permission before filling a prescription. One Maryland pharmacist told me she had seen many prescriptions for Wegovy, none of which had ever come back after being sent for authorisation.

Rubino says she becomes exasperated ploughing through appeal forms for patients who she believes should be exceptions, such as one whose bipolar medication caused weight gain. She says she once spent two hours on the phone trying to get the correct case ID and fax number to send along one appeal. Frequently, appeals are ignored or rejected without reason, she adds.

“It’s a system that’s been put in place to basically prevent you from being persistent. And I’ll do it for my patients. But it takes a tremendous amount of time,” she says. Rubino believes insurance companies also stigmatise obesity. “For the longest time, the explanation of why it wasn’t covered was there wasn’t sufficient weight loss,” she says. “Now, I don’t know what the excuse is.”

Major US insurers Aetna, UnitedHealthcare and Cigna did not respond to requests for comment on coverage decisions. James Gelfand, who leads public affairs at the Erisa Industry Committee, which represents US employers that sponsor health plans, says previous obesity drugs were so ineffective it was a “no brainer” to refuse coverage. Currently about half of all US employers have opted to put Wegovy on their list of covered drugs. But they may still restrict it to certain groups of patients or make those who qualify jump over other hurdles.

Wegovy might be different, but he suspects employers will wait to collect more data and then, perhaps, begin with those most in need. If drugmakers really want it covered, Gelfand suggests they could cut prices. “Drug companies do a delicate dance attempting to extract as much money as they possibly can from third-party payers, knowing an individual patient will never have means to be able to afford the drug,” he says.

Novo Nordisk also has to win over Congress to get Medicare, the US’s publicly funded health insurance for seniors, to cover obesity drugs. For 10 years, legislators have proposed removing the ban that stops Medicare from paying for obesity treatments, but it is not clear if the political will to do so exists. The Danish drugmaker might particularly struggle to win politicians’ votes after insulin, one of its biggest products, became the “poster child” for rising drug prices, according to Novo Nordisk’s Langa.

A congressional committee accused the company this year of jacking up the price of insulin 28 times since 2001, resulting in a 628 per cent price increase. Novo Nordisk argues that its net price has actually fallen and that the increases are going to middlemen and insurers. Langa half-jokes that if you want to see him really stressed, watch a video of him testifying in Congress.

The prospect of losing coverage after the age of 65 worries patients who know the weight could pile right back on. Gwendolyn, a 66-year-old musician, lost 80 pounds in Eli Lilly’s drug trial. She says she used to be a “walking heart attack”, whose problems were exacerbated when she developed long Covid. Now she feels like she could work for many more years. But if Medicare won’t pay, she’ll have to find the money or would even consider cycling on and off the drug to save costs.

Eli Lilly has not yet announced the price of its obesity drug, though it will probably be in the same ballpark as Wegovy. Gwendolyn describes it as “very scary” that the medicine could cost so much, though she has some sympathy that drugmakers want their money back from trials that cost a “fortune”. “But when you realise the sheer numbers of people that would take this, I would think that they could make money by scale,” she says. “I feel like what this is going to be is more like a designer drug that wealthy people will take to help reduce their weight . . . that’s kind of sad.”

In the UK, the NHS has a vested interest in tackling obesity, saving on future associated medical costs. About 28 per cent of adults in England were obese in 2019, almost double the rate in 1993 and one of the worst in Europe. In February, the UK’s National Institute for Health and Care Excellence issued preliminary guidance advising that Wegovy can be given to the most overweight patients, with at least one obesity-related condition, alongside a diet and exercise plan, but only for two years.

Production-related supply problems mean it is not yet available. When it is, UK patients will get it for the prescription cost of £9.35 per item. When there are more doses available, Novo Nordisk will expand promotion across Europe, where some health authorities including those in Ireland, the Netherlands and Switzerland already cover the cost of Saxenda.

Even if Novo Nordisk and its competitors succeed in getting their drug accepted by the people who hold the purse strings, they will still face opponents who reject the whole premise that obesity should be treated with medicine. Advocates of “body positivity” and some weight management experts believe health metrics such as blood pressure or blood sugar are far more useful than body mass index. The company is hoping to sway doubters with a trial, which reports later this year, that will show whether Wegovy reduces the risk of cardiac problems.

Marquisele Mercedes, a doctoral student in public health at Brown University, is fed up hearing that Wegovy is a “miracle”. She warns the drug could actually encourage “weight cycling”, which is “incredibly dangerous”. Studies show that losing and regaining weight could increase the risk of conditions such as diabetes. “All of the things we attribute to fatness, like cardiovascular risk, diabetes, depression, anxiety . . . have actually been found to be related to weight cycling,” she explains.

Some critics fear that Novo Nordisk will be too successful in converting doctors. Clinicians often find drugs — such as overprescribed antidepressants — are a convenient crutch when they lack the time or skill to dig into the complex roots of a problem. Krista Varady, a professor of nutrition at the University of Illinois, recounts her “eye-opening” experience at a conference of diabetes specialists who have used GLP-1 for years. Some said they immediately put 95 per cent of patients on the drug, without waiting to see if diet or exercise would work. “I was shocked,” she says. “But our system is designed to treat the sick, not to do prevention.”

Varady worries that it will be easier to medicate a world that she describes as “obesogenic” — tending to cause obesity. Wegovy could become a societal sticking plaster, allowing food companies to continue selling junk and pharma companies to profit from slimming people down. She believes it would be more “humane” if governments found ways “to teach people or tax them”, such as the UK levy on sugary drinks.

Mercedes believes Novo Nordisk’s efforts to counter stigma — the Queen Latifah campaign — could actually end up embedding existing bias. “They’re selling you a solution to the discrimination and stigma you face by giving you a way to be smaller,” she says. It is “literally just advertising. We’re transitioning from the personal failure, lacking willpower, lacking self-control narrative, to this narrative that says ‘Obesity is a disease, you need a prescribed cure’ . . . so we can sell weight-loss medication,” she says. “They are going to make a killing.”

Novo Nordisk does not believe there is a binary choice between offering drugs and changing society. Propelled by the potential for huge profits, it may be more successful than the patchy and poorly funded efforts to address the underlying conditions that exacerbate obesity, including mental health, poverty and lack of access to fresh food. The company’s scientists are working on improved versions of Wegovy — including a pill — and combinations they hope could help people lose even more weight.

Lisa Robillard feels she is one of the lucky ones. Her insurance covers Wegovy, so it only costs her $40 a month. When the drug was approved, she had to go to four or five pharmacies to find it, but now has a reliable supply. Her knees and ankles don’t hurt, she’s stopped snoring, and she has more energy. She says she has no problem taking the drug forever. Yet she resents people who think it is a quick fix. She says she has to continue watching what she eats and exercising. “It’s not like you take the drug, and then you can eat pie and cookies all day.”

Hannah Kuchler is the FT’s global pharmaceuticals correspondent