Stitch Fix (NASDAQ:SFIX) will release its quarterly earnings report on Tuesday, 2024-12-10. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Stitch Fix to report an earnings per share (EPS) of $-0.14.

The announcement from Stitch Fix is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

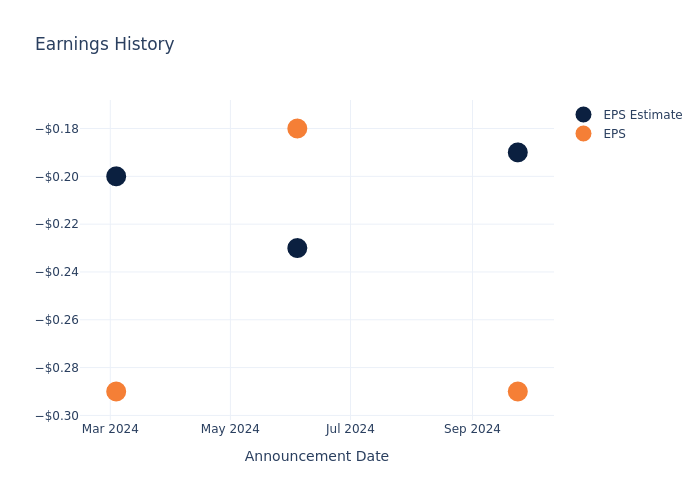

Performance in Previous Earnings

The company's EPS missed by $0.10 in the last quarter, leading to a 39.47% drop in the share price on the following day.

Here's a look at Stitch Fix's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.19 | -0.23 | -0.20 | -0.23 |

| EPS Actual | -0.29 | -0.18 | -0.29 | -0.30 |

| Price Change % | -39.0% | 28.999999999999996% | -21.0% | -3.0% |

Tracking Stitch Fix's Stock Performance

Shares of Stitch Fix were trading at $4.63 as of December 06. Over the last 52-week period, shares are up 14.32%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on Stitch Fix

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Stitch Fix.

Stitch Fix has received a total of 7 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $4.04, the consensus suggests a potential 12.74% downside.

Analyzing Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of and Stitch Fix, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

Key Findings: Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for and Stitch Fix, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Stitch Fix | Neutral | -12.39% | $142.48M | -18.44% |

Key Takeaway:

Stitch Fix ranks at the bottom for Revenue Growth, with a decrease of 12.39%. It also ranks at the bottom for Gross Profit, with a decline of 18.44%. Additionally, it ranks at the bottom for Return on Equity. Overall, Stitch Fix is positioned at the bottom compared to its peers across all metrics analyzed.

Discovering Stitch Fix: A Closer Look

Stitch Fix Inc offers personal style services for men and women. The company engages in delivering one-to-one personalization to clients through the combination of data science and human judgment. It provides a shipment service called A FIX where the stylist's hand selects items from several merchandise with analysis of client and merchandise data to provide a personalized shipment of apparel, shoes, and accessories suited to the client's needs. The company offers products across categories, brands, product types, and price points including Women's, Petite, Maternity, Men's, and Plus. It also offers various product types, including denim, dresses, blouses, skirts, shoes, jewelry, and handbags and sells merchandise across various ranges of price points.

Stitch Fix: Financial Performance Dissected

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Stitch Fix's financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -12.39% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Stitch Fix's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -11.42%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -18.44%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Stitch Fix's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -7.13%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.63, Stitch Fix adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Stitch Fix visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.