Build-A-Bear Workshop (NYSE:BBW) is preparing to release its quarterly earnings on Thursday, 2024-12-05. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Build-A-Bear Workshop to report an earnings per share (EPS) of $0.65.

Anticipation surrounds Build-A-Bear Workshop's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

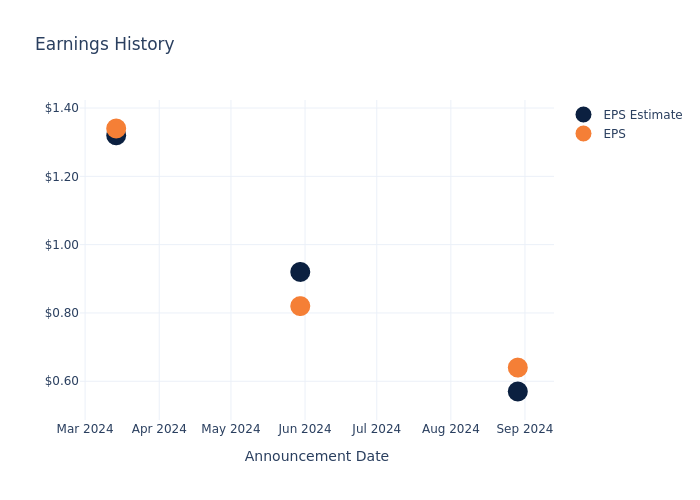

Overview of Past Earnings

The company's EPS beat by $0.07 in the last quarter, leading to a 3.47% increase in the share price on the following day.

Here's a look at Build-A-Bear Workshop's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.57 | 0.92 | 1.32 | 0.51 |

| EPS Actual | 0.64 | 0.82 | 1.34 | 0.53 |

| Price Change % | 3.0% | -2.0% | 3.0% | 4.0% |

Stock Performance

Shares of Build-A-Bear Workshop were trading at $38.14 as of December 03. Over the last 52-week period, shares are up 63.25%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Build-A-Bear Workshop

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Build-A-Bear Workshop.

A total of 5 analyst ratings have been received for Build-A-Bear Workshop, with the consensus rating being Buy. The average one-year price target stands at $41.0, suggesting a potential 7.5% upside.

Analyzing Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of 1-800-Flowers.com, BARK and MarineMax, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for 1-800-Flowers.com, with an average 1-year price target of $7.5, suggesting a potential 80.34% downside.

- The consensus among analysts is an Neutral trajectory for BARK, with an average 1-year price target of $2.5, indicating a potential 93.45% downside.

- MarineMax received a Buy consensus from analysts, with an average 1-year price target of $42.0, implying a potential 10.12% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for 1-800-Flowers.com, BARK and MarineMax, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Build-A-Bear Workshop | Buy | 2.36% | $60.57M | 6.91% |

| 1-800-Flowers.com | Neutral | -10.02% | $92.32M | -7.60% |

| BARK | Neutral | 2.50% | $76.11M | -4.18% |

| MarineMax | Buy | -5.29% | $193.19M | 0.41% |

Key Takeaway:

Build-A-Bear Workshop ranks at the bottom for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity. The company with the highest Revenue Growth has a Buy consensus, while the one with the highest Gross Profit has a Neutral consensus. The company with the highest Return on Equity also has a Buy consensus.

Unveiling the Story Behind Build-A-Bear Workshop

Build-A-Bear Workshop Inc is a U.S.-based specialty retailer of customized stuffed animals and related products. The company operates through three segments. Its Direct-to-consumer segment with key revenue, includes the operating activities of corporately-managed locations and other retail delivery operations in the U.S., Canada, China, Denmark, Ireland, and the U.K., including the company's e-commerce sites and temporary stores. The international franchising segment includes the licensing activities of the company's franchise agreements with store locations in Europe, Asia, Australia, the Middle East, and Africa. The commercial segment includes the transactions with other businesses, mainly comprised of licensing the intellectual properties for third-party use and wholesale activities.

Build-A-Bear Workshop's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Build-A-Bear Workshop's revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 2.36%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Build-A-Bear Workshop's net margin excels beyond industry benchmarks, reaching 7.85%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Build-A-Bear Workshop's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.91% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.22%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.81.

To track all earnings releases for Build-A-Bear Workshop visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.