In the latest quarter, 32 analysts provided ratings for ServiceNow (NYSE:NOW), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 12 | 18 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 9 | 16 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

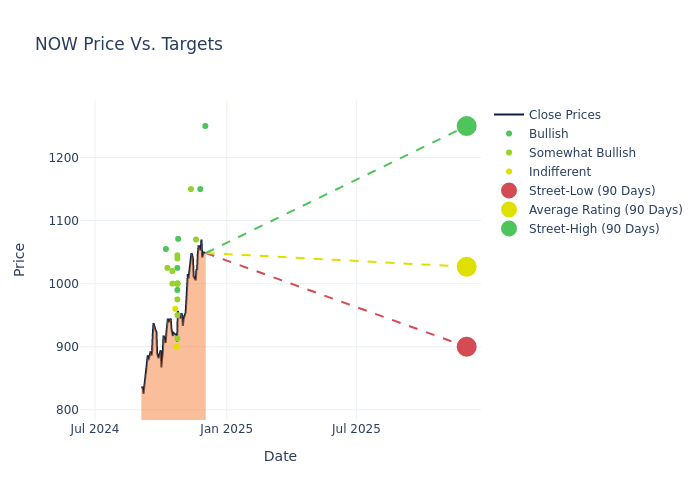

The 12-month price targets, analyzed by analysts, offer insights with an average target of $1022.41, a high estimate of $1250.00, and a low estimate of $900.00. Marking an increase of 10.48%, the current average surpasses the previous average price target of $925.44.

Exploring Analyst Ratings: An In-Depth Overview

The analysis of recent analyst actions sheds light on the perception of ServiceNow by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Samad Samana | Jefferies | Raises | Buy | $1250.00 | $1100.00 |

| Mike Cikos | Needham | Raises | Buy | $1150.00 | $1075.00 |

| Gregg Moskowitz | Mizuho | Raises | Outperform | $1070.00 | $980.00 |

| Michael Turrin | Wells Fargo | Raises | Overweight | $1150.00 | $1050.00 |

| Tyler Radke | Citigroup | Raises | Buy | $1071.00 | $1068.00 |

| Peter Weed | Bernstein | Raises | Outperform | $913.00 | $906.00 |

| Matthew Hedberg | RBC Capital | Raises | Outperform | $1045.00 | $985.00 |

| Derrick Wood | TD Cowen | Raises | Buy | $1025.00 | $1000.00 |

| Brad Reback | Stifel | Raises | Buy | $990.00 | $900.00 |

| Jason Ader | Keybanc | Raises | Overweight | $1040.00 | $1020.00 |

| Kirk Materne | Evercore ISI Group | Raises | Outperform | $1000.00 | $950.00 |

| Michael Turrin | Wells Fargo | Raises | Overweight | $1050.00 | $1025.00 |

| Rob Owens | Piper Sandler | Raises | Overweight | $1000.00 | $850.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $1000.00 | $980.00 |

| Mark Murphy | JP Morgan | Raises | Overweight | $950.00 | $820.00 |

| Rob Oliver | Baird | Raises | Outperform | $975.00 | $900.00 |

| David Hynes | Canaccord Genuity | Raises | Buy | $1000.00 | $850.00 |

| Mike Cikos | Needham | Raises | Buy | $1075.00 | $900.00 |

| Joel Fishbein | Truist Securities | Raises | Hold | $900.00 | $780.00 |

| Keith Weiss | Morgan Stanley | Raises | Equal-Weight | $960.00 | $900.00 |

| Derrick Wood | TD Cowen | Raises | Buy | $1000.00 | $900.00 |

| Tyler Radke | Citigroup | Raises | Buy | $1068.00 | $915.00 |

| Brian Schwartz | Oppenheimer | Raises | Outperform | $1020.00 | $825.00 |

| Gregg Moskowitz | Mizuho | Raises | Outperform | $980.00 | $850.00 |

| Patrick Walravens | JMP Securities | Raises | Market Outperform | $1000.00 | $850.00 |

| Samad Samana | Jefferies | Raises | Buy | $1100.00 | $900.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $980.00 | $890.00 |

| Keith Bachman | BMO Capital | Raises | Outperform | $1025.00 | $860.00 |

| Kirk Materne | Evercore ISI Group | Raises | Outperform | $950.00 | $850.00 |

| Karl Keirstead | UBS | Raises | Buy | $1055.00 | $900.00 |

| Michael Turrin | Wells Fargo | Raises | Overweight | $1025.00 | $935.00 |

| Mike Cikos | Needham | Maintains | Buy | $900.00 | $900.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to ServiceNow. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of ServiceNow compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of ServiceNow's stock. This analysis reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into ServiceNow's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on ServiceNow analyst ratings.

Discovering ServiceNow: A Closer Look

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

Financial Insights: ServiceNow

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: ServiceNow's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 22.25%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: ServiceNow's net margin is impressive, surpassing industry averages. With a net margin of 15.45%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): ServiceNow's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 4.81%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): ServiceNow's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.36% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: ServiceNow's debt-to-equity ratio is below the industry average. With a ratio of 0.24, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.