Throughout the last three months, 8 analysts have evaluated Ciena (NYSE:CIEN), offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 4 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 4 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

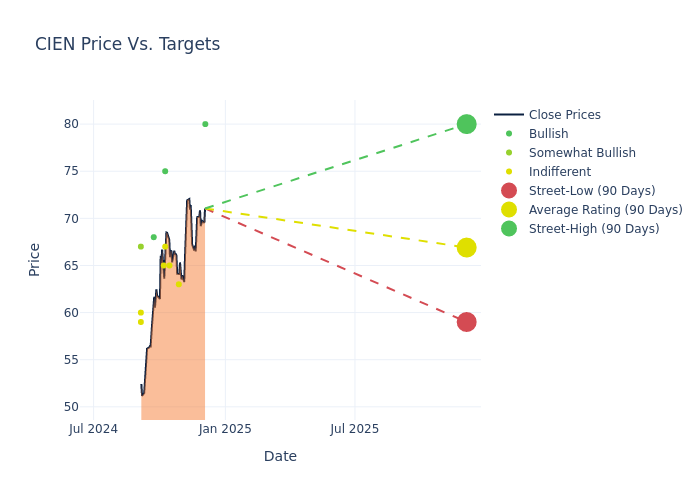

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $68.25, along with a high estimate of $80.00 and a low estimate of $63.00. Observing a 9.2% increase, the current average has risen from the previous average price target of $62.50.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Ciena. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ryan Koontz | Needham | Raises | Buy | $80.00 | $75.00 |

| Meta Marshall | Morgan Stanley | Maintains | Equal-Weight | $63.00 | $63.00 |

| Amit Daryanani | Evercore ISI Group | Maintains | In-Line | $65.00 | $65.00 |

| Karl Ackerman | Exane BNP Paribas | Announces | Neutral | $67.00 | - |

| Ruben Roy | Stifel | Raises | Buy | $75.00 | $68.00 |

| Meta Marshall | Morgan Stanley | Raises | Overweight | $63.00 | $60.00 |

| Samik Chatterjee | JP Morgan | Announces | Neutral | $65.00 | - |

| Jim Suva | Citigroup | Raises | Buy | $68.00 | $44.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ciena. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ciena compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Ciena's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Ciena's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Ciena analyst ratings.

About Ciena

Ciena Corp is a network and technology company. It provides network hardware, software, and services that support the transport, switching, aggregation, service delivery, and management of video, data, and voice traffic on communications networks. It serves various industries such as communication services providers, web-scale providers, cable operators, government, and large enterprises world-wide. The business activities function through Networking Platforms; Platform Software and Services; Blue Planet Automation Software, and Global Services segments. Geographically, its presence is seen in the markets of the United States, Canada, the Caribbean, Latin America, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India. The maximum revenue is generated from Americas.

Understanding the Numbers: Ciena's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Ciena's financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -11.76% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Ciena's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 1.51%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ciena's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 0.49%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Ciena's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.25%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Ciena's debt-to-equity ratio is below the industry average. With a ratio of 0.55, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.