The concept that retirees should pay off their mortgage stems from a combination of historical economic conditions, cultural values surrounding homeownership and debt, and financial planning principles aimed at ensuring security and peace of mind in retirement. This idea has been passed down through generations, although individual circumstances today may lead to different approaches.

Nearly 40% of retirees, for instance, have a mortgage. And the average mortgage balance is over $100,000, which translates to average annual mortgage payments of $10,000 that will last at least 12 years or more.

That doesn’t mean retirement plans are doomed to fail if they include a mortgage. Rather, we think that in designing your plan for retirement, you ought to consider the equity in your home, and then decide whether a mortgage, either existing or new, belongs in your plan.

No differences between mortgages for Millennials and Boomers

The market for cars, clothes and restaurants is different for the Millennial generation vs Baby Boomers.

However, that’s not the case for mortgages. It’s the same product whether you are age 30 or 60. Why should that be the case for a financial vehicle when at age 30 you’re concerned about mortality and paying off the mortgage if you pass away early but at 60 you’re concerned about longevity and making mortgage payments into your 80s and beyond?

Let’s work through an example for a Boomer.

A Boomer with a mortgage

Mary, the 70-year-old cousin of Sally, the consumer we often refer to as our sample investor, is also 70 and has a $150,000 mortgage (against a home worth $1 million) and mortgage payments of nearly $13,000 a year for the next 15 years until the mortgage is paid off. She’s generating $100,000 in income from her retirement savings and $25,000 in Social Security benefits, but that $13,000 mortgage payment represents more than 10% of her income. Compounding this issue is her desire to age in place like 75% of aspiring and current retirees.

Her options regarding her mortgage

Like lots of retirees, she’s always considering her options when it comes to housing and finances. Here are the options she’s considering:

- Continue as is and cut back spending other than on the mortgage. But unless absolutely necessary, she wants to be able to spend at her budgeted amount, which includes trips to see the grandkids and other small luxuries.

- Sell the house and downsize. She’s moved a few times in her life and hated it. Plus, she loves the house she’s in, along with the neighborhood.

- Pay off the mortgage by taking $150,000 from retirement savings. That would remove the $13,000 in yearly mortgage payments, but also reduce her annual income from savings by $7,500 to $9,000 in her Go2Income plan. Is the net gain, and the reduction in savings and liquidity, worth it?

- Replace her existing forward mortgage with a home equity conversion mortgage (HECM). Also known as a reverse mortgage, a HECM would eliminate her monthly mortgage payments, but over time see her legacy fall.

- Refinance her forward mortgage with HomeEquity2Income (H2I). Under H2I, she generates more income and does a better job of maintaining her legacy.

Her choice

The approach we’ll focus on here is to refinance a forward mortgage as part of an H2I plan. There are a couple of steps involved, but if you follow the HomeEquity2Income plan I’ve written about recently, including in my article Transform Your Retirement Plan With This Powerful Combo, you will see that the reasons a Boomer might order an H2I-Refi plan include:

- Eliminating mortgage payments for the term of the current mortgage

- Generating additional current and lifetime cash flow

- Creating additional liquidity for unplanned expenses

- Delivering a reasonable amount of legacy from the value of a home

Mary originally liked the idea of continuing her mortgage payments to eliminate the mortgage at 85 and leave the house unencumbered at her passing. That plan is OK and fits the conventional wisdom about paying off the mortgage.

Mary is one, however, who could use additional cash flow from eliminating mortgage payments — and then some — to maintain her home and have funds to pay for caregivers she might bring into the house.

High-level results from H2I

To prepare, she read my most recent H2I article, How 'Home-Based Planning' Can Address Long-Term Care Costs, but learned that for her to fund those costs, she must refinance the current mortgage. ( A recent poll conducted by University of Michigan’s Institute for Healthcare Policy and Innovation found that long-term health care costs top the list of concerns of older Americans.)

This refinancing requirement means that the $150,000 mortgage balance is paid out of the line of credit set up under the HECM component of H2I. This leaves a smaller line of credit than if there were no loan. (Paying part of the mortgage off with savings and the balance with a HECM line of credit is another option.)

While there are lots of assumptions that could be tested, the bottom-line results under H2I for her three primary objectives were:

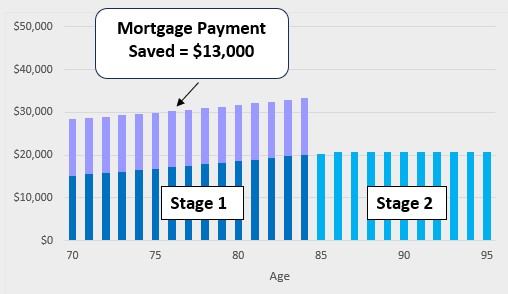

- Current cash flow changed with (a) the elimination of outflow of $13,000 per year for the term of the mortgage and (b) the addition of H2I inflow of $15,000 (and growing) per year for life. That means an extra $28,000 in cash flow over the next 15 years and thereafter $20,500 annually for life. That addition of combined cash flow can be spent on her budget, providing gifts to kids and grandkids or growing her savings and legacy.

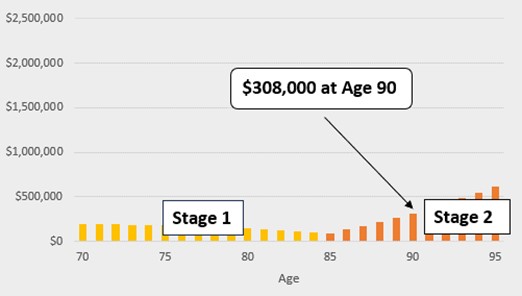

- Liquidity from moving from the existing mortgage to an H2I plan jumped from $0 to over $300,000 at 90 — not counting the potential reinvestment of the additional cash flow.

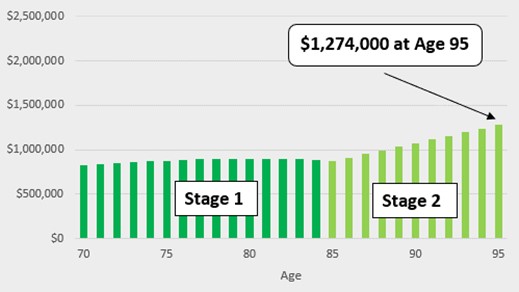

- Her legacy at 95 would be $1.3 million for H2I, and substantially more if she reinvests the additional cash flow.

Year-by-year results from H2I

The adjustments a retired mortgage holder can make with H2I, and the different applications of income, are clear in the charts below. H2I provides for more cash and liquidity and can still result in a meaningful legacy.

Cash flow

H2I, which combines HECM with a deferred income annuity called a QLAC, allows Mary to end her mortgage payments and to generate additional income for life.

Liquidity

The HECM component also provides a line of credit even after paying off the forward mortgage that can help pay for home improvements, health care costs or unplanned expenses.

Legacy

Finally, when the QLAC payments start at age 85, Mary will be able to pay interest on the line of credit, which enables her to leave a substantial legacy to her heirs.

Like most investors, Mary has a number of objectives. H2I gives her options to create the best plan to meet her personal goals.

Even for the dedicated DIY retirement planner, we don’t expect you to dig into H2I alone. Order your own Go2Income plan to learn about how to use the equity in your residence to create more retirement income and a new source of liquidity as you prepare for long-term health care and other needs.