High-rolling investors have positioned themselves bearish on Snowflake (NYSE:SNOW), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SNOW often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 16 options trades for Snowflake. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 43% bearish. Among all the options we identified, there was one put, amounting to $242,570, and 15 calls, totaling $4,976,474.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $85.0 and $210.0 for Snowflake, spanning the last three months.

Analyzing Volume & Open Interest

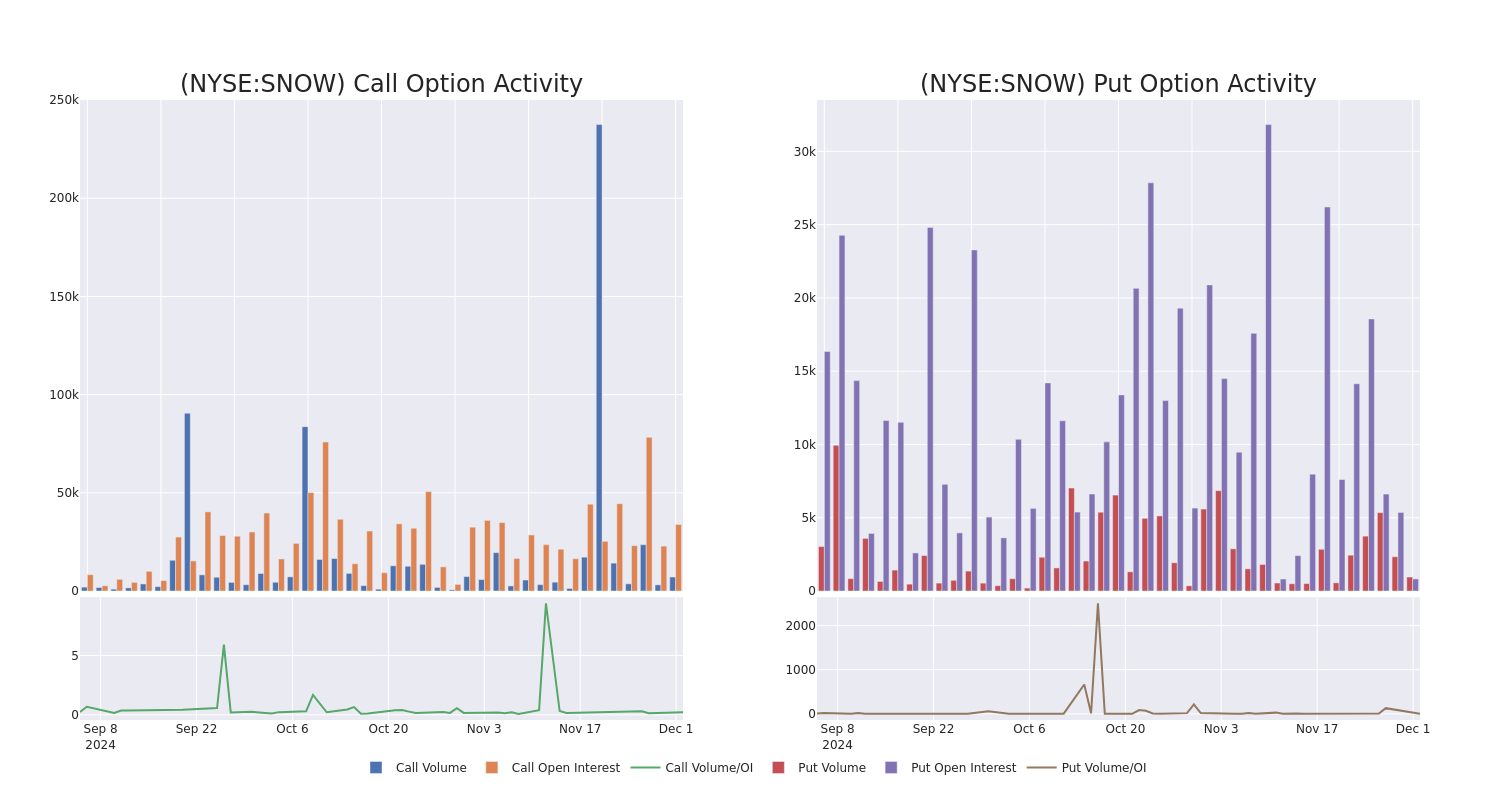

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Snowflake's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Snowflake's whale activity within a strike price range from $85.0 to $210.0 in the last 30 days.

Snowflake Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | SWEEP | BEARISH | 08/15/25 | $36.6 | $32.5 | $32.55 | $165.00 | $3.3M | 1.4K | 1.0K |

| SNOW | CALL | TRADE | BEARISH | 03/21/25 | $8.25 | $8.0 | $8.01 | $210.00 | $881.1K | 2.0K | 12 |

| SNOW | PUT | TRADE | BULLISH | 02/21/25 | $2.64 | $2.54 | $2.54 | $150.00 | $242.5K | 830 | 956 |

| SNOW | CALL | SWEEP | BEARISH | 12/06/24 | $2.13 | $2.02 | $2.13 | $177.50 | $105.6K | 2.6K | 997 |

| SNOW | CALL | SWEEP | BEARISH | 12/20/24 | $9.85 | $9.6 | $9.6 | $170.00 | $96.0K | 1.8K | 100 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that went public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to buy and ingest data, while its data solutions can be hosted on various public clouds.

Current Position of Snowflake

- With a volume of 1,585,748, the price of SNOW is up 0.59% at $175.84.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 86 days.

What Analysts Are Saying About Snowflake

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $175.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Keybanc has decided to maintain their Overweight rating on Snowflake, which currently sits at a price target of $150. * An analyst from Oppenheimer has decided to maintain their Outperform rating on Snowflake, which currently sits at a price target of $180. * An analyst from TD Cowen has decided to maintain their Buy rating on Snowflake, which currently sits at a price target of $190. * Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Snowflake with a target price of $172. * An analyst from B of A Securities persists with their Neutral rating on Snowflake, maintaining a target price of $185.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.