Financial giants have made a conspicuous bullish move on MercadoLibre. Our analysis of options history for MercadoLibre (NASDAQ:MELI) revealed 9 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 11% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $184,010, and 6 were calls, valued at $268,120.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1500.0 to $2400.0 for MercadoLibre over the last 3 months.

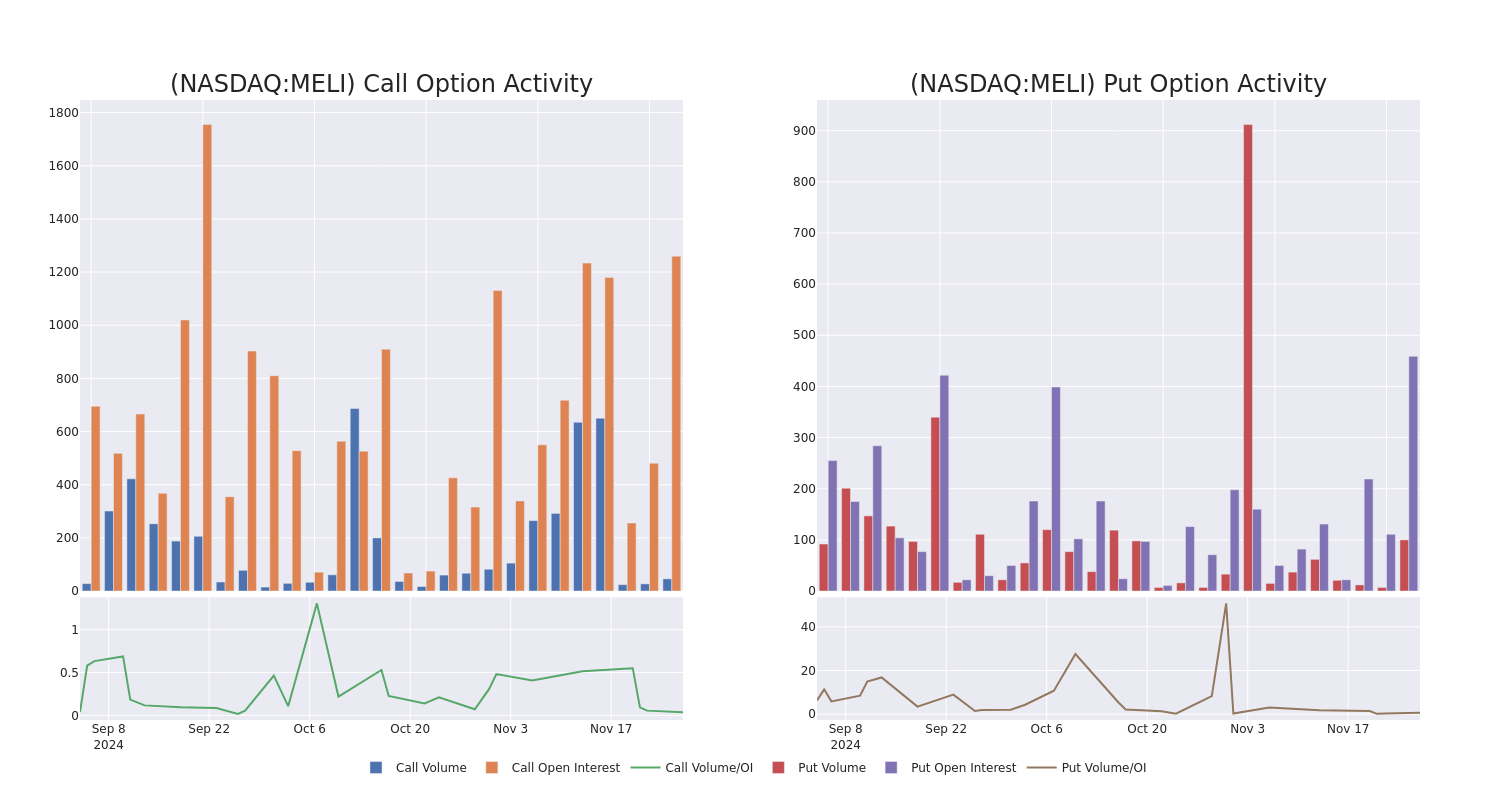

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for MercadoLibre's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across MercadoLibre's significant trades, within a strike price range of $1500.0 to $2400.0, over the past month.

MercadoLibre 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | TRADE | BULLISH | 01/17/25 | $426.8 | $410.1 | $412.7 | $2400.00 | $123.8K | 0 | 3 |

| MELI | CALL | TRADE | BULLISH | 12/18/26 | $685.0 | $670.0 | $685.0 | $1580.00 | $68.5K | 14 | 0 |

| MELI | CALL | TRADE | BEARISH | 03/21/25 | $110.1 | $105.0 | $105.0 | $2100.00 | $52.5K | 161 | 5 |

| MELI | CALL | TRADE | BULLISH | 01/15/27 | $500.0 | $496.0 | $500.0 | $1940.00 | $50.0K | 5 | 1 |

| MELI | CALL | TRADE | BULLISH | 12/06/24 | $444.0 | $442.4 | $444.0 | $1520.00 | $44.4K | 1 | 1 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Following our analysis of the options activities associated with MercadoLibre, we pivot to a closer look at the company's own performance.

Current Position of MercadoLibre

- Currently trading with a volume of 29,092, the MELI's price is down by -2.87%, now at $1986.0.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 83 days.

What Analysts Are Saying About MercadoLibre

In the last month, 5 experts released ratings on this stock with an average target price of $2260.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on MercadoLibre with a target price of $2200. * An analyst from Citigroup persists with their Buy rating on MercadoLibre, maintaining a target price of $2450. * An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on MercadoLibre, which currently sits at a price target of $2300. * Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on MercadoLibre with a target price of $2150. * An analyst from BTIG persists with their Buy rating on MercadoLibre, maintaining a target price of $2200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MercadoLibre, Benzinga Pro gives you real-time options trades alerts.